| | In this edition, it’s getting closer to the time that AI investments should pay up, and recent IPOs ͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- CEOs test the IPO waters

- Wall St. improvises on data

- The ‘burn-it-all-down’ trade

- Fed in the wilderness

- Gulf’s glowup moment

|

|

With the billions flying into AI startups, data centers, and chips, the question we’ve been asking, repeatedly in this newsletter, is: Who’s paying for all of this? Investors are prone to fevers, and foreign governments trying to stay on the White House’s good side have their own reasons to announce massive AI commitments that may or may not materialize. The missing piece has been big corporate customers spending actual money on the products built by OpenAI and Anthropic. AI labs are quick to tout supplier and investor deals, no matter how futuristic or fuzzy. Where are the customer brags? News that OpenAI had signed nine-figure deals with Delta Airlines or Citadel or Eli Lilly would presumably do the same, financially speaking, for the AI ecosystem. Corporate quiet here has suggested, uncomfortably for students of history, that companies either aren’t spending much or aren’t seeing much in the way of returns. Enter Jamie Dimon yesterday with a rare and welcome receipt: JPMorgan is spending $2 billion a year on AI services that are paying for themselves in cost savings. He was vague about the details, but said about half of JPMorgan’s 317,000 employees use the bank’s internal large language model each week to scrape research reports, write code, and generate ideas. Of course, the real economic promise of AI for JPMorgan and its ilk isn’t replacing app developers or risk managers. It’s using AI to build new products and bring them to new markets — to create a bigger pie, not just a cheaper one. Mock my prediction, as some of you gently did, that live-translating AirPods could crack open global commerce. But JPMorgan sending its top bankers to São Paulo whether or not they speak Portuguese is a small example of AI growing markets, not just cutting costs. Deeper analysis could spin up better ETFs. Predictive tax planning — hard to do now without endless data collection — could attract new customers to wealth management. I want to hear more of this from Dimon and from other CEOs who’ve been conspicuously quiet during this era of AI hype. Until there’s a clearer picture of who’s actually buying AI products, the doubts will keep piling up about the massive sums being spent to build them. |

