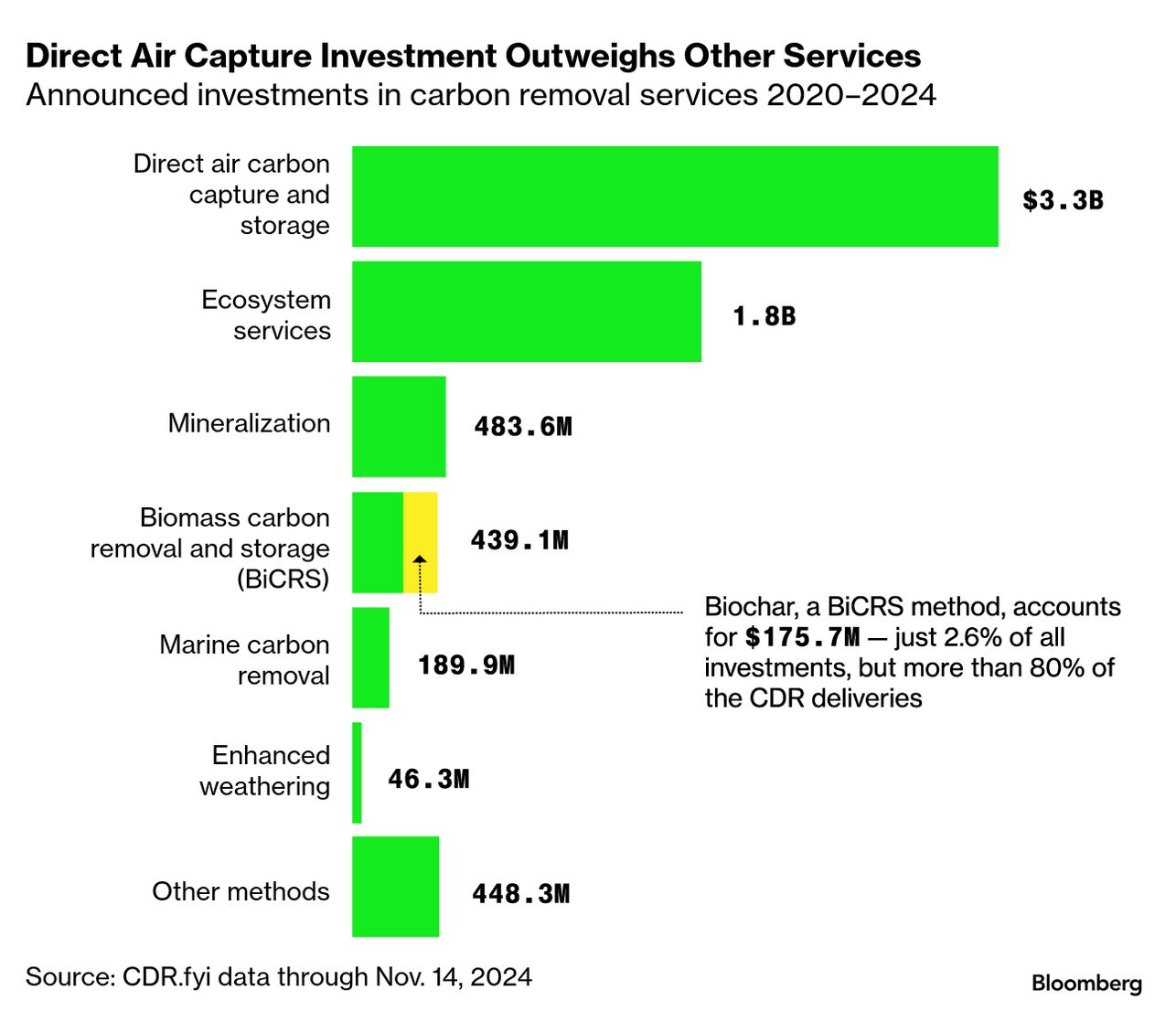

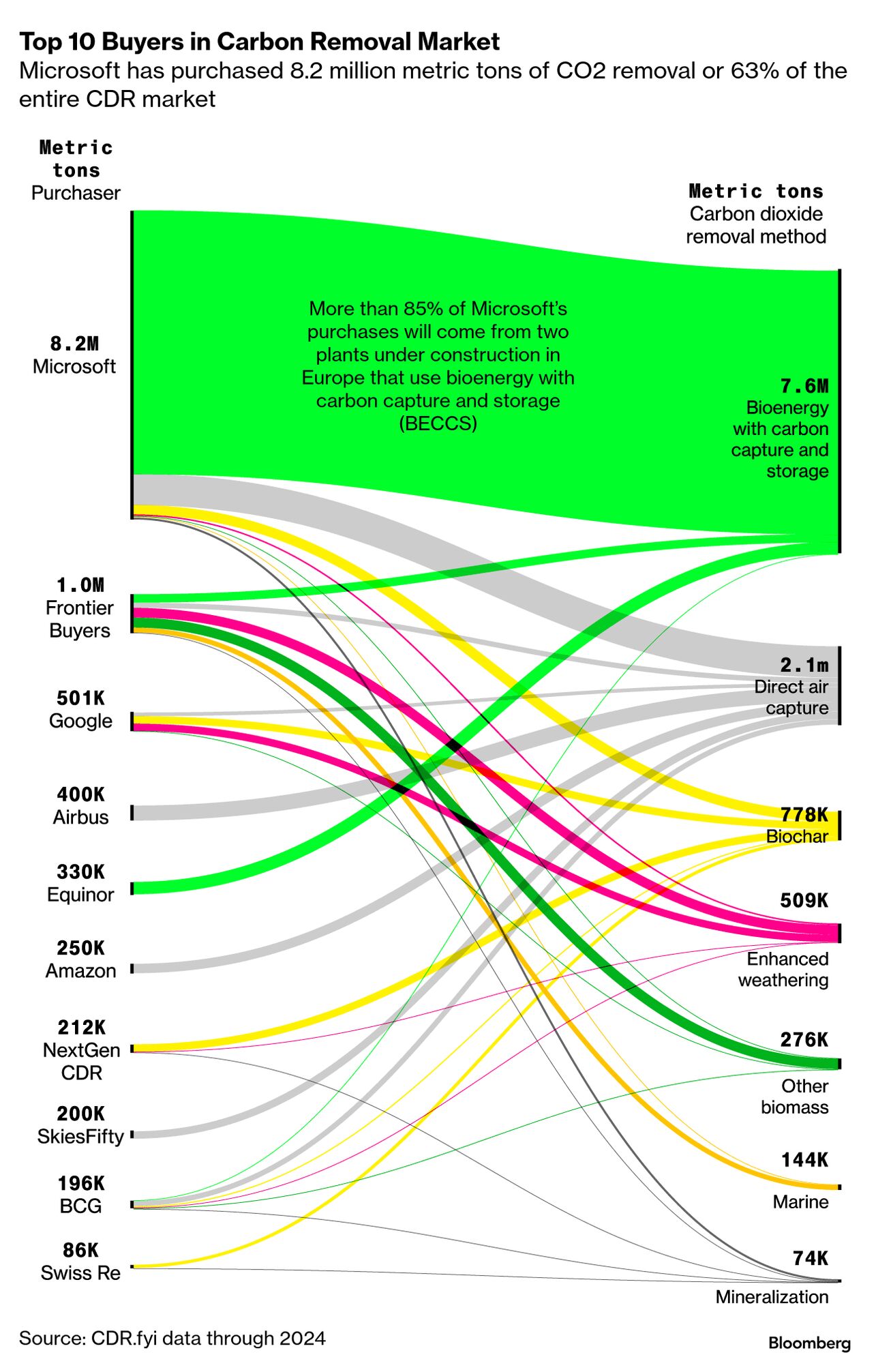

| By Michelle Ma and Dave Merrill It’s becoming increasingly apparent that the world is going to need carbon removal technologies to meet ambitious global warming targets. Companies from Occidental Petroleum Corp. to Microsoft Corp. along with firms like BlackRock Inc. and Bill Gates’ Breakthrough Energy Ventures are among the investors throwing billions at startups aiming to do this. The US government has been a significant patron, with the Energy Department committing more than $1 billion to get carbon removal off the ground. But funding and buyers of carbon removal services have so far targeted a narrow subset of techniques to clean the atmosphere. And federal support is now up in the air as the Trump administration pursues funding cuts to all manner of climate programs.  Source: CRD.fyi data through Nov. 14, 2024 There are at least eight broad categories for removing carbon to clean up the atmosphere, with more than 900 startups trying different approaches. The money that’s been rushing into the carbon chase has overwhelmingly backed a technique known as direct air capture, or DAC, which involves using machines to suck up carbon. Firms are placing major bets on it even though the technology remains unproven at scale, inordinately expensive and energy intensive. Far less investor money is flowing to competing methods such as sequestering CO2 in the ocean and using crushed rocks, a process known as enhanced weathering. Between 2020 to 2024, firms have bet $3.3 billion on DAC compared to $3.4 billion for all other novel approaches, according to publicly available data compiled by carbon removal clearinghouse CDR.fyi. The technology receives a disproportionate amount of private investment because it’s backed by US federal tax credits and grants, according to Danny Cullenward, a senior fellow with the University of Pennsylvania Kleinman Center for Energy Policy. That support isn’t because the government decided DAC is the best way to remove carbon, he said, but “because the political economy of the oil and gas industry is much