| | In today’s edition: Banks rake in the deal fees, Qatar is investing in Japan, and the insatiable dem͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Gulf |  |

| |

|

- Goldman’s $110 million fee

- QIA launches Japan fund

- Abu Dhabi’s energy push

- Chinese builders’ Gulf woes

- Priciest Dubai properties

- A $1.5B bank upgrade

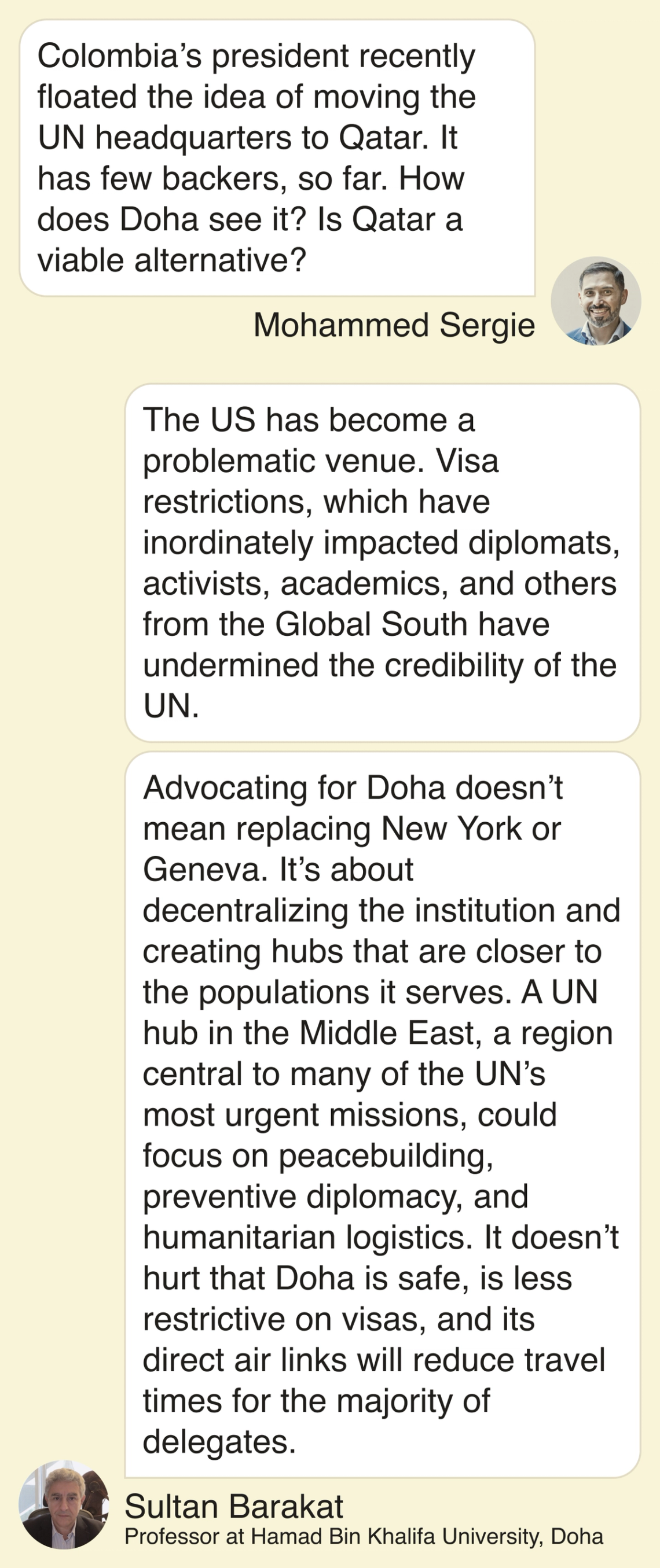

Is Doha really vying to host the United Nations? |

|

Goldman scores record fee on EA sale |

Goldman Sachs CEO David Solomon. Courtesy of FII. Goldman Sachs CEO David Solomon. Courtesy of FII.Goldman Sachs is set to earn its highest-ever fee for its role advising on the $55 billion Saudi-backed deal to buy video gaming giant Electronic Arts. The US bank was the sole adviser to EA when it was bought by a consortium of Saudi Arabia’s Public Investment Fund, private equity firm Silver Lake, and Jared Kushner’s Affinity Partners in a deal announced in September. The massive fees paid are the latest sign of how advisory work and financing packages related to Gulf sovereign wealth funds’ international investments have become crucial to Wall Street’s biggest firms amid a flurry of dealmaking. That’s led bank bosses and private equity titans to spend more time and money in the region. Goldman will get $110 million for its role, according to an EA filing, which also disclosed that the US bank earned $24.3 million from PIF over the past two years for advisory work and underwriting. That’s in