|

||

| Axios Markets | ||

| By Madison Mills · Oct 01, 2025 | ||

|

⛔ The government has shut down and stock futures are lower this morning. The markets don't tend to react strongly to lapses in federal funding, but if it's different this time, we will be watching.

Let's get into it. All in 1,000 words in 4 minutes. |

||

| 1 big thing: CEO says tariffs are the market "wild card" | ||

| By Madison Mills | ||

|

||

|

Illustration: Gabriella Turrisi/Axios |

||

|

Stocks keep grinding higher and Wall Street remains sanguine about policy risks, however, the view of the economy from a large regional lender is more cautious. Tariffs, the CEO of Citizens Financial tells Axios, continue to have the potential to trigger an economic slowdown. Why it matters: While ignoring tariffs has been a critical part of the bull market formula, Bruce Van Saun warns investors to check their "unbridled enthusiasm." What they're saying: "The one thing that's still the wild card really is the tariffs," the bank CEO says in an interview with Axios. He adds that "the biggest risk for a bank is always the external environment, the macro."

Catch up quick: The sweeping global tariffs unveiled by President Trump back in early April initially spooked investors, with the S&P 500 hitting an intraday bear market.

Zoom in: Companies have been having "pretty good years," Van Saun says. Still, the uncertainty around the tariffs is holding back "what should be an even better environment given some of the other policies."

Yes, but: While the tariff risks remain, Van Saun notes that "the good news is companies are pretty adaptable and resilient."

Friction point: Immigration policy is another concern for Van Saun.

Follow the money: Citizens Financial's stock has rallied 29% over the past 12 months, significantly ahead of U.S. Bancorp, PNC and other regional banks.

|

||

|

|

||

| 2. October will be more "treat than trick" for investors | ||

| By Madison Mills | ||

Data: Financial Modeling Prep. Chart: Axios Visuals For investors, it's the most wonderful time of the year: the fourth quarter, typically the best performing period of the year for stocks. Why it matters: After a 13% rally so far this year, history suggests stocks have more room to run. By the numbers: Wall Street gets excited about the final quarter of the year for good reason.

State of play: Historic early weakness in fall didn't materialize this year. The S&P 500 closed September up on the month, marking its fifth month of gains. What they're saying: "The market has blatantly ignored the seasonal weakness we've historically seen during August and September," writes J.C. Parets, a chartered market technician and the founder of Trend Labs. "This is probably the most bullish part of it all."

Yes, but: For other investors, that's a sign of the market's biggest risk: complacency.

Between the lines: Equities keep rising regardless of several market risks, including but not limited to evolving tariffs, weakness in the labor market, high valuations, and slowing earnings growth for Big Tech, which is driving the majority of earnings growth. Portfolio managers who have to beat the S&P 500 can't afford to stay out of the market, even if the continued rally starts to be justified by technicals more than fundamentals. |

||

|

|

||

|

A message from Axios |

||

| Available now: Your insider guide to the media industry | ||

|

||

|

Axios' Sara Fischer has just released the 2025 Annual Media Trends Report — a boardroom-ready slide deck covering the year's biggest shifts across media and what's next for 2026. Right now, Media Trends Executive members can unlock the full report. Don't miss out — become a member today to unlock all the insights. |

