| | Amid a wave of support from the Trump administration, Wall Street analysts think some new nuclear co͏ ͏ ͏ ͏ ͏ ͏ |

| |   Abu Dhabi Abu Dhabi |   Singapore Singapore |   Tokyo Tokyo |

| Net Zero |  |

| |

|

- Nuclear bubble warning

- Lucid’s magnet woes

- AES to go private?

- OPEC’s comeback moment

- Carbon credit boom

US shutdown elevates climate risks, and Ukraine war elevates nuclear meltdown risks. |

|

| |  | Tim McDonnell |

| |

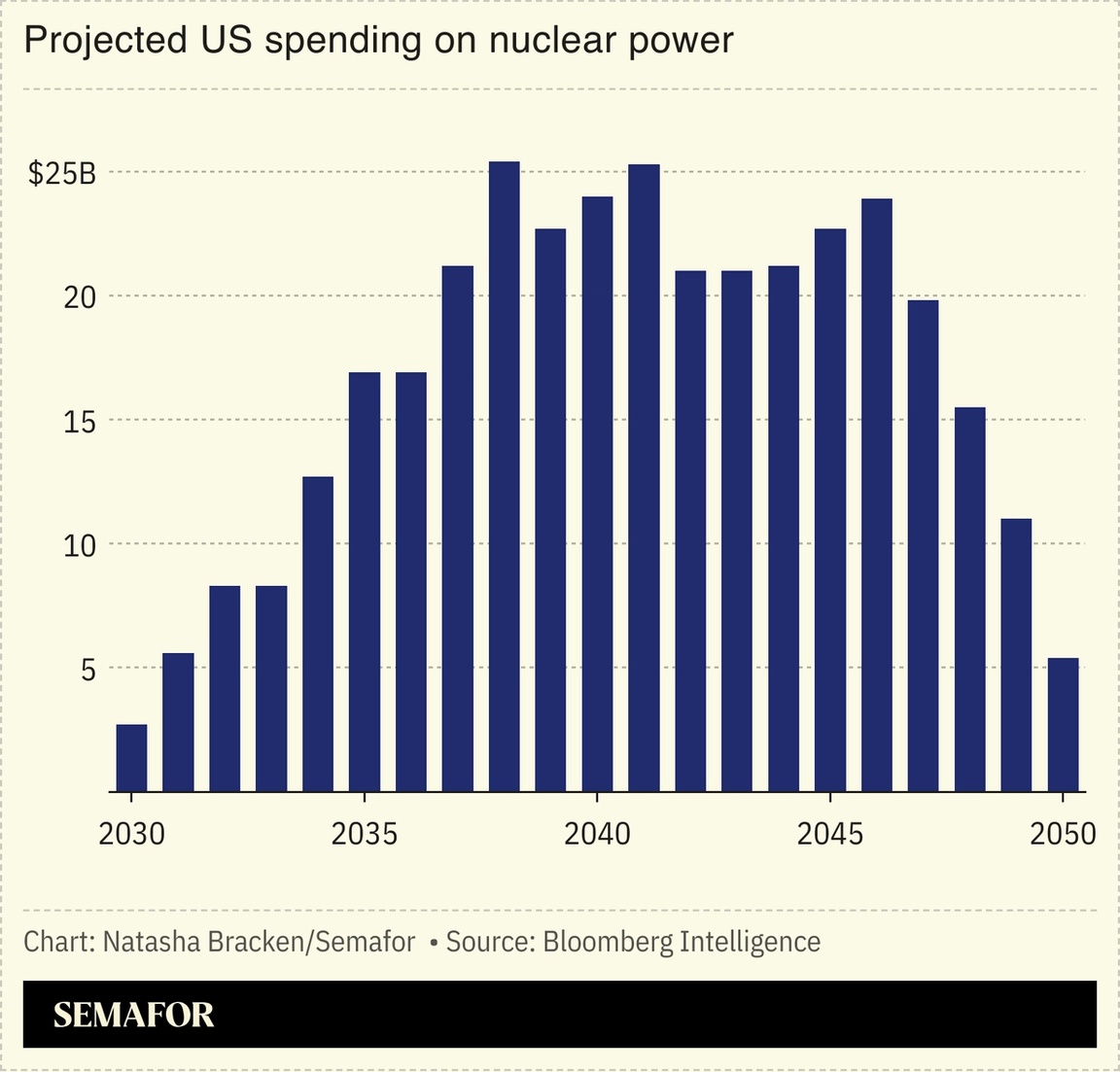

US Energy Secretary Chris Wright cast a renewed vote of confidence in cutting-edge nuclear power technology this week, even as some Wall Street analysts caution of a bubble in the making.  A host of nuclear power startups — some developing fusion technology, others conventional fission but in smaller, more cost-effective packaging than traditional big reactors — are drawing billions of dollars in investment even though none are yet sending electrons to the grid. The nascent sector has strong political backing and has made significant progress on core engineering problems. Now, a key question is which specific companies will prove to be a smart play, or a bust, for their investors. With dozens of startups now in the field, some bankruptcies and consolidations are inevitable. For a private company like Commonwealth Fusion Systems, which Wright visited this week, that risk remains limited to the handful of VCs and tech companies bankrolling it. But others, especially in the small modular reactor (SMR) field, are now making forays into the public market, creating new opportunities and risks for retail investors. And Wall Street is beginning to cast a wary eye toward some in particular. Since the Sam Altman-backed SMR startup Oklo went public last year, for example, its share price has soared from about $8 to $115. But this week Bank of America downgraded its rating for Oklo stock from “buy” to “neutral,” and another SMR startup, NuScale, from “neutral” to “underperform.” Goldman Sachs launched its tracking of Oklo stock this week, also giving it a lackluster neutral rating, despite Oklo’s selection this week by the Department of Energy for a new fast-tracking program. In general, the hysteria around power demand is pushing the valuations of many newly public energy startups beyond what they will realistically be able to deliver, Dimple Gosai, head of US clean tech equity research at Bank of America, told Semafor. “The disconnect between fundamentals and valuation is too wide to ignore,” she said. “There’s too much optimism baked into the stock price here.” |

|

| |  | Liz Hoffman |

| |