more powerful than these other emerging industries.” Carbon removal buyers looking to meet their climate targets have also not diversified their portfolios. Almost 60% of all purchases tracked by CDR.fyi between 2019 and 2024 are for bioenergy with carbon capture and storage (BECCS). It involves burning wood to run power plants, then capturing and sequestering the resulting emissions underground. Hence, the CO2 the trees and plants pull from the atmosphere during their lifetimes stays put. Despite the interest, research has found that cutting down and transporting feedstock can emit more carbon than it sequesters, making carbon accounting a big challenge.  Source: CDR.fyi data through 2024 BECCS and DAC approaches have yet to live up to their promise. Through 2024, DAC delivered around 1,200 tons of CO2 removal — less than 0.2% of all carbon removed over that timeframe — and BECCS has delivered 10,000 tons — less than 1.7% of the total — per CDR.fyi. While BECCS and DAC are attracting the most purchases and investment respectively, they’re crowding out other promising carbon removal technologies. Some startups use clever engineering to accelerate natural processes, like increasing the ocean’s alkalinity. Others are electrolyzing seawater and spreading crushed basalt rock over farmland. These methods promise greater durability, verifiability and effectiveness of storing CO2 than simply planting trees. Another method has provided the majority of all carbon removal delivered: biochar. It’s done so without the support of US tax credits, large purchases from brand-name buyers or billions in investments. But like all carbon removal techniques, there are downsides, the biggest being uncertainty about how much CO2 stays sequestered when it’s added to different soils. That’s an area of active investigation for researchers. “It’s got so much potential, but it’s inconclusive,” said Ben Kolosz, an assistant professor in renewable energy and carbon removal at the University of Hull in the UK. What else is giving investors and would-be buyers pause about carbon removal technologies? Read the full story on Bloomberg.com. |