|

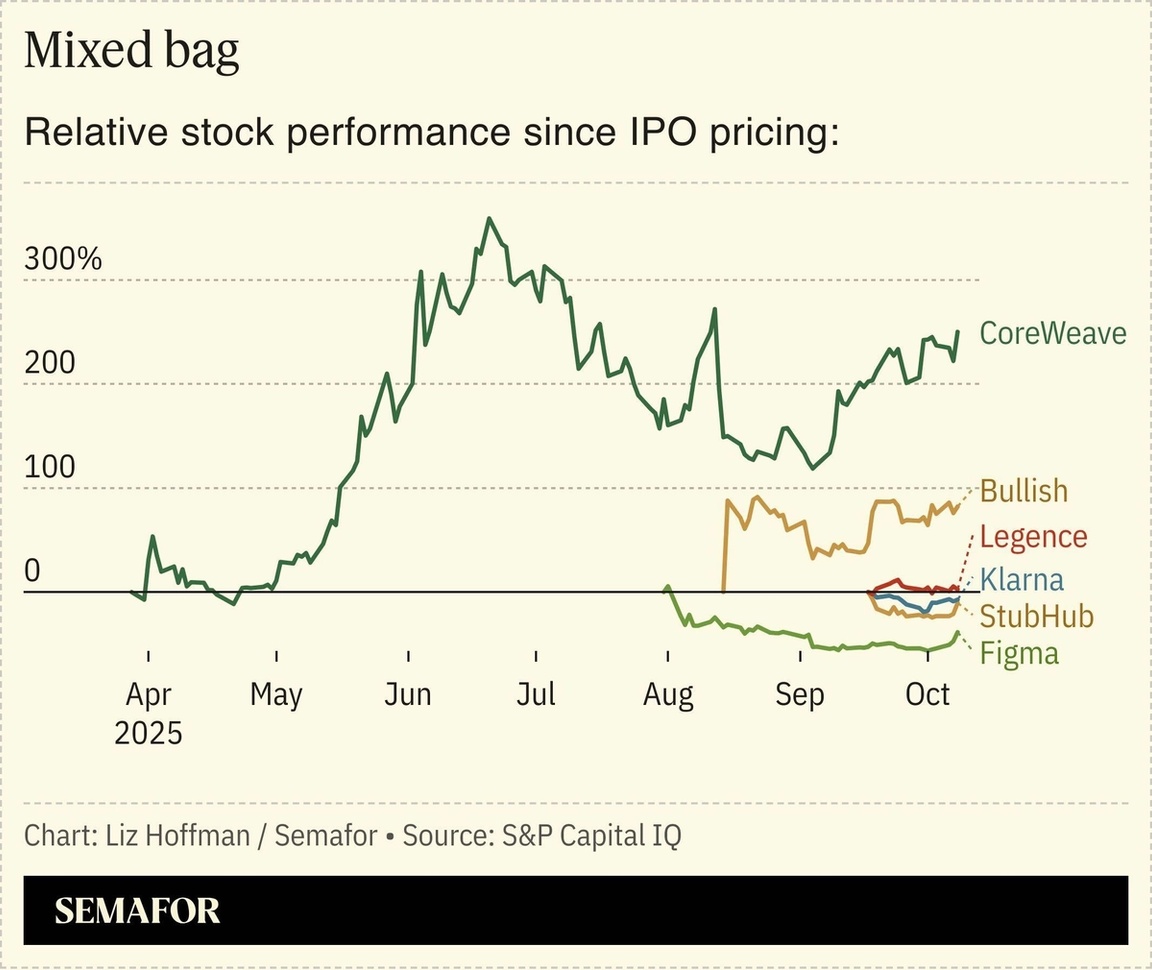

A series of (mostly) successful IPOs have bolstered CEO confidence about entering the public markets, after a yearslong drought. Private equity firms sitting on an estimated 29,000 unsold companies worth $3.6 trillion are desperate for exits; the average hold time is now more than six years, up from just over five in 2021, according to Bain & Company. Public investors, still bruised from the IPO and SPAC free-for-all of 2020 and 2021, have signaled an appetite to back profitable companies — a quarter of new entrants are in the black when they listed this year, more than double the level in 2021, PitchBook data shows.  And US regulators are pushing hard to make the public markets more appealing to companies, worried that an endless supply of private capital will crowd out retail investors, suck investment away from non-AI industries, and lead to a hollowing-out of one of America’s biggest financial and cultural exports: its stock markets. Proofpoint, which was acquired by Thoma Bravo in 2021 and uses AI and machine learning to detect online threats, has been preparing for a float that could value the company at around $20 billion, according to people familiar with the matter. “The IPO window looks to be reopening,” Proofpoint CEO Sumit Dhawan told Semafor. |