Courtesy of Lucid Motors Courtesy of Lucid MotorsEV maker Lucid is reaching into its own pockets to replace some of the US federal tax credit for EVs that expired this week, its CEO told Semafor, and is also scrambling to find solutions to problems stemming from the Trump administration’s tariff and immigration policies. Marc Winterhoff said he worries that a recent massive hike in the price for H-1B visas could hamstring advanced manufacturing companies like his: “Quite frankly, there’s a reason why so many people with H-1B visas are being employed here: You don’t have enough [qualified workers] that have an American passport.” Another challenge is sourcing magnets: Export restrictions implemented by China in response to US tariffs nearly caused Lucid to run out of essential parts, and the company needed to rapidly find new suppliers and expedite an overhaul of its battery design as a result. One thing Winterhoff isn’t worried about: Competition with cheap EVs from China, which Lucid has made a calculated decision to avoid: “I don’t think that’s a place you want to be in the future.” |

|

Mark Schiefelbein/Reuters Mark Schiefelbein/ReutersThe stock market is bad at understanding the value of renewable energy, the CEO of one of the largest US power companies told Semafor, which could explain why his company is reportedly closing in on a takeover by private equity. AES Chief Executive Andrés Gluski said he has been frustrated in the past few years to see his company’s share price fall by half even as it has become one of the largest purveyors of clean energy to tech companies and data centers. One reason, he said, is the large amount of upfront debt required to build solar and wind farms, which leaves a company’s balance sheet looking unhealthy in the short term even though, in the long term, renewables are less prone to breakdowns and less exposed to fuel price volatility than fossil power plants. But the more important problem is vibes, Gluski said: “Our stock has suffered because renewables aren’t in the zeitgeist of the moment.” So it may come as no surprise that, according to the Financial Times, BlackRock’s Global Infrastructure Partners is nearing a $38 billion deal to buy AES. The company declined to comment on that report, but Gluski told Semafor in the interview: “The public markets are failing to see an opportunity.” Maybe the private market would treat the company better. |

|

Carlos Cuerpo, Minister of Economy, Trade, and Business, Spain, will join the stage at the Fall Edition of Semafor’s World Economy Summit. Hosted in the Gallup Great Hall and spanning eight sessions over two days, Semafor editors will feature on-the-record interviews on the state of global growth and finance, AI advancements, powering global energy needs, and the forces reshaping the world economy. Each session brings together the leaders and forces most directly shaping the global economy, with programming powered by Semafor’s world-class editorial and executive leadership. Oct. 15 & 16, 2025 | Washington, DC | Request Invitation |