addition to an estimated $500 million in fees paid to banks including JPMorgan which provided $20 billion of debt for the deal. Goldman has been building up its presence in Saudi Arabia and the wider Gulf region. It launched onshore private wealth management services in Riyadh last month, having set up a regional headquarters in the city in 2024. — Matthew Martin |

|

Qatar earmarks $1B for Japan buyouts |

QIA’s Mohammed Al-Sowaidi and ORIX’s Makoto Inoue. Courtesy of QIA. QIA’s Mohammed Al-Sowaidi and ORIX’s Makoto Inoue. Courtesy of QIA.Qatar’s sovereign wealth fund launched a $2.5 billion Japan-focused private equity fund with ORIX, a giant Japanese financial services firm, in a move highlighting rising investor interest in Japanese buyouts. Qatar Investment Authority is joining firms like Blackstone and KKR in looking to put more cash into Japan as governance reforms and aging business owners looking for successors spark a wave of deals. The QIA will contribute 40% of the capital for the fund and ORIX the rest. It will target deals for companies worth at least $200 million. Japan appears increasingly attractive for Gulf countries looking for investment opportunities and partners to invest in their own economies. It’s a major buyer of Qatari gas and Saudi oil, and next month the Saudi sovereign wealth fund will take its flagship investment conference to Tokyo for the first time. The fund has doubled investments in the country since 2021. — Matthew Martin |

