| | ‘We don’t have any plans’ for new projects or investments in Russia,” Darren Woods added.͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Net Zero |  |

| |

|

- Exxon ‘pessimistic’ on trade

- US nuclear strategy

- New oil export hub

- Mineral fund gets funded

- US mineral strategy

David Wallace-Wells is ‘still pretty worried.’ |

|

Exxon ‘pessimistic’ on trade talks |

| |  | Tim McDonnell |

| |

Brendan McDermid/Reuters Brendan McDermid/ReutersThe Trump administration’s efforts to score a rollback of European climate rules for the benefit of US oil and gas companies aren’t paying off yet, ExxonMobil’s CEO told Semafor, adding that he was “pessimistic” that the White House could score a breakthrough on behalf of American fossil fuel firms. Darren Woods said he’s taken his complaints directly to Trump about a set of EU environmental disclosure regulations that he views as trade-crushing overreach, and which were on the table when Energy Secretary Chris Wright met with European officials last week. “Europe is slowly suffocating itself,” Woods said. “They’re trying to build a so-called green economy, that’s not working. And

instead of trying to fix that, they’re now trying to drag every American company down.” Trump, who recently completed a trade deal with the EU that hinges on facilitating a massive increase in gas exports, “understands the challenge,” Woods said. But he cautioned: “We haven’t seen the response from European leaders we’d like to see.” Woods added that he doesn’t share the view of his peer Patrick Pouyanné of TotalEnergies, who said last week that the US is adding “too much” LNG export capacity. “Long-term, the world’s going to need LNG,” Woods said. “We underpin our LNG investments with long-term offtake agreements.” And he called a recent Wall Street Journal article saying Exxon engaged in secret talks to restart its operations in Russia “blatantly false,” adding “we don’t have any plans” for new projects or investments in Russia. |

