| | In this edition, the Pfizer deal shows there’s a new art to negotiating with the White House, and In͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- Shutdown shakiness

- Intel seeks AMD business

- WH pushes for college reform

- Vanguard bearish on stocks

|

|

A remarkable exchange took place in the Oval Office on Tuesday. “I’m surprised you’re agreeing to this,” President Donald Trump said to Pfizer CEO Albert Bourla, who posed in front of the president’s smiling medical advisors and agreed to give up billions of dollars in profit margin. “I’m getting better,” responded Bourla. Companies once relied on well-funded lobbying groups to fight their battles and availed themselves of the revolving door. (Pfizer added Trump’s first-term FDA chief, Scott Gottlieb, to its board in 2019.) But the old playbook — drag your feet, lawyer up, wait for the enforcement action that may never come, and sue if you must — has been replaced by something weirder. Companies are policing themselves into pretzel knots before lettered agencies pick up their fine-print pen. Traditional regulation is coercive but predictable. Companies know the rules of the road and test them when they dare. That’s been replaced by a regime that is in theory voluntary but fickle. It’s less open to negotiation than Trump’s first term “bid-ask” approach to regulation, which many CEOs actually came to like, but more open than Biden’s, which had almost no give and take. Pick your poison. When Bourla professed his self-improvement to Trump, he was acknowledging a new reality. And he got what he came for: Pfizer added $6 billion in market value by the time the president said, “he’s doing the right thing.” |

|

Jonathan Ernst/Reuters Jonathan Ernst/ReutersThe government shutdown will drag at least into Friday, with effects rippling through the wider economy. The Trump administration paused $18 billion of New York infrastructure projects citing DEI concerns, and tens of thousands of federal workers are furloughed as Trump meets with his budget chief to discuss making those furloughs permanent, turning the shutdown into a backdoor DOGE reboot. And it appears likely that September’s jobs report won’t be published Friday, leaving investors to piece through private-sector substitutes with shaky track records. (The Chicago Fed is trying to step in with a new real-time tracker.) Consumer confidence fell sharply during the last government shutdown, in late 2018, and while its effects on GDP were miniscule, the public mood now is primed for bad news. Shares of health insurers, which would likely be hit by the expiration of subsidies that are a key issue in the congressional standoff, have shrugged off the concerns. |

|

AMD may join Intel’s new fanbase |

Ann Wang/Reuters Ann Wang/ReutersIntel is in early-stage talks to add AMD as a customer at Intel’s factories, in what would be another vote of confidence in the struggling chipmaker, according to people familiar with the matter. In the past seven weeks, Intel has gained investment dollars and public support from the White House, Nvidia, and SoftBank, and is in talks for backing from Apple, Semafor and others have reported. It’s unclear how much manufacturing AMD is discussing shifting to Intel, or whether that commercial partnership would come with a direct investment, similar to the deals cut by other companies. It is also possible that no agreement will be reached, the people said. |

|

Trump sets new terms for university funding |

Brian Snyder/Reuters Brian Snyder/ReutersThe government has already waded into the boardroom — now, it’s explicitly linking federal university funding to classroom culture reforms. In a 10-point memo sent to leaders at nine top schools, the White House said it would tie funding to, among other things, mandatory standardized testing in admissions, a five-year tuition freeze, and a ban on use of race in admissions and political statements by university employees. The last point picks up a baton left behind by Charlie Kirk, whose Turning Point USA runs a “Professor Watchlist” service that flags professors the organization considers anti-conservative. The White House memo requires universities to ensure a “vibrant marketplace of ideas on campus,” The Wall Street Journal reported. Some of the reforms are less politically charged. A tuition freeze — and an outright waiver for students of the “hard sciences” — would be popular with young people and potentially solve the US’ longstanding engineering shortage. |

