| Market Snapshot S&P 500 Futures 5,443.5 +0.05% Stoxx Europe 600 Index 505.3 +1.08% US 10-Year Treasury Yield 4.378% +0.004 WTI Crude Oil Fut |

| |

| | Markets Daily is now exclusively for Bloomberg.com subscribers. Your access will expire on May 10. If you’d like to continue receiving this newsletter, and gain unlimited digital access to all of Bloomberg.com, we invite you to subscribe now at the special rate of $149 for your first year (usually $299). Already a paying subscriber or BBA user? Make sure you’re signed up to Markets Daily with the same email address associated with your account. | | | | | | |

| Markets Snapshot | | | | Market data as of 05:56 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

Five things you need to know | |

| |

| |

| Take a breath, everyone. Markets are showing signs of stability for the first time in what seems like years (actually, it’s been 13 days since “Liberation Day’’), so here’s a look at where we stand: - Treasuries rose yesterday after a five-day selloff that sent 10-year yields surging the most in over two decades, and they’re little changed today. Still, the risk premium to hold the 10-year has climbed to the highest in a decade on concern Trump’s unpredictable tariff policy will sap investor confidence in US government bonds.

- The S&P 500 has surged 12% from its intraday low of last week. Tech, industrial and financial shares have gained the most. Still, Bank of America’s latest fund manager survey, out today, shows investor sentiment regarding economic prospects is the most negative in three decades. That pessimism isn’t yet fully reflected in their asset allocation, which could mean more losses for US stocks.

- MSCI’s emerging market stock index is gaining for a fourth straight day and is on the verge of erasing its loss for the year. India became the first major market to fully rebound from the April 2 tariff announcements. Citi on Monday downgraded its view on developing-nation stocks to underweight.

- The dollar is still under pressure, with a Bloomberg index of the greenback headed for a sixth straight drop (although the move is tiny for now). That’s the longest streak of declines in more than a year, and not a great sign for US assets overall.

The bond rebound is particularly reassuring because last week’s rise in yields threatened to deal the economy another hit by pushing up the cost of all kinds of loans. Treasury Secretary Scott Bessent moved to tamp down concerns in a Bloomberg Television interview, saying he has tools to steady the market if needed. He also said there’s no evidence that overseas governments are selling their stockpiles of Treasuries. Still, investors are on edge for further developments in the trade war. “We’re not saying the bottoms are in — we’re hopeful they are — but things can flare up at any time,’’ said Adam Phillips, managing director of investments at EP Wealth Advisors. “One press conference or post on X could spark new headwinds. We’re not in the clear yet.” —Phil Serafino, Ye Xie, Bailey Lipschultz and Alexandra Semenova | |

