| | In this edition, new subscription models face their first big test with the expected downturn, and r͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- Bond vigilantes vs. budget

- Trump’s ‘perfecto’ Gulf trip

- A test for subscription mania

- Boomerang CEOs, ranked

- Can VCs replace the NIH?

- Apple’s India problem

Walmart says price hikes are coming... Julius Randle is making Skechers (and its soon-to-be PE owners) look good... |

|

A strange thing about today’s economy is that normal commerce — you give a company money, they give you a widget — has become raw material for a financial factory. Daily coffee habits, pampering our pets, or simply our desire not to have our electricity turned off for nonpayment are now “high retention rate, sustainable business models” in credit-rating reports that companies present to lenders to get better terms. We used to just buy things. Now we’re providing recurring cash flows. Sometimes that financial innovation is helpful. Mortgage bonds put home ownership within reach for more people. Sometimes it’s toxic. Some of those people shouldn’t have owned homes, and consumers who need to spread their takeout over two paychecks perhaps should cook instead. I’ve been thinking lately about a different flavor of this. When I wanted to rent a formal dress last month, it took time to even find Rent the Runway’s single-rental option amid a sea of buttons hawking its monthly service. Thanks to Amazon’s “subscribe and save” option and my inability to appropriately gauge my paper towel usage, I’ve run out of storage space in my apartment. My freezer is full of steaks because I keep forgetting to change the default frequency setting on my ButcherBox subscription. It’s gone from thrilling to convenient to exhausting. And as recession-worried consumers tighten their belts, it could turn into a major liability for companies and their lenders, who have gotten ensorcelled by these payment streams. Regulators, too, are cracking down on companies that make it maddeningly hard to quit. “Click to subscribe” is colliding with “click to cancel,” and Wall Street isn’t ready. More on that in today’s newsletter. And as you economize in these times, a reminder that your Semafor subscription is free.

|

|

Bond vigilantes vs. the big, beautiful bill |

Bond investors, whose revolt last month caused President Donald Trump to back off his tariff fight, are mutinous again. US government bonds sold off sharply in response to Trump’s tax and spending bill, raising fears that the US is in for its own “Liz Truss moment.” The UK prime minister was quickly bounced from office in 2022 after proposing a budget that cut taxes far more than it cut spending — sowing fears that the government would have to borrow heavily to close the gap. Investors dumped their bonds and (aided by poor risk management in an arcane corner of the pension system) set off a gilt crisis. Republicans’ “big, beautiful bill” likewise cuts taxes more deeply than spending, and some estimates expect it to add $3.3 trillion to the national debt by 2034. Treasury yields — the amount of interest investors demand in exchange for lending to the federal government — are back at their post-“Liberation Day” levels. Bondholders don’t want to be bagholders, and there were already worries about declining demand for Treasury bonds. One market veteran told Bloomberg that “it may be necessary to have a repeat” of the UK crisis “to force everyone to do the right thing” and get serious about fiscal discipline. |

|

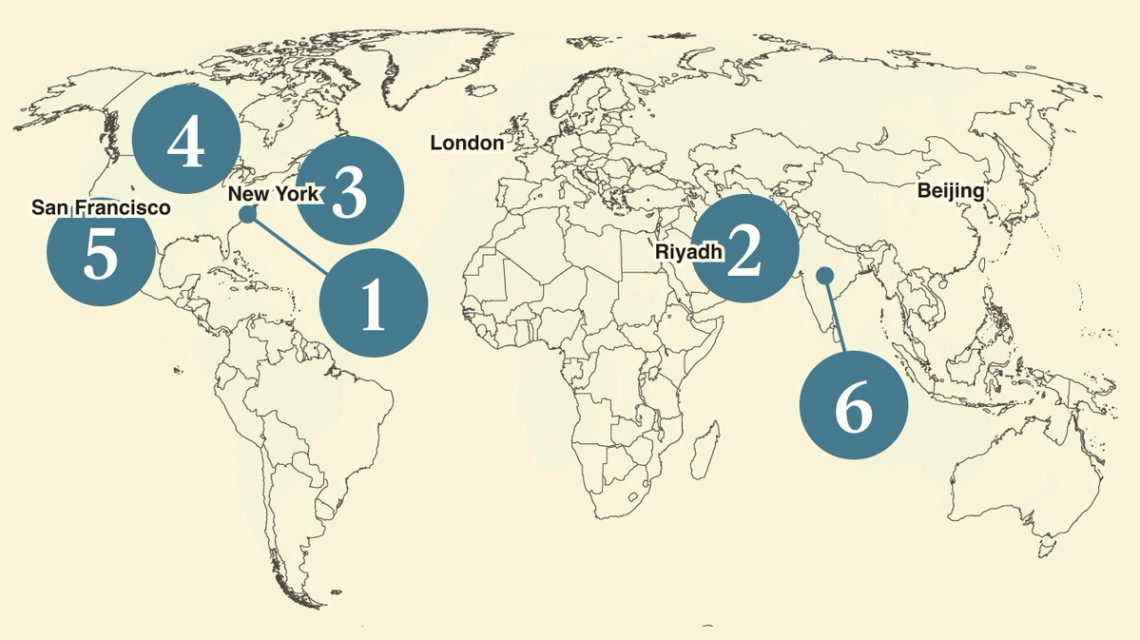

Parades, palaces, and promised deals |

Brian Snyder/Reuters Brian Snyder/ReutersTrump’s Middle East tour started with a camel parade, ended with him declaring the Qatari palace marble “perfecto,” and in between netted deals worth hundreds of billions of dollars — on paper, at least — to American companies. Trump marveled at Saudi Arabia’s transformation, a sense of wonder shared by Semafor’s Manal Albarakati, whose essay on her home country is worth a read. Qatar announced it would buy nearly $100 billion worth of Boeing planes, days after British Airways’ parent inked a $13 billion deal at Trump’s urging. Trump’s favor has helped Boeing shares surge 20% this year, even as the president moves closer to accepting a Qatari jet as a replacement for Boeing-made Air Force Ones that are behind schedule. |

