|

Novo Nordisk is a global pharmaceutical leader in diabetes and obesity care

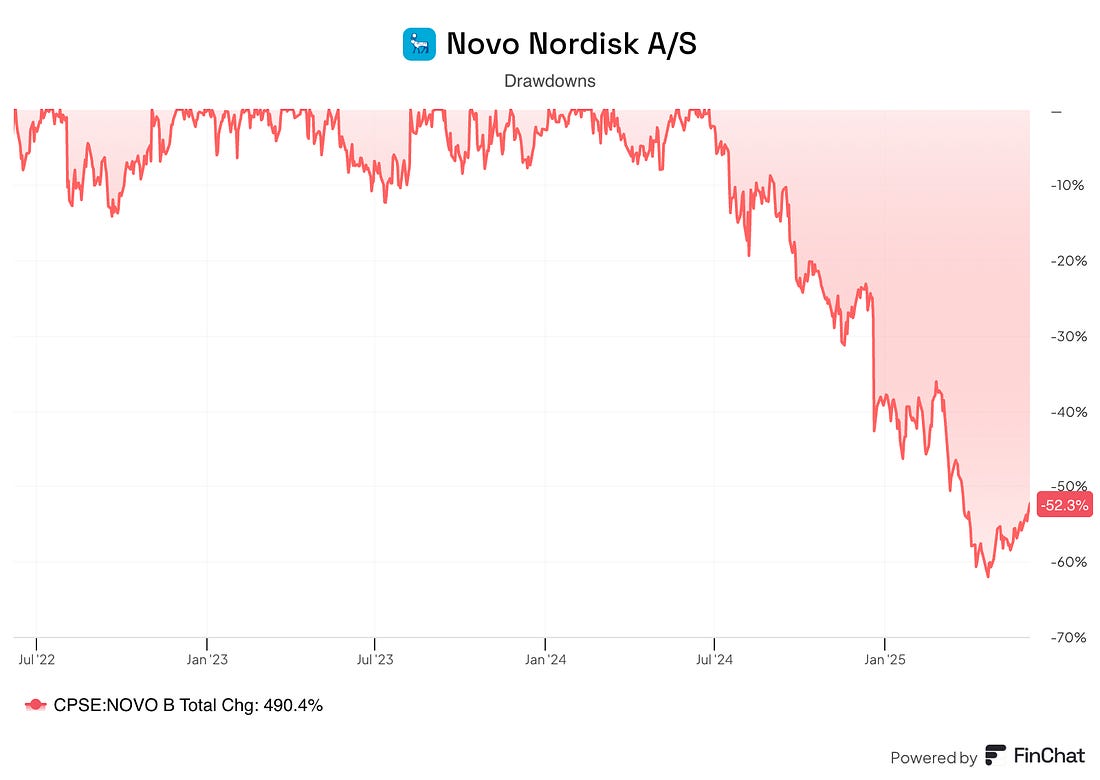

Novo Nordisk’s share price peaked in mid‑2024 at over DKK 1,000 then plunged sharply through early 2025. By late April 2025 it hit a 52‑week low of DKK 380, before modestly recovering to ~DKK 490.

That’s a drawdown of more than 60% at the low, and the stock is still more than 50% below the peak.

|

What happened?

There are five main reasons why the stock is down so much:

Disappointing trial results from CagriSema

Increased competition, mostly from Eli Lilly

Pricing pressures & regulatory challenges

Import tariffs from the United States

The CEO got fired

These are either temporary problems that present an interesting opportunity, or permanent ones that the market is correctly pricing into the stock.

Let’s dive into the company to find out which!

1. Do I understand the business model?

Novo Nordisk is a global pharmaceutical company. Their main revenue sources are from drugs that deal with diabetes and obesity.

Novo also has medications for rare diseases and cardiovascular problems.

The company focuses on discovering, developing, and manufacturing innovative drugs globally.

Novo Nordisk has a long history in a competitive industry. In 2023, the company celebrated its 100th(!) birthday.