|

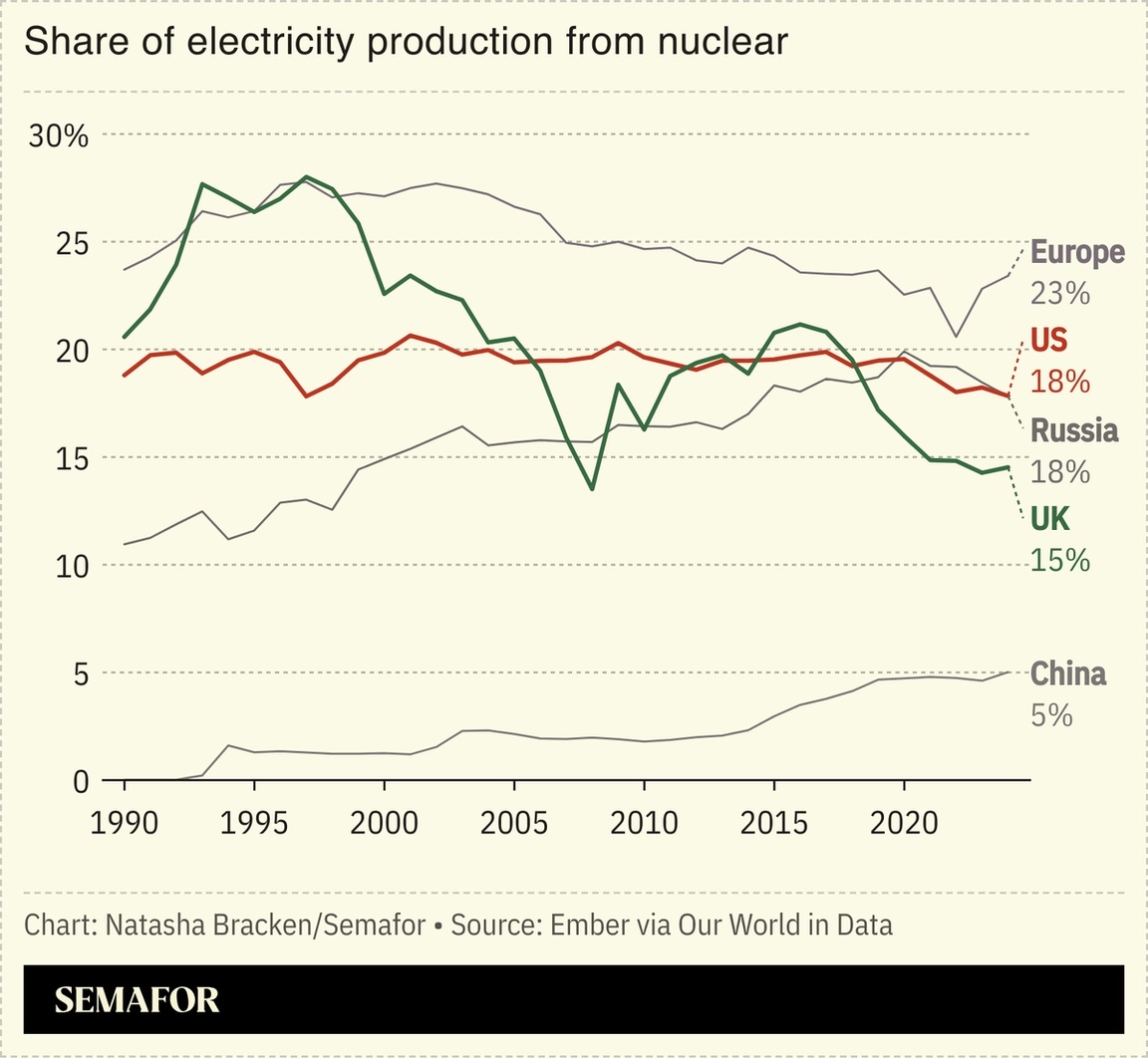

The Trump administration is elevating the role of nuclear power in trade negotiations. US President Donald Trump’s state visit to the UK this week included the conclusion of a deal that will make it easier for US companies to build nuclear power stations in Britain. More such agreements are in the works with other countries, Energy Secretary Chris Wright told the UN’s nuclear oversight agency this week. Future deals could include Saudi Arabia; Wright said back in April that early talks on such a deal were underway. Unlike renewables, nuclear is one low-carbon technology that Wright, himself a former nuclear entrepreneur, can get behind. Nuclear power is also an important avenue for countering the geopolitical influence of Russia and China. But unlike gas, where the US holds a more commanding position, the administration’s nuclear diplomacy will need to be “tempered with the recognition that US partners and allies are crucial to commercial success,” Jennifer Gordon, director of the Atlantic Council’s Nuclear Energy Policy Initiative, told Semafor. In this case, at least, the US seems to have achieved a better deal, Gordon said: The UK had previously expressed interest in prioritizing its own nuclear technologies. |

|

Dr. Tedros Adhanom Ghebreyesus, Director-General, World Health Organization, will join the stage at The Next 3 Billion — the premier US summit focused on closing the global digital divide. Semafor editors will sit down with global executives and thought leaders to highlight the economic, social, and global impact of bringing the next 3 billion people online. Sept. 24, 2025 | New York City | Delegate Application → And don’t forget to join the Net Zero reader happy hour on Thursday, Sept. 25! |