| |

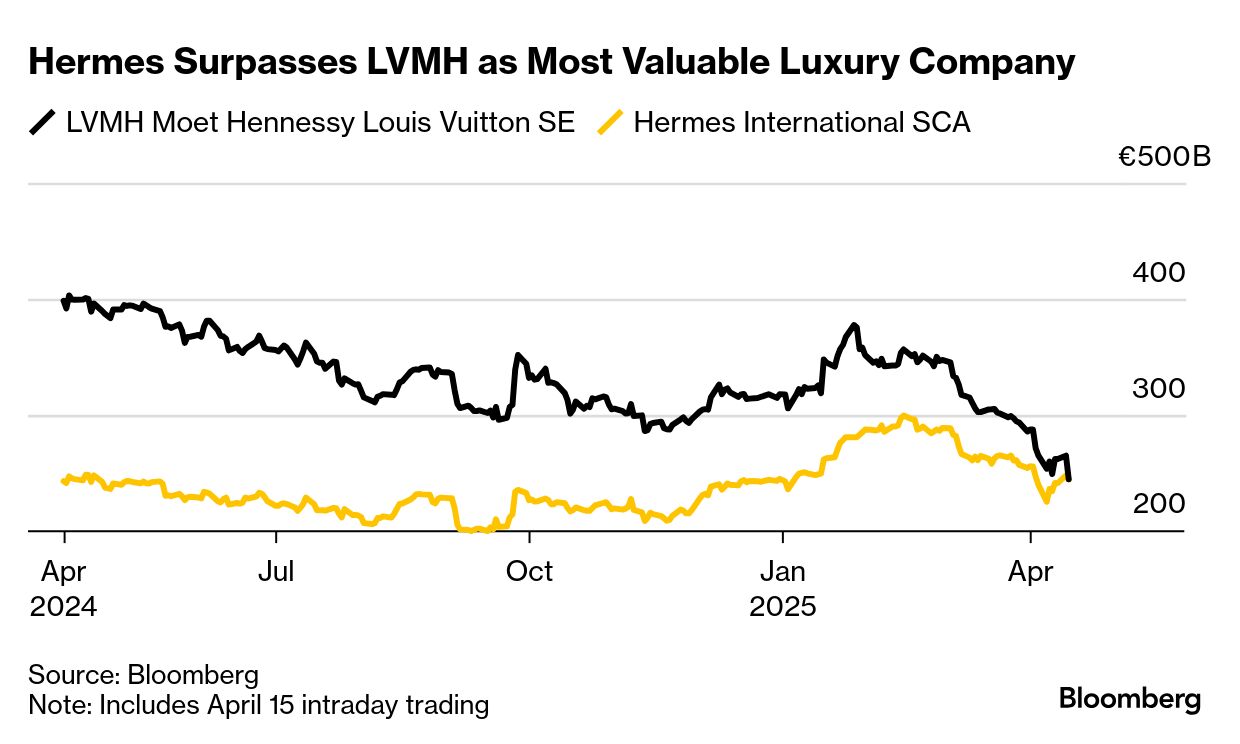

- LVMH falls 6.7% in Paris after the luxury group published weaker-than-expected sales, weighed down by sluggish demand for high-end goods in China and the US and the threat of a trade war. Meanwhile, Hermès’s market value surpassed that of LVMH, the conglomerate that once tried to buy the maker of the coveted Birkin bag in a stealth raid that shocked the French corporate world 15 years ago.

- Boeing falls 2.7% in premarket trading. China has ordered its airlines not to take any further deliveries of Boeing jets.

- Allegro MicroSystems tumbles 12% after ON Semiconductor scrapped efforts to acquire Allegro, withdrawing a bid of $35.10 a share.

- BE Semiconductor rallies 8.2% after Applied Materials said it bought a 9% stake in the Dutch chip-equipment maker via market-based transactions.

- Applied Digital drops 12% after the digital infrastructure company reported third-quarter results that missed expectations in terms of revenue and adjusted profit.

- Looming tariffs on the entire pharmaceutical industry will be in focus when Johnson & Johnson reports first-quarter results before the opening bell on Tuesday. Meanwhile, after the market closes, United Airlines may lower its full-year financial guidance due to growing uncertainty about travel demand and the effects of the trade war. —Subrat Patnaik

| |

| |

| |

| One big fund manager who’s been hoarding cash for three years is stepping in to buy corporate debt in the selloff. Over the past few weeks, Bill Eigen of J.P. Morgan Asset Management has bought assets including high-yield debt and convertible bonds, as well as exchange-traded and closed-end funds that hold corporate debt. While he declined to specify what he purchased or how much he’s buying for his $10 billion JPMorgan Strategic Income Opportunities Fund, Eigen said he’s seeing opportunities that haven’t existed in years. In high-yield debt, for example, Eigen said last week that he was seeing yields pushing toward 9% or higher, and spreads around five percentage points above Treasuries. That yield level is more than a percentage point above the average over the past year, according to a Bloomberg index. “That’s when I start to get interested — when you’re finally being compensated for the risks embedded in these areas of the market,” he said. —Ye Xie | |

| |

| |

| |