Main Revenue Drivers

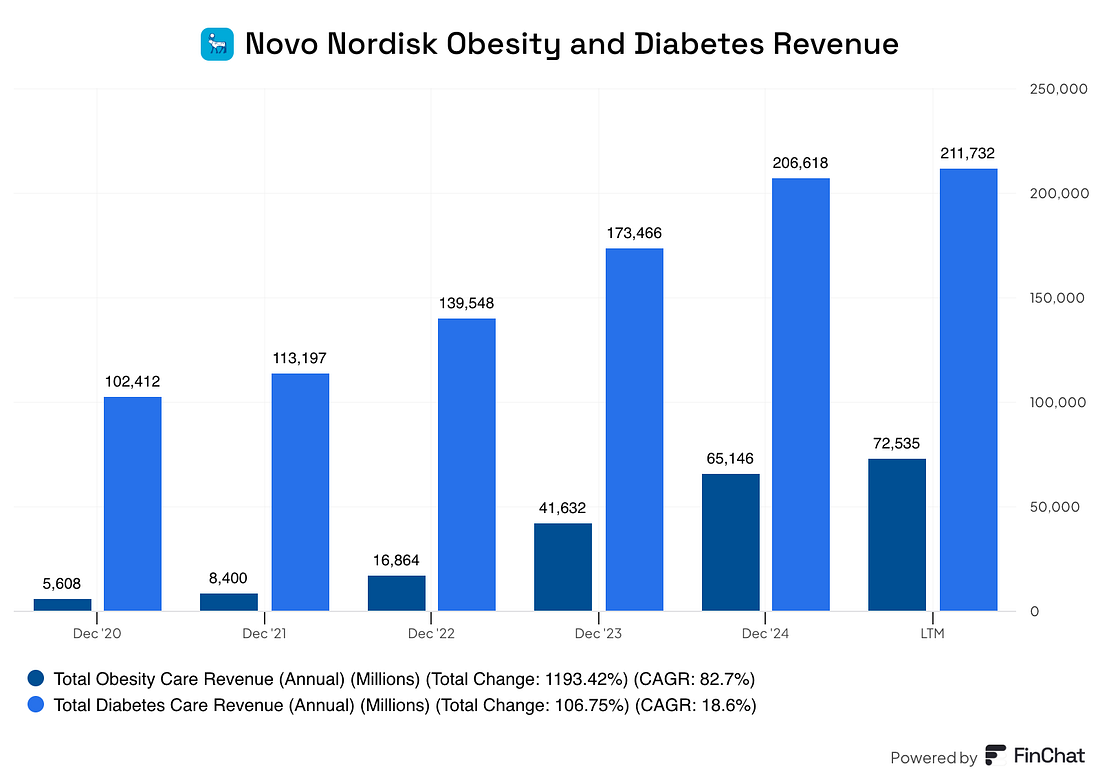

The obesity and diabetes markets are by far the most important for Novo - they made up more than 90% of revenue in 2024.

They offer two unique products:

Ozempic for diabetes care

Wegovy for obesity care

These drugs are both based on the same molecule called semaglutide.

Semaglutide is a medicine that helps people with type 2 diabetes and those trying to lose weight. It copies a natural hormone in your body to control blood sugar and reduce hunger.

Obesity Care is becoming more and more important in Novo’s revenue split. It’s one of the key growth drivers for the company, growing at more than 80% (!) per year since 2020.