|

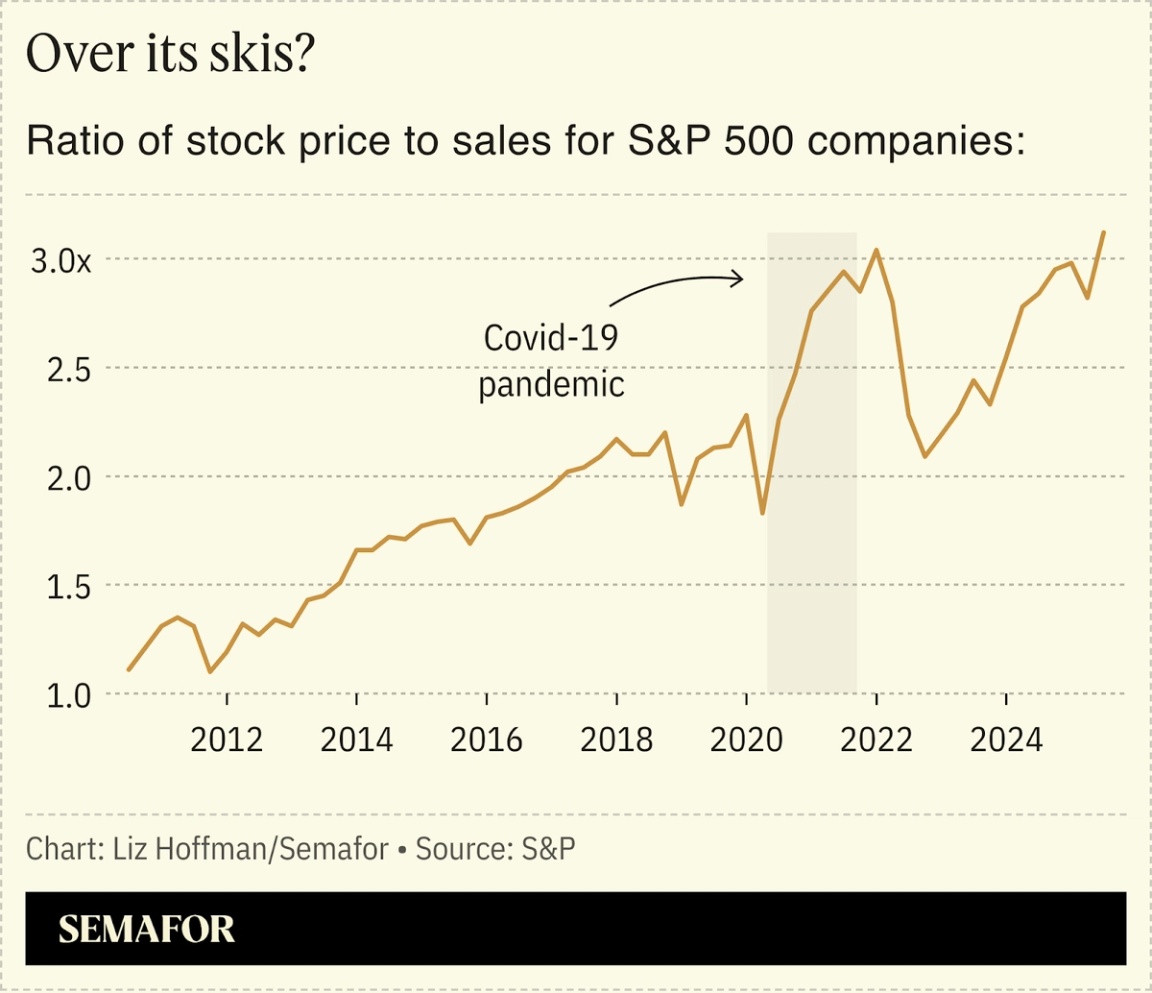

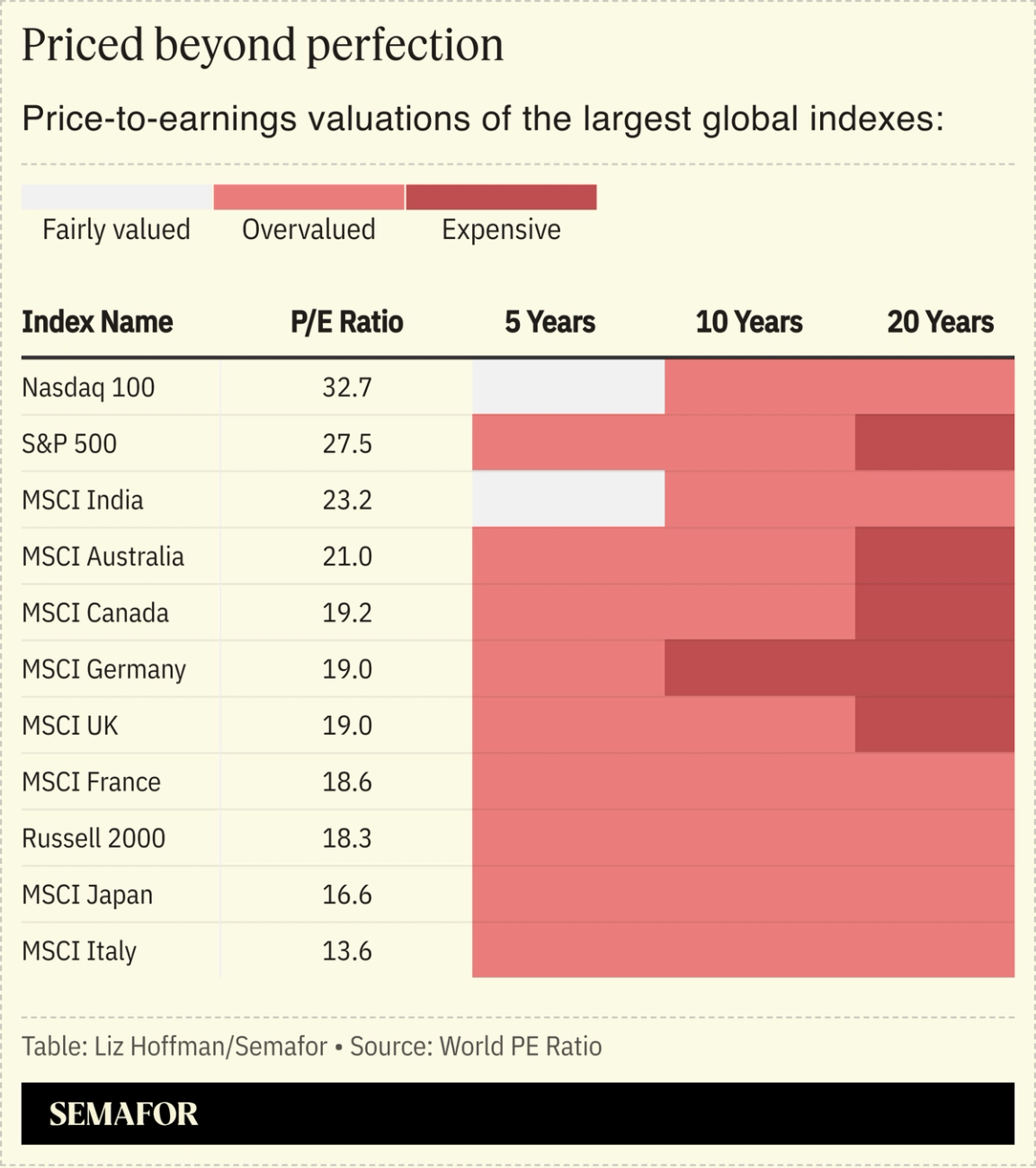

The US stock market, which just posted its best September in 15 years, is “priced for perfection” and likely to disappoint, says Vanguard’s No. 2 executive. The $11 trillion firm has lowered its expectations for stock returns over the next decade to as little as 3.3% — worse than you’d get from a bucket of corporate bonds.  “There’s a lot of great news priced in” to US stock prices, Greg Davis, Vanguard’s president and chief investment officer, told Semafor. The S&P 500’s price-to-sales ratio hit an all-time high of 3.3 in September, meaning that investors’ enthusiasm for companies is outpacing that of their customers. That metric topped out around 2 during the dot-com boom, and at just over 3 during the pandemic’s frothy markets and muted economy. It’s not just AI hype: As Bloomberg columnist Jonathan Levin noted recently, red-hot Walmart and Costco, both more richly valued than Nvidia on a profits-per-share basis, remain “one of the market’s great valuation mysteries.” And it’s not just the US: The 15 largest global stock indexes are all overvalued or expensive on 10-year lookbacks.  |

|

Walmart US CEO John Furner will join the stage at the Fall Edition of Semafor’s World Economy Summit. Hosted in the Gallup Great Hall and spanning eight sessions over two days, Semafor editors will conduct on-the-record interviews on the state of global growth and finance, AI advancements, powering global energy needs, and the forces reshaping the world economy. Each session brings together the leaders and forces most directly shaping the global economy, with programming powered by Semafor’s world-class editorial and executive leadership. Oct. 15 & 16, 2025 | Washington, DC | Request Invitation |

|

