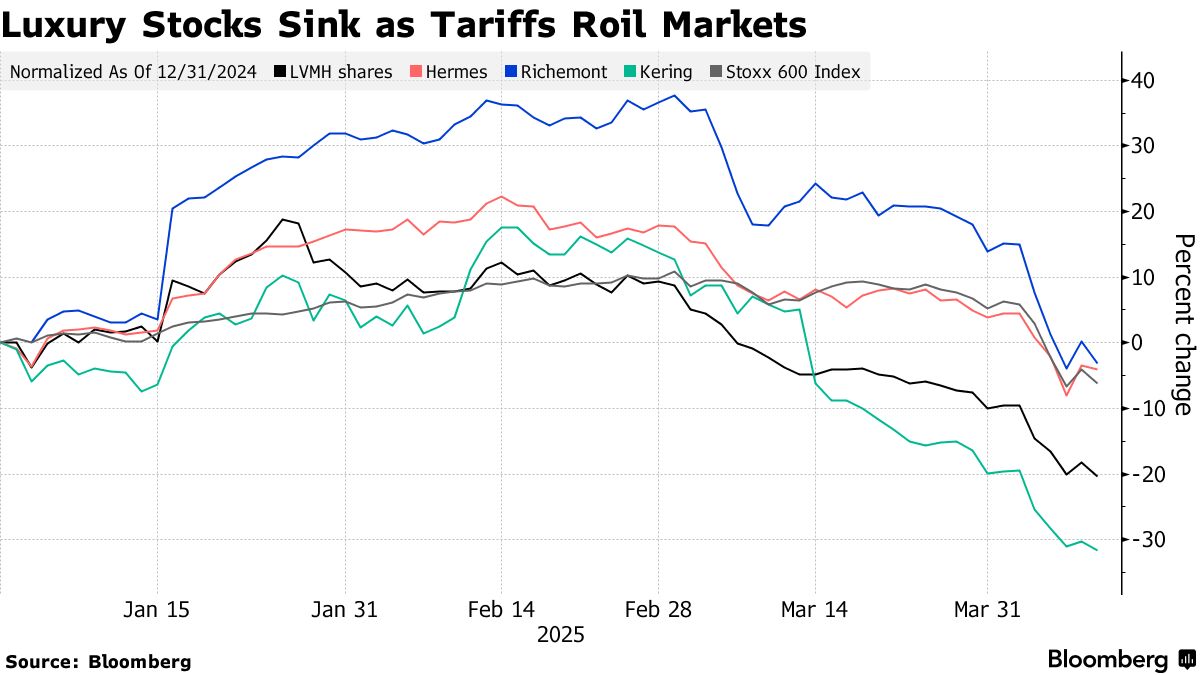

| The French-made Dassault Rafale fighter jet is not cheap – buying 26 of them will set you back around $7.4 billion, at least judging by India’s purchase terms approved on April 9. Yet military gear is becoming a necessary form of luxury good in today’s world, as the US pulls back from existing security commitments and China steps up military assertiveness in the Indo-Pacific. What’s becoming less essential are the luxury items that Paris is better-known for. LVMH, the maker of Christian Dior jackets and Louis Vuitton handbags, this week reported declining sales in every area save watches and jewelry. It’s not just uncertainty over US tariffs that’s biting: The much-anticipated post-Covid rebound of the Chinese economy has been an ongoing disappointment, with a property slump weighing on consumers who are moving away from bling. Even Hermes, the poshest of the posh, reported disappointing sales hit by a slowdown in Chinese demand.  An Hermes Birkin handbag. Photographer: Nathan Laine/Bloomberg And while threats of real war can drive up demand for made-in-France defense kits, the brewing trade war is likely to produce the opposite effect for everything else. Pernod Ricard SA reported worse-than-expected sales after its Cognac was hit by a duty-free block in China. And even if wholesalers in the US are stocking up on bottles ahead of tariffs landing in full, those effects will likely unwind in future. With Donald Trump apparently in no rush to give the European Union a deal to avoid tariffs, LVMH’s Bernard Arnault warned of “dramatic” economic pain to come. All this is visible in the share-price performance of some of France’s biggest brands: Kering has shed 31% of its value this year, Remy Cointreau 25%, LVMH 24% and Pernod 15%. This may be a point where long-term value starts to creep in, of course. The luxury industry’s top champions have the financial flexibility to strike out into other areas and could benefit from the fact that their top customers can afford to pay higher prices in a tariff war. Hermes has already said it will look to fully offset the cost of blanket tariffs of 10% in the US by raising prices for Americans.  Meanwhile, those buying into France’s geopolitical gleam are sitting prettier. Thales, Exosens and Rafale-maker Dassault Aviation are respectively up 82%, 73% and 54% this year. Dassault Aviation reported a 30% jump in sales in 2024, a year that saw France cement its place as the world’s second-largest arms exporter. Even if some kind of deal is found on tariffs, it feels like a new world for hard-power needs: The US is eager to “move on” from Ukraine, is pressuring France and other NATO allies to lead the continent’s defense efforts and has even pushed Poland to turn to Paris for nuclear deterrence. Luxury is no defense in a tariff war – and defense is no longer a luxury in a more dangerous era. France’s nuclear deterrent could be a solution against a potential Russian threat, Poland’s President Andrzej Duda said. He also called for access to US atomic weapons. US officials told Europeans in Paris that they want to secure a full ceasefire in Ukraine within weeks, according to people familiar with the matter. L’Oreal SA reported resilient sales growth in the first quarter, led by demand for high-end make-up and perfumes. French billionaire Bernard Arnault called on the European Union to strike a deal with the US on tariffs to defend the region’s winegrowers. His luxury firm LVMH reported weaker-than-expected sales, weighed down by sluggish demand for high-end goods in China and the US.  Arnault, during LVMH’s annual general meeting in Paris, on April 17, 2025 Photographer: Nathan Laine/Bloomberg Hermes International SCA reported first-quarter sales that reflected a slowdown in Chinese demand, showing that even the most resilient purveyor of high-end goods wasn’t spared the slump in the luxury industry there. Renault SA and China’s Geely powertrain venture Horse Powertrain will show up to next week’s Shanghai auto show with a concept aimed at car buyers still reluctant to go fully electric. Pernod Ricard SA sales fell more than expected in its fiscal third quarter after Cognac was hit by a duty-free block in China and Europe demand was held back by a late Easter. Monday: Macron starts five-day trip to Madagascar, Mauritius, French territories in Indian Ocean Wednesday: Results from Danone, Kering, EssilorLuxottica; French April preliminary PMIs Thursday: Results from BNP, Renault, Sanofi, Dassault Systemes, Air Liquide, Orange, Carrefour, Michelin, Vinci; French April consumer confidence Friday: Safran results; French April business and manufacturing confidence Cruise ships are getting a high-end makeover, with luxury billionaires Bernard Arnault and Francois Pinault leading the charge.  The Explora 1 Conservatory. Source: EXPLORA JOURNEYS |