|

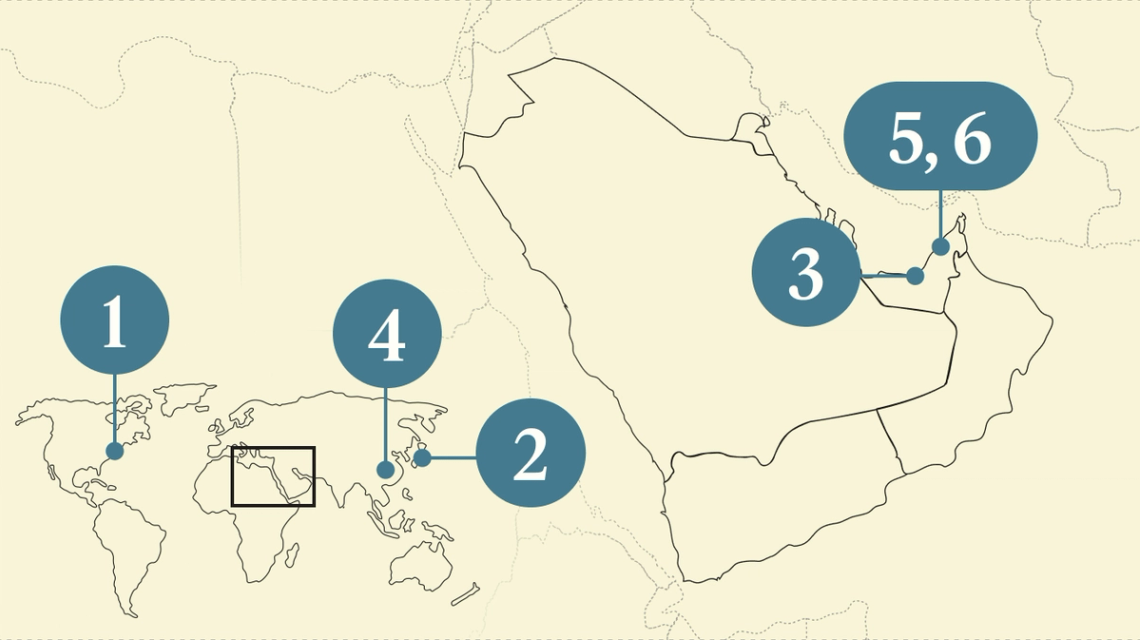

XRG doubles its value in a year |

The enterprise value of XRG, the global investment arm of Abu Dhabi energy company ADNOC. The figure — revealed by XRG Executive Chairman Sultan Al Jaber, who is also the UAE minister of industry and advanced technology and group CEO of ADNOC — nearly doubles the firm’s valuation from when it launched a year ago. Assets include holdings in ADX-listed retail, gas, and drilling units that ADNOC transferred to XRG in September, as well as chemicals firm Fertiglobe, which together are worth around $100 billion. Its international portfolio include an 11.7% equity stake in an LNG project in Texas and a 35% holding in a nearby ExxonMobil hydrogen and ammonia project. XRG aims to become a top-five player in global gas and LNG and a top-three in chemicals. It is in the final stages of a $17 billion takeover of German chemicals giant Covestro and remains interested in Australian gas supplier Santos — a deal that would vault it to among the top global gas players — Semafor scooped. — Kelsey Warner |

|

China builders hit Gulf roadblocks |

Salah/Xinhua via Getty Images Salah/Xinhua via Getty ImagesChinese construction companies seeking opportunities in the Gulf to offset their domestic property slowdown are hitting obstacles. Despite the region’s infrastructure boom — “Saudi Arabia now is like China 30 years ago,” a Shenzhen-based contractor told the business-focused outlet Caixin — firms are finding it difficult to capitalize on the moment. Companies operating in the kingdom say they’ve grown frustrated with strict contractual terms, fierce competition, and local-hiring and ESG requirements that are uncommon in China. Still, plenty of Chinese contractors are active in the sector, judging by the growing number of participants. Notably, Chinese firms are also investing in local manufacturing: Bunyan, part of China’s Rongsheng Group, recently opened a steel plant near Riyadh to supply the construction market. Yet the Gulf’s opportunities are unlikely to significantly ease the pain in China’s property sector, which remains a major pillar of its economy. |