Companies & Deals- Quincenti-corn alert: OpenAI employees sold shares at a $500 billion valuation, turning the ChatGPT maker into the most valuable private company in the world, overtaking Elon Musk’s SpaceX.

- Spiked: Berkshire Hathaway’s BNSF is urging rail customers to lobby against the merger of Union Pacific and Norfolk Southern, a deal that has Trump’s blessing. It also said it isn’t interested in acquiring rival CSX.

- Bromance in the boardroom: Three companies — Spotify, Comcast, and Oracle — named co-CEOs this week. Spotify’s move is an experiment in replacing founder Daniel Ek, Comcast’s looks to be a long-play baton handoff from scion Brian Roberts, and Oracle has done this before. One study of 87 companies with co-CEOs found they outperformed, but for every Netflix, there’s a BlackBerry.

- Tunnel vision: Apple is pausing a planned update to its Vision Pro headset, aimed at prosumer gadget nuts, to focus on building a rival to Meta’s more everyday-wearable smart glasses.

- Under the wire: Tesla reported unexpected higher sales last quarter as buyers rushed to secure a $7,500 federal EV tax credit that expired Sept. 30. Lucid’s CEO Marc Winterhoff told Semafor last week that demand was “strong” ahead of the subsidy’s end.

- Terminal value: Yahoo is reportedly in talks with Italian tech company Bending Spoons to sell AOL for $1.4 billion, 0.6% of the legacy internet giant’s peak valuation.

Watchdogs- On the docket: The Supreme Court said Fed Gov. Lisa Cook is staying put until January, when judges will be able to hear arguments on the Trump administration’s bid to oust her, Semafor’s Eleanor Mueller reports.

Markets- No need to sleep on it: CME will offer round-the-clock crypto trading starting next year, pending approval from the regulators, which shouldn’t be a problem. “Crypto is job No. 1 right now,” Securities and Exchange Commission Chair Paul Atkins told reporters last week.

|

|

|