| | GOP plan could cut US household incomes by more than $300 annually.͏ ͏ ͏ ͏ ͏ ͏ |

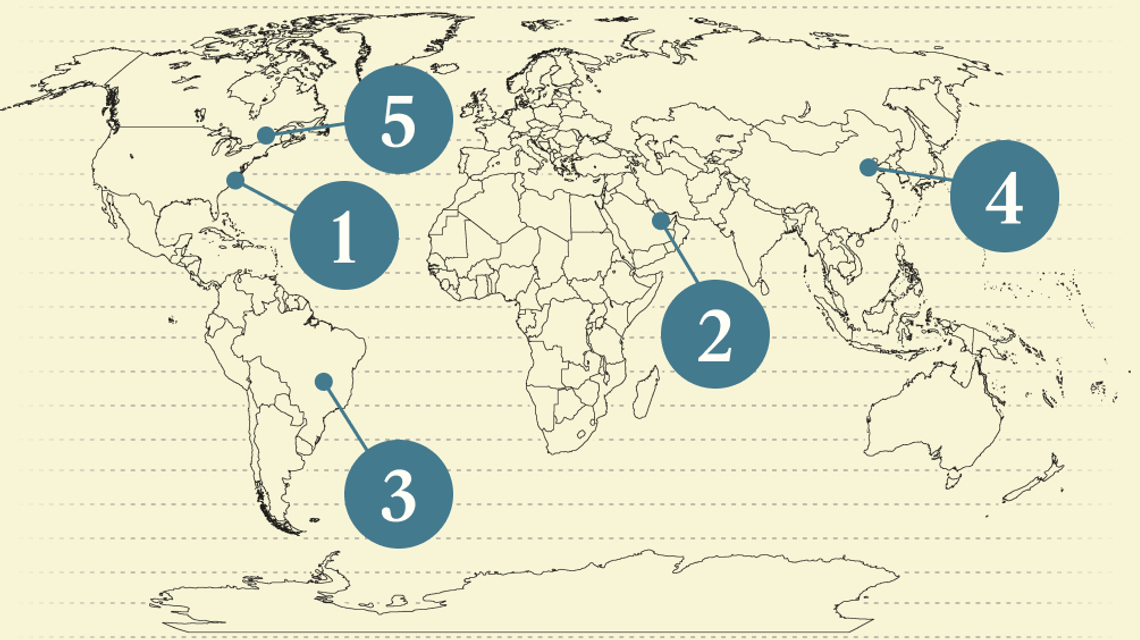

| |   Washington DC Washington DC |   Riyadh Riyadh |   Beijing Beijing |

| Net Zero |  |

| |

|

- Dems push back

- Trump’s Gulf contradictions

- $1 billion SAF deal

- EV sales surge

- Carbon capture is calm

It seems that the solar panels are listening quite aggressively.

|

|

Dems focus on energy costs in tax credit fight |

| |  | Tim McDonnell |

| |

Brian Snyder/Reuters Brian Snyder/ReutersCongressional Democrats plan to focus on the risk of rising US consumer energy prices in their pitch to Republicans to walk back proposed deep cuts to clean energy programs. Rep. Scott Peters (D-Calif.) told Semafor he was “frustrated” with draft budget legislation approved this week in two House committees that would give fossil fuel projects express access to permit approvals, scrap billions of dollars in clean energy grants and loans, and significantly scale back tax credits for renewables, nuclear power, and other technologies. Peters said he plans to keep reminding his more conservative colleagues that removing tax credits for clean energy amounts to a higher tax on all energy. A study shared today exclusively with Semafor by the Clean Energy Buyers Association, an industry group, found that some states would lose an average of $336 in annual household income if the tax credit cuts proceed as planned, thanks to higher energy costs and reduced job opportunities. “Everyone agrees we need all this energy. The quicker we do it, and the more we get, the cheaper it will be. The stuff that’s in line, literally hundreds of gigawatts, is mostly solar and wind. If you just cut [the tax credits] off, all those projects die,” Peters said. “We have a choice between higher energy bills and astronomically higher energy bills.” |