|

Economic gloom threatens Wall St.’s sub fever |

Fears of an economic downturn will test Wall Street’s favorite new business model: subscriptions for everything. Dry cleaning, razor blades, car washes, food delivery, sneakers, dog toys, bottles of wine, dental cleanings — things we used to buy as needed — have turned into memberships over the past decade, fueled by a money machine clamoring for assets. Two forces are now threatening that model: belt-tightening consumers suffering from subscription fatigue, and regulators cracking down on the mazes of corporate trickery that keep users from canceling.  “People are increasingly aware of what they’re getting value from,” Tom Hale, CEO of wellness-ring maker Oura, tells Semafor. He thinks his business is safe: Without the software, Oura’s rings are hunks of metal — nice-looking ones, Hale is quick to note, but not that useful. “That’s so different from other subscriptions, where the value isn’t as obvious and all of a sudden people are going to say, ‘When’s the last time I used this?’” |

|

Boomerang CEOs are corporate security blankets |

UnitedHealth is bringing back a former CEO to right a company in serious trouble. Stephen Hemsley, who retired in 2017 but remained on its board, takes over as the insurance giant faces spiraling costs and a criminal investigation into its Medicare billing, The Wall Street Journal reported. Returning CEOs are corporate-governance safety blankets, brought back (or sometimes elbowing their way) in times of crisis. “There’s safety in someone familiar, who can relatively quickly parachute in,” Constantine Alexandrakis, CEO of search firm Russell Reynolds, told Semafor. Does it mean the board has bungled succession? “Not necessarily,” he said. “But it means there was no one ready inside the organization who trumped the boomerang option.” They tend to be big personalities deeply entwined with their companies — Bob Iger at Disney, Howard Schultz at Starbucks — though the low-key Hemsley doesn’t fit that bill. Jerry Yang’s return at Yahoo was a dud, while Steve Jobs famously saved Apple. (There is, notably, a boomerang boss in the Oval Office, too.)  Further reading: One boomeranger to another — Procter & Gamble’s A.G. Lafley had some advice for Iger. “Be humble.” — Rohan Goswami and Liz Hoffman |

|

Beleaguered scientists turn to Silicon Valley for help |

Stephen McCarthy/Web Summit via Sportsfile. CC BY 2.0. Stephen McCarthy/Web Summit via Sportsfile. CC BY 2.0.Can private investors step into the research funding gap? That’s the question facing the scientific community as Trump continues his punitive cuts. Almost certainly not — those billions can’t easily be absorbed by a venture capital community that, for all its bravado, is pretty small — but some interesting efforts are underway, my colleague Reed Albergotti reports. Meta released a massive trove of chemistry data Wednesday that it hopes will supercharge drug discoveries. “Instead of saying, ‘Oh, let me try this new molecule, and I’ll check back in a couple days,’ it’s saying, ‘Let me try these 10,000 different molecules and just run them all simultaneously,’ and then getting an answer in a minute,” one of Meta’s scientists said. And VC Lux Capital has set aside $100 million to help scientists commercialize their discoveries, hoping that the prospect of profits will unlock other sources of funding. “We’re willing to take more science risk than ever,” Lux Co-Founder Josh Wolfe told Reed. |

|

Trump’s brushback to CEOs sidestepping tariffs |

Julia Nikhinson/File Photo/Reuters Julia Nikhinson/File Photo/ReutersTrump has a simple warning for CEOs looking to offset tariff risk by shifting their supply chains around: Don’t. “I had a little problem with Tim Cook yesterday,” Trump said in Qatar on Thursday. “He is building all over India… I said, ‘Tim, don’t do that.’” Apple is ramping up production of iPhones in India, which it aims to ship to the US to get around stiff Chinese tariffs. Trump has also threatened Mattel with a 100% tariff if it moves its supply chains abroad. (The Barbie-maker plans to have no single country account for more than 25% of its sourcing within two years.) CEOs are in a bind: India and Vietnam were favored places to friend-shore production — until they weren’t. Cheap labor and proximity to inputs made them beneficiaries of Trump’s last trade escalations and a post-Covid reassessment of supply chains.

|

|

With so many financial newsletters competing for attention, it’s hard to find one that makes sense of the market. That’s why more than a million savvy readers trust The Daily Upside for their daily dose of finance, economics, and investing insights. Created by Wall Street insiders, each issue delivers clear, actionable analysis — straight to your inbox. Subscribe for free today. |

|

➚ BUY: CATL. The Chinese battery maker is preparing for the year’s biggest stock offering, and investor demand is high. ➘ SELL: Hogs. Harley-Davidson’s CEO survived a hedge fund’s effort to oust him but just barely: 48% of investors voted to kick him off the company’s board. |

|

Venture capitalists like to say that their advice is as valuable as their money. But two investors offered some scathing advice for free this week. YC founder Paul Graham criticized Elon Musk’s xAI chatbot for spouting alarming — and discredited, per the BBC — responses about white genocide in South Africa. “It would be really bad if widely used AIs got editorialized on the fly by those who controlled them,” he said of Musk, who has taken up the cause of Afrikaners. Meanwhile, Pace Capital’s Chris Paik warned Airbnb’s Brian Chesky not to be blinded by his success after the company announced a new focus on experiences and services, alongside its signature stays. |

|

|