|

Here comes the shadow economic data |

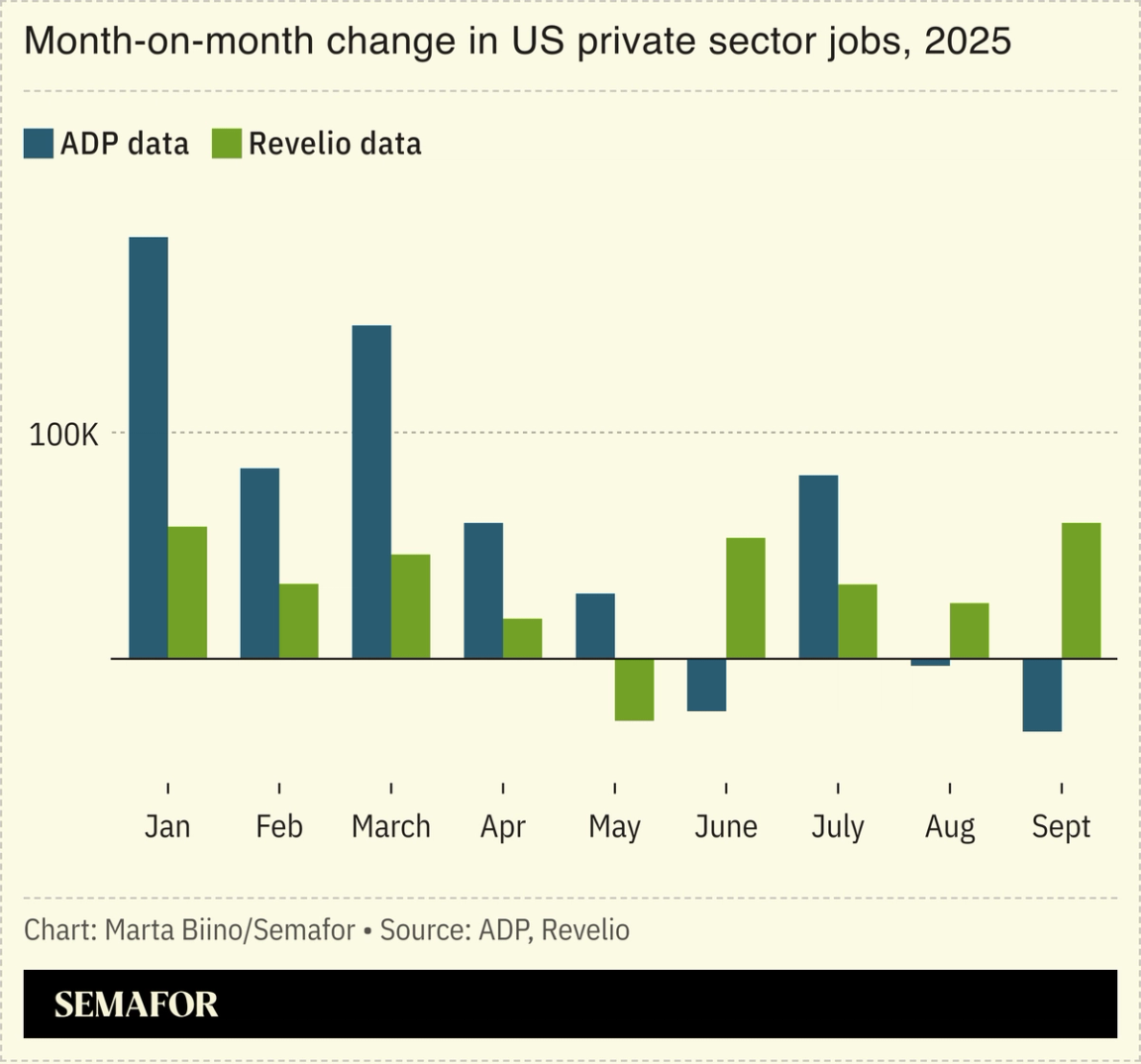

Alternative economic data is trickling in to fill the blind spots created by the suspension of data collection during the government shutdown, and the broader doubts over the reliability of numbers put out by bureaucrats pressured by President Donald Trump to paint a sunny picture. But the substitutes are all over the map. Private investment firm Carlyle’s new jobs report, pulled from its 277 portfolio companies with 730,000 employees, shows the US added just 17,000 jobs in September. Payroll giant ADP says private companies cut 32,000 jobs last month, while Revelio, which scrapes online profiles and job postings, estimated a gain of more than 60,000. Meanwhile, the Chicago Fed’s new unemployment tracker “indicates some steadiness in the labor market,” the regional Fed’s president, Austan Goolsbee, said. Carlyle’s entry is notable for another reason. PE portfolios were once too disconnected from the broader economy to offer a read-through; equity stakes in highly leveraged companies can only say so much about the economy as a whole. But private capital’s growth into new sectors and credit give a wider window that’s now worth peeking through. “The size of the portfolio, that’s number one,” Carlyle’s chief economist, Jason Thomas, told Semafor. “And second, when you have control positions or significant influence in companies, you get access to a lot more information — order books, backlogs, prices paid, prices received, headcount. We see a lot more data than a shareholder in a public company. “You look back over the past five years, and [our data] is mapping right on top of actual GDP,” with some statistical fixes to correct for sectors, like consumer goods, where Carlyle is smaller, he added. |