The Diabetes Care market is growing at a still healthy 18% CAGR over the same time period.

|

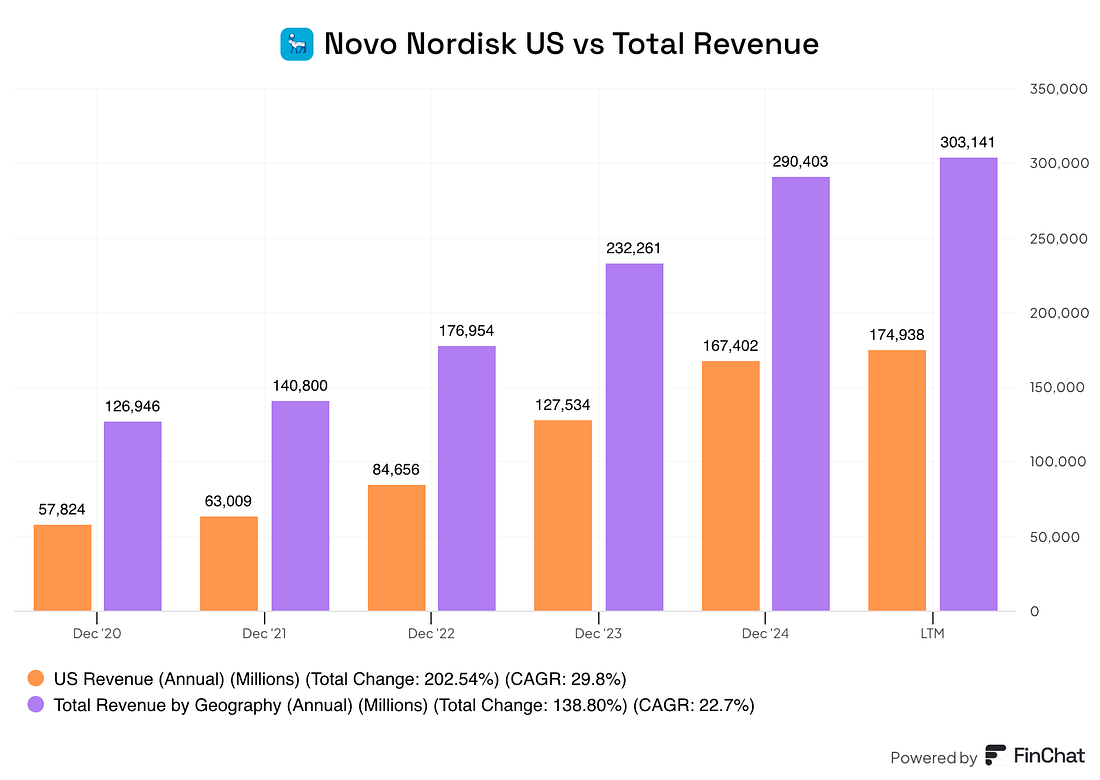

The U.S. Market is also important for Novo Nordisk, providing nearly 60% of the total revenue for the company.

|

2. Is management capable?

This is one of the problems leading to the large decline in Novo Nordisk’s share price.

In May, the Novo Nordisk Foundation, the company’s main shareholder, pressured CEO Lars Fruergaard Jørgensen to step down after eight years in the role.

Jørgensen has been with the company since 1991 and led them to dominate the weight-loss drug market with Wegovy and Ozempic.

Lars Sørensen, the Chair of the Novo Nordisk Foundation (and former CEO from 2000 to 2016), said the following about this topic:

“Considering recent market challenges and the decline in the company’s share price, we expressed an interest in being closer to the discussions in the company’s board. We also think that the timing is right for a new profile as CEO of the company. The aim is to make sure that the company is optimally positioned to secure future growth and realise its great potential.”

The Foundation seems concerned about losing ground in the obesity drug market, especially in the U.S.

Sørensen rejoined the board as an observer to lead the search for a new CEO and plans to become a full board member soon.

He’s pushing for an external candidate, a first for the company, as all prior CEOs were Danish and internal hires.

They’re likely looking for someone with strong U.S. market skills to deal with competition, pricing issues, and potential policy shifts.

Camilla Sylvest, head of commercial strategy, also left in April 2025, adding to the leadership changes. The board, led by Helge Lund, insists the company’s strategy remains unchanged.

There is good news within Novo Nordisk’s management, however:

The Novo Nordisk Foundation owns nearly 30% (!) of the company with 1.3B shares.