|

| |  | Mohammed Sergie |

| |

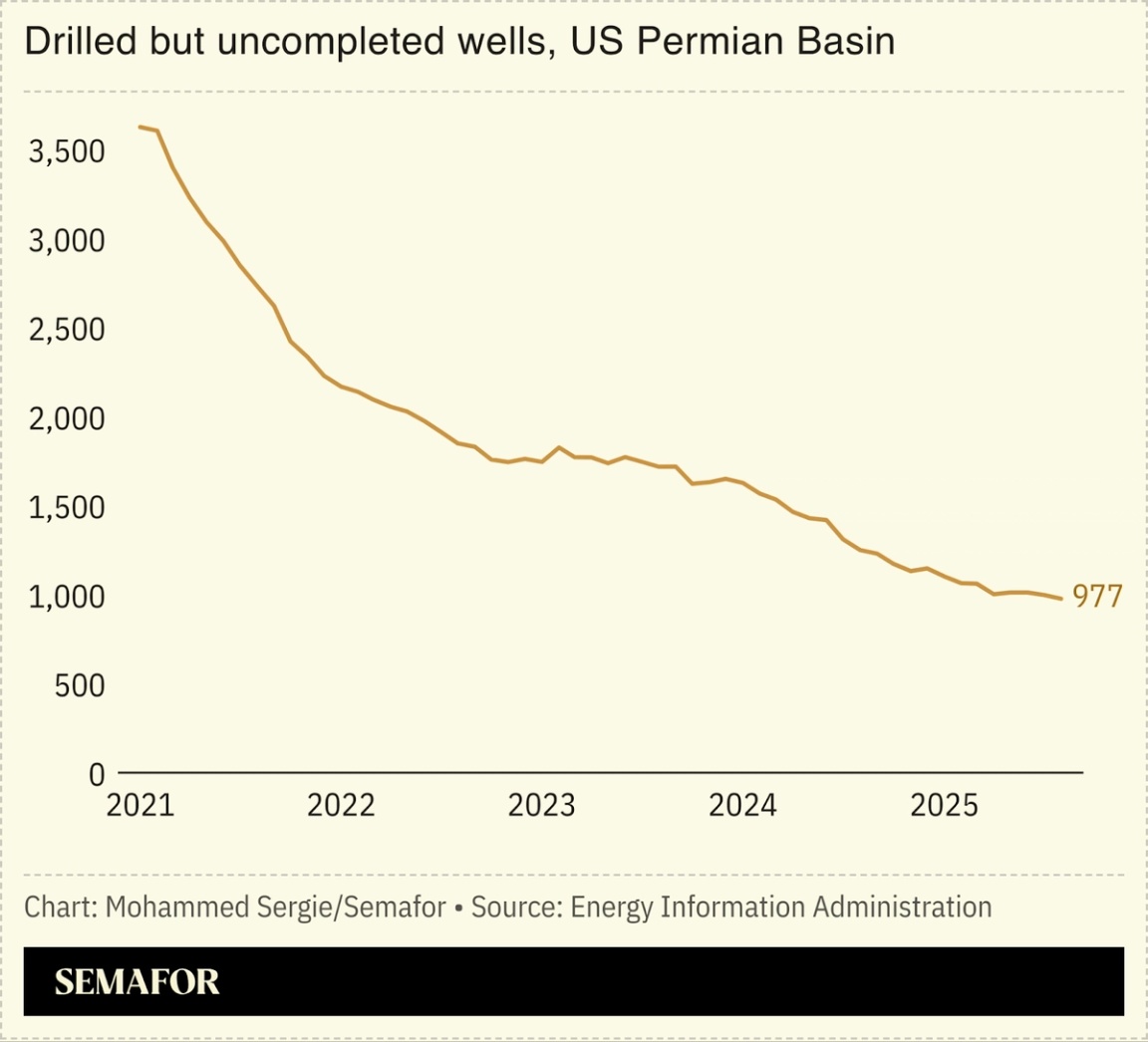

Oil market dynamics have opened a window for OPEC+ to reclaim market share lost to US shale, with expectations building that the group will raise output despite short-term price pressures, investors and experts said at a Gulf energy conference. US oil production is forecast to decline slightly next year, according to the Energy Information Administration, as drilling slows in prime acreage in the Permian basin. A key measure of activity there — drilled-but-uncompleted wells, often used by operators to raise debt or hold for higher prices — has dropped below 1,000. That suggests the most productive “Tier 1” assets have been tapped, leaving little room for a rapid rebound, said Brien Pieri, founder of Colorado-based data platform and advisory Energy Rogue. The timing for an OPEC surge now “is brilliant,” Pieri told Semafor, because US producers will be finalizing their 2026 budgets soon and may trim investment in anticipation of lower prices. |

|

Million tons of carbon credits retired on the global voluntary carbon market in the first half of 2025, the largest half-year volume on record. The data show that although carbon markets froze up after successive greenwashing scandals in the past few years, trading is heating up again: The carbon trading desk at Trafigura is preparing for “huge” growth, a trader there told Bloomberg. New data from the carbon analytics firm Sylvera also show that prices for high-quality carbon credits are reaching record highs. |

|

New Energy Athit Perawongmetha/Reuters Athit Perawongmetha/ReutersFossil FuelsPolitics & PolicyMinerals & MiningEVsCOP30Personnel- The US government shutdown will affect 89% of EPA workers, with the long-term consequences still unclear: Trump threatened to use the closure to fire, rather than furlough, federal employees, and his past attacks on the agency suggest EPA staff won’t be spared.

|

|

|