||

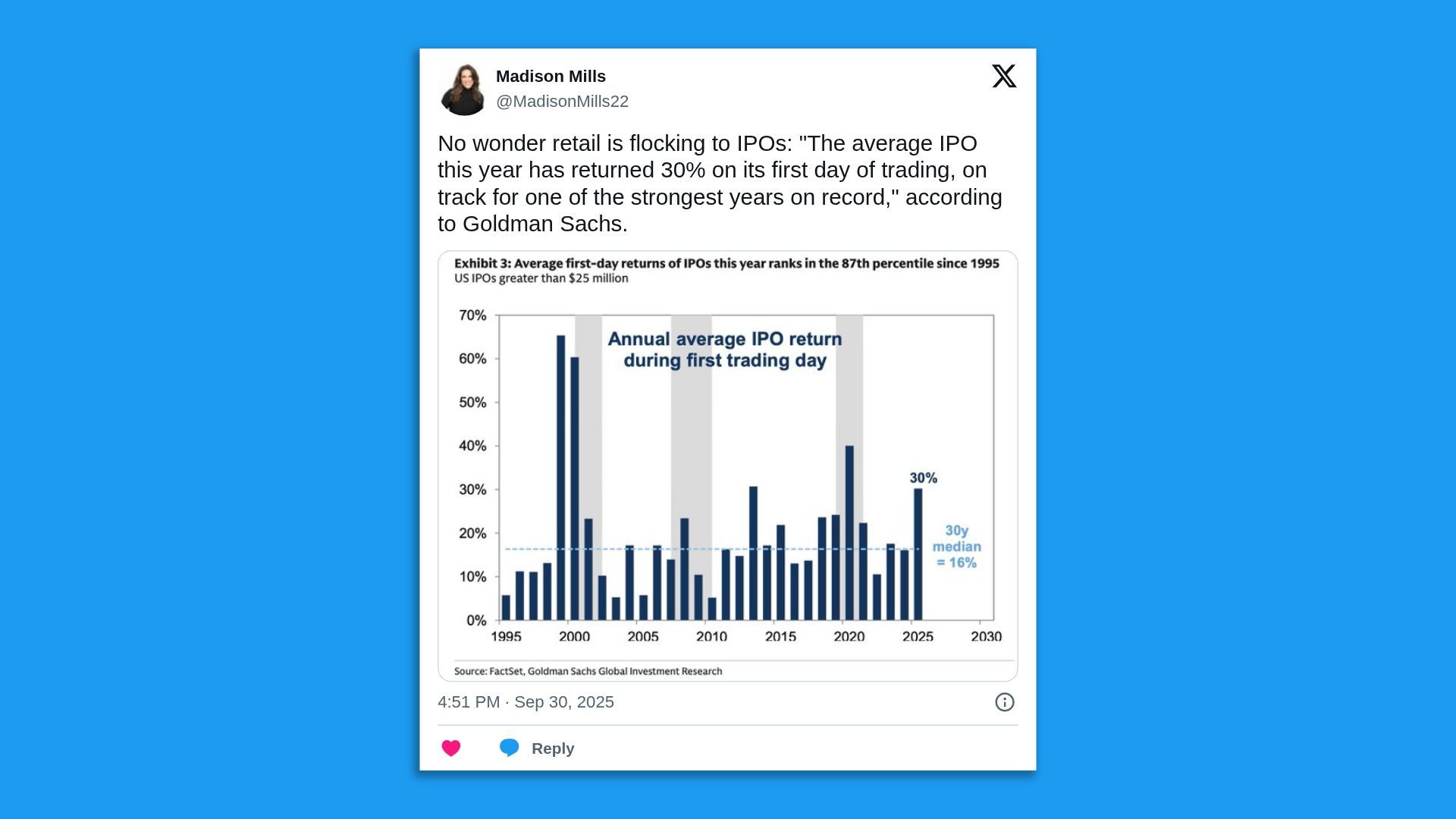

| 3. IPOs deliver 30% average return with trading debut | ||

|

||

|

Chart: Goldman Sachs and FactSet. |

||

|

The average IPO in 2025 returned 30% on its first day of trading, according to research from Goldman Sachs. This rate has only been exceeded in 1999, 2000, 2013, and 2020. Why it matters: It's the latest signal of growing risk appetite for investors. By the numbers: Goldman Sachs also notes that IPO activity this year has been outpacing 2024 activity by 18% thus far, with 2025 on track to be the strongest open year since 2021.

Thought bubble: It's no surprise then that retail investors are flocking to invest in new companies with that kind of single day performance. |

||

|

|

||

|

A MESSAGE FROM AXIOS |

||

| Go deeper with Media Trends Executive Membership | ||

|

||

|

The Media Trends Executive Membership connects modern digital media and marketing leaders to expert insights, actionable data and premier industry connections—all designed to tackle the pressing challenges of today. Curated by award-winning Axios senior media correspondent Sara Fischer and media reporter Kerry Flynn, this exclusive membership is your guide to navigating and shaping the future of media. |

||