|

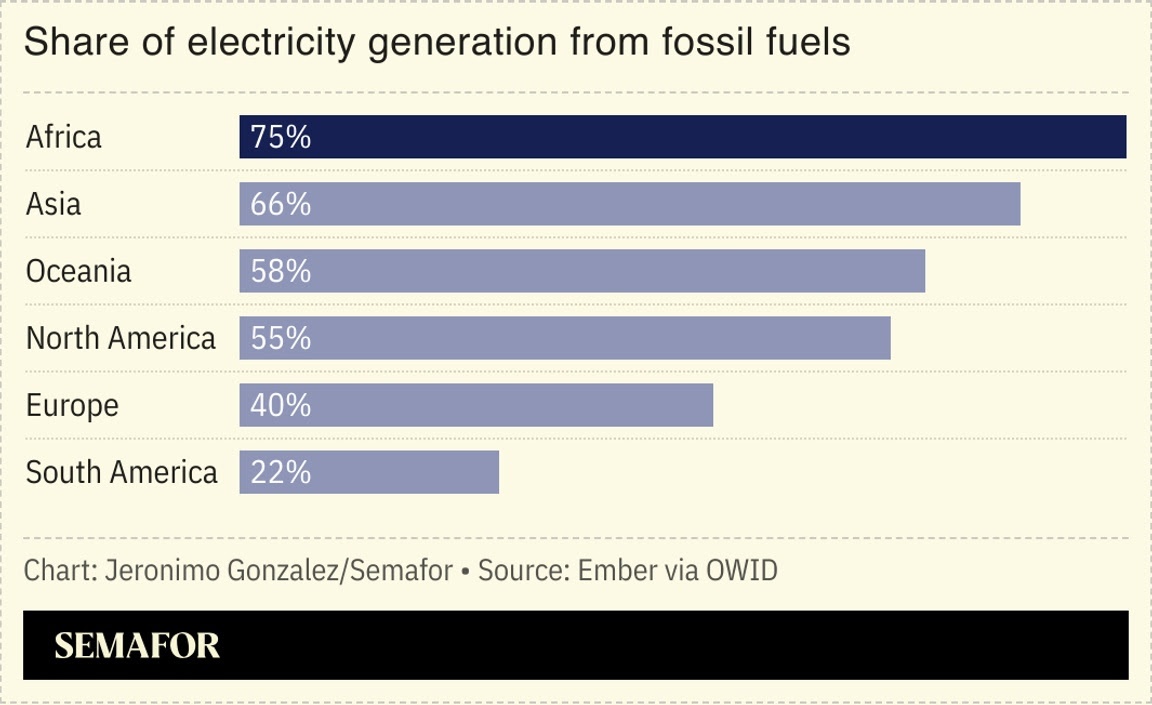

A $19-billion refinery in Nigeria sent its first shipment of gasoline to the US, marking a new chapter for the country as a major fuel exporter. Africa imports the vast majority of its refined fuels despite being a major oil producer, with leaders across the continent vowing in recent months to bolster their energy independence, including via renewable energy investments. The signature effort in this push is the Nigerian refinery project, built by Aliko Dangote, the continent’s wealthiest man. The Dangote Refinery could bring “greater energy independence to Africa’s largest oil-producing nation, and redefine trade flows across the Atlantic Basin,” Africanews wrote. |

|

New cash promised by the US and Ukraine to seed a fund for supporting mineral and fossil fuel development in Ukraine. The allocation is the first tangible result of the mineral deal orchestrated by US President Donald Trump earlier this year. Ukraine also opened bidding for the first project under the deal, a lithium mine, one contender for which is a mining company partially owned by the US government. The funding could also be used for new geologic surveys or other preliminary steps to draw US oil and gas companies to invest in Ukraine. |

|

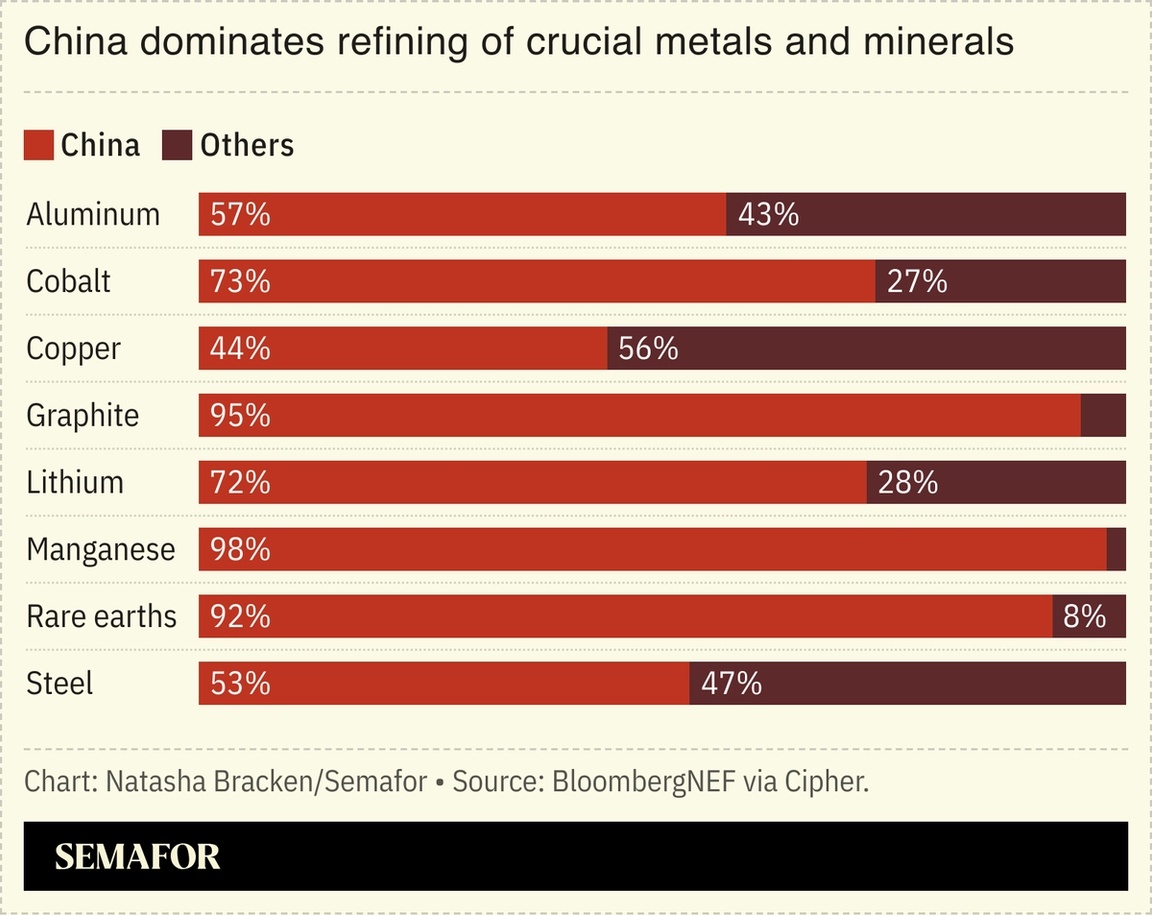

The US is in talks with a New York-based investment firm to launch a multibillion-dollar fund for overseas mining projects, the Financial Times reported — the latest move in Washington’s race to lock down critical minerals. The tit-for-tat tariff war with China drove home a hard truth for Washington: Beijing holds a tight grip on critical minerals — essential for making defense technologies — and it’s willing to weaponize that grip. In response, it seems the US has stepped up efforts to counter Beijing’s dominance: Washington’s mediation between the Democratic Republic of Congo and Rwanda was followed by a show of keenness from America to invest in the mineral-rich DRC; and just this week, the US pledged $75 million to jump-start a deal to invest in Ukraine’s mineral reserves. This new deal, if finalized, would signal the administration’s willingness to work more closely with the private sector on mining investments. —Natasha Bracken |

|

New Energy- Demand and investment in solar energy remain strong despite US President Donald Trump’s attacks on clean energy, with the US EIA projecting that solar power will supply the largest share of growth in America’s power sector.

- Electricity use in the Middle East and North Africa has tripled since 2000 and is projected to rise by a further 50% by 2035, with renewables also on the increase.

Thomas Mukoya/Reuters Thomas Mukoya/ReutersFossil FuelsFinancePolitics & Policy |

|

|