|

Trump’s Gulf contradictions |

Brian Snyder/Reuters Brian Snyder/ReutersUS President Donald Trump’s visit this week to Saudi Arabia and Qatar largely relegated oil and gas, the commodities traditionally at the heart of US-Gulf relations, to the sideline. Trump already had what he wanted from OPEC, a drilling boost to temper US gasoline prices, before even leaving DC. And in the rush of deals — hundreds of billions of dollars, according to the White House, although the figure may be much lower — defense, tech, and aerospace took center stage, a signal of Trump’s eagerness to drop the Biden administration’s fixation on the region’s human rights record and draw more of its riches to the US. One snag in the plan, as OPEC analyst Amena Bakr wrote for Semafor, is that lower global oil prices mean less cash for Gulf governments to invest in Trump’s agenda — as well as a lot of angry oil executives back home. And one of the big investments announced in Qatar, a deal to expand that country’s liquified natural gas export facilities, also comes at the expense of market share for US LNG exporters. |

|

Cars sold worldwide this year that will be electric, up from one in five last year, according to the International Energy Agency. That growth is led by China, which produces 70% of EVs and where EVs will account this year for 60% of all car sales. In the US, although EV sales grew 10% last year, they still account for only 10% of car sales. Falling battery prices and increasingly extensive charging networks are key drivers of adoption, the IEA reported, but warned that the global tariff wars — and their knock-on effects on GDP and oil prices — will make EVs less cost-competitive. |

|

Carbon capture remains calm |

Courtesy of Svante Courtesy of SvanteCarbon capture investors have no reason to worry about the tax credit debates in Congress, the head of a leading company in that industry told Semafor. Svante, a Canadian startup, this week opened the world’s first “gigafactory” for producing carbon capture filters, a technology it plans to sell to a wide range of industrial emitters. The $145 million project is a bit of a gamble, CEO Claude Letourneau said: “We’re still not out of the valley of death.” The company was able to raise money for the facility “without a purchase order,” he said, on the conviction that its technology will soon be highly valued in a world that restricts CO2 emissions and puts a monetary value on their capture. That includes a US tax credit, 45Q, that was among the few to escape cuts this week by House Republican budget planners. “I have no concerns whatsoever about the US market, or any signs from Trump or anyone else that 45Q will go away,” Letourneau said. In the meantime, the company is proactively building its first batch of customers, by taking equity stakes in nascent carbon capture projects. Demand for carbon capture tech is moving more slowly than Letourneau hoped for a few years ago, and for one big potential customer pool — gas plants running AI data centers — more engineering work is needed to make carbon capture sufficiently cost-efficient. “We’re still in market push mode,” he said, whereas the company planned to be in “pull mode” by now. But he still expects the new gigafactory’s capacity to be sold out within five years. |

|

In my story Tuesday on how China has cut coal out of its overseas investing, I implied that the Philippines could be an example of a country that might have attracted investment from China into new coal plants, but that could be concerned about taking on more debt. Boston University researcher Diego Morro was quick to point out that the Philippines, which has a relatively healthy debt ratio and no history of drawing Chinese finance for coal plants, was a bad example. A better choice, he suggested, would have been Sri Lanka, which is the opposite on both those points. Sorry for the mixup, and thanks Diego for the catch! |

|

New EnergyFossil Fuels Pavel Mikheyev/Reuters Pavel Mikheyev/ReutersFinanceEVs |

|

Gage Skidmore/Flickr. CC BY-SA 2.0 Gage Skidmore/Flickr. CC BY-SA 2.0One of the most consequential new proposals in the House GOP’s massive tax plan — a “MAGA” investment account for kids — may carry a Donald Trump-inspired name, but it’s Sen. Ted Cruz’s brainchild, Semafor’s Burgess Everett reported. “You can call it anything you like,” Cruz told Semafor, describing his plan to seed tax-advantaged accounts with $1,000 for every newborn baby with a Social Security number as “essentially a 401(k) for every newborn in America.” Now it needs to survive votes in both chambers of Congress. |

|

|