|

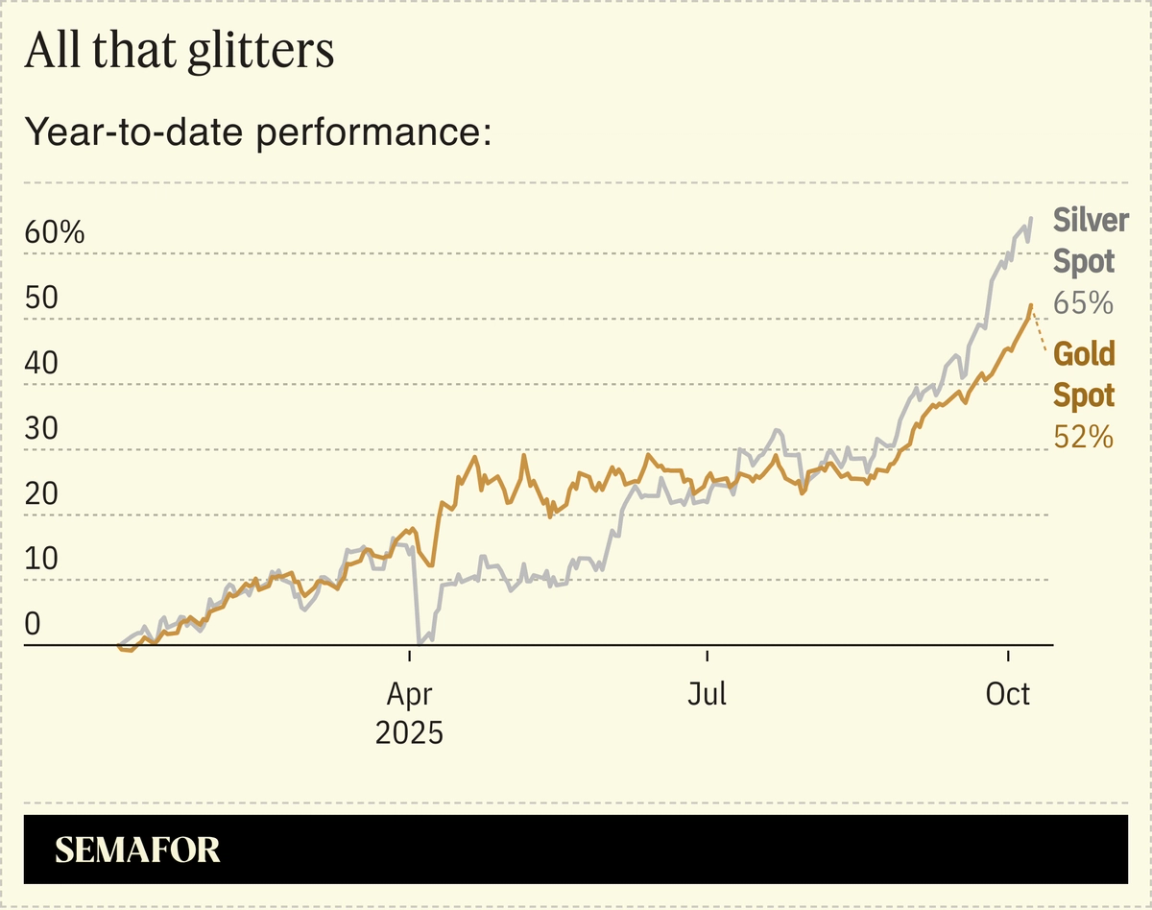

The ‘what-now’ trade lifts precious metals |

Gold, silver, and bitcoin are at or near record levels as investors search for safe havens.  Wall Street calls it the “debasement trade,” named for the underhanded effort by old-time kings to reduce the amount of precious metal in coins (today’s money-printer-go-brrr problem) as a way to fund more wars (runaway public spending). It’s a reflection of deep mistrust in governments and a sign that traditional answers to unease — sovereign bonds, including those issued by the US Treasury — are the problem. Most flights to precious metals happen during acute financial crises and are paired with a flight from stocks, which isn’t happening now. “I’m going to bet on American business, but I want to immunize some of my sovereign exposure to the United States,” Citadel’s Ken Griffin told Bloomberg this week. Ray Dalio, long a sovereign-debt doomsayer, told a Greenwich, Conn. crowd this week to put 15% of their money into gold. And tax shelters are gaining popularity among everyday investors bracing for what some see as an inevitable tax increase to cover ballooning deficits. |