|

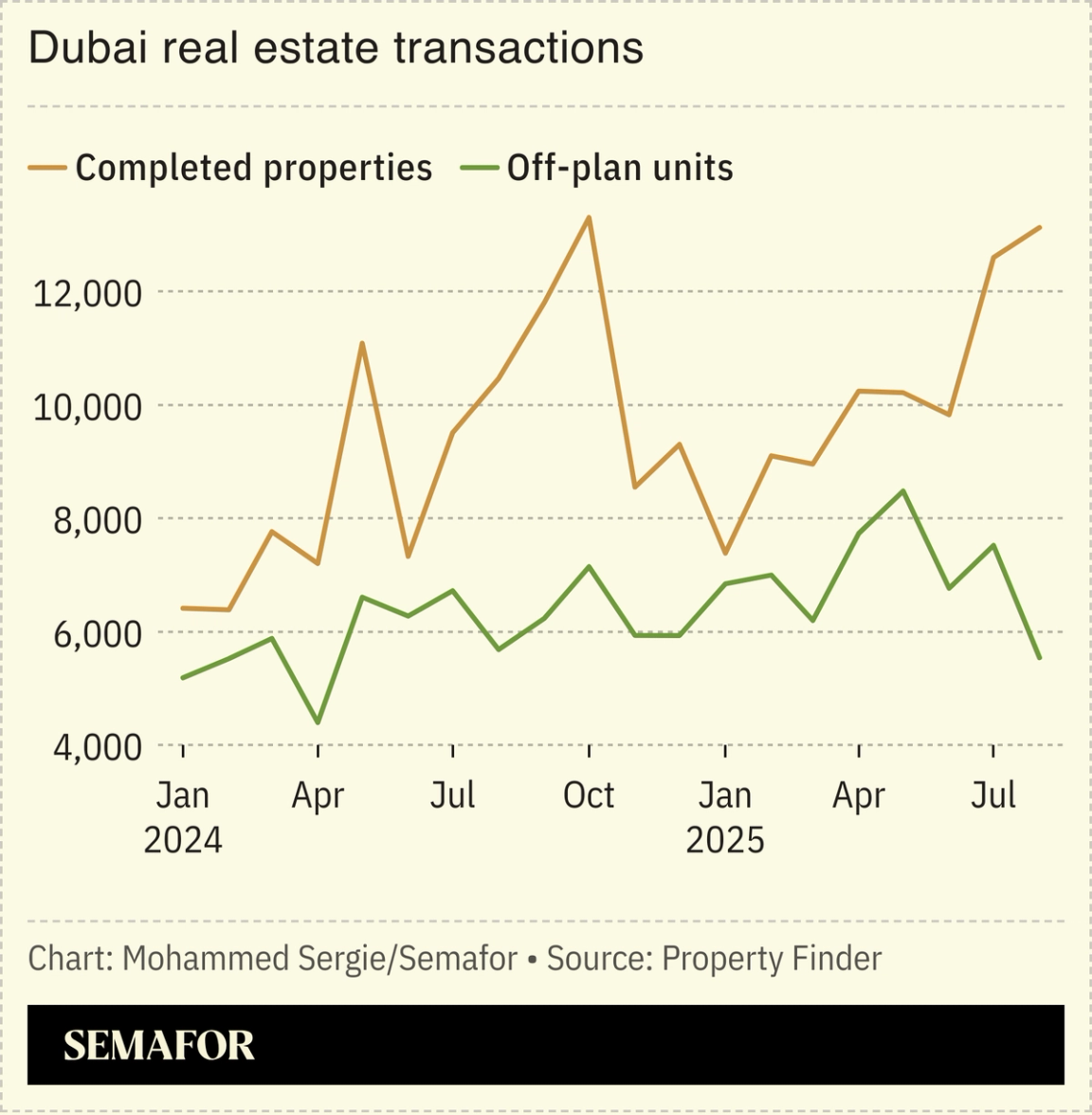

Dubai property boom heats up |

Dubai’s property market is showing no signs of slowing. Buyers eager to secure a spot in a new luxury beachfront development — set for completion in 2028 — must put down 1 million dirhams ($272,000) just to be considered, Bloomberg reported. Penthouses come with private elevators, terrace pools, and bespoke interiors, features that aim to meet surging demand for $10 million+ homes, a segment where Dubai now leads globally, according to property consultancy Knight Frank. The frenzy for off-plan (yet to be constructed) projects echoes the 2009 real estate bust that weighed on Dubai’s economy for years. UBS recently warned that the market looks “increasingly overheated,” yet analysts note strong fundamentals such as high rental yields, population growth, and tighter regulations that restrict speculation, which make a sharp correction less likely this time. |

|

Dubai glam lures Standard Chartered |

The Museum of the Future in Dubai. Dubai Future Foundation/Handout via Reuters. The Museum of the Future in Dubai. Dubai Future Foundation/Handout via Reuters.Standard Chartered is leaning on its Dubai hub to court affluent families. At a recent five-course dinner at the shimmering Museum of the Future, the bank gathered its wealthiest customers from around the world to kick off a two-day confab on wealth management. The UK firm is 18 months into a five-year, $1.5 billion spending plan that will see $750 million poured into recruiting new relationship managers and wealth specialists, Raymond Ang, global head of private bank and affluent clients, said in an interview. Standard Chartered has earmarked the other $750 million on freshening up offices and developing better technology, according to Ang. One new AI tool will summarize research across the bank’s 54 markets, compare it with individual client portfolios, and make tailored investment recommendations, Ang said, noting that clients are fine with using AI for investment decisions as long as a human is in the loop. Though legacy hubs Hong Kong and Singapore still dominate Standard Chartered’s business, the UAE is seen as crucial to the bank’s growth: It is largely catering to Asian and Indian families in Abu Dhabi and Dubai who have business in both the Gulf and Asia, according to Ang. — Kelsey Warner |

|

On the sidelines of the G20 in Johannesburg, Semafor convenes The Next