|

OpenAI Chief Economist Dr. Ronnie Chatterji; BofA Global Research Head of Global Economics Claudio Irigoyen; Goldman Sachs President John Waldron; NYSE President Lynn Martin; and British International Investment CEO Leslie Maasdorp are among executives joining us next week on stage at the fall edition of Semafor’s World Economy Summit. Hosted in the Gallup Great Hall and spanning eight sessions over two days, the summit will feature on-the-record interviews on the state of global growth and finance, AI advancements, powering global energy needs, and the forces reshaping the world economy. Oct. 15 & 16, 2025 | Washington, DC | Request Invitation |

|

Dissent racks Fed, new minutes show |

Elizabeth Frantz/File Photo/Reuters Elizabeth Frantz/File Photo/ReutersNewly released records show a Federal Reserve increasingly at odds with itself over the path forward on interest rates. While most of the central bank’s policymakers still see inflation as a bigger threat than the jobs market — whose weakening may be more driven by slower immigration than corporate gloominess — there’s little consensus on the path forward, according to the September minutes released Wednesday. Seven of 19 voting members of the Fed’s rate-setting committee saw no need for any further cuts this year, while the market is pricing in two more. One official wanted to raise interest rates, which would likely spook the markets by signaling acute concerns about a recession. The Fed’s decision-making seems more delicate — and more divided — than it’s been in years. We’ll ask its newest and most dovish member, Stephen Miran, about all of this on stage at Semafor’s World Economy Summit next week. What do you want to hear from him? You can reply to this email with questions, and request an invitation here. |

|

KKR exec sees Gulf emerging as global financial hub |

Bernd von Jutrczenka/picture alliance via Getty Bernd von Jutrczenka/picture alliance via GettyThe Gulf is no longer the West’s piggy bank but a burgeoning financial hub in its own right, a top KKR executive told Semafor’s Mohammed Sergie. A decade after the Middle East splashed onto the global financial scene with huge outbound checks to the likes of SoftBank Vision Fund, Uber, London’s Canary Wharf, and Italy’s Ferrari, the region is now attracting outside money to its own domestic economies, tilting away from oil and toward technology. The Middle East is moving from somewhere “people came just to raise capital” to “a hub of investment,” and may soon challenge global financial centers like Hong Kong, London, and Singapore, said Henry McVey, who runs global macro and asset allocation at KKR. McVey was speaking fresh off a tour of Kuwait, Saudi Arabia, and the UAE that coincided with KKR’s investment in gas pipelines owned by Abu Dhabi’s national oil company. He said Gulf countries will need to deploy capital more efficiently and step up productivity. (That helps explain an ongoing corruption crackdown in Saudi Arabia that recently detained executives at one of the kingdom’s signature gigaprojects, Semafor reported.) |

|

Tired of financial newsletters that bury the lead, or worse... don’t have one? That’s why more than 1 million investors start their day with The Daily Upside. Written by former Wall Street insiders, it cuts through the noise with actionable market insights that actually matter. Subscribe for free and stay ahead. |

|

➚ BUY: WBD. The Ellisons-backed Paramount bid for Warner Bros. appears to be moving forward, with the company reportedly seeking outside funding from Apollo. “One thing I don’t see any time soon is Larry Ellison selling $60 billion of his Oracle stock to buy WBD,” analyst Rich Greenfield told The New York Post. ➘ SELL: FSD. Tesla shares tumbled after news of a fresh government probe into at least 58 misfires of the assist technology the company bills as full self-driving. |

|

Companies & Deals- Dew-over: PepsiCo replaced its CFO after less than two years in the job as it faces pressure from activist investor Elliott Management.

- A small town: In an attempt to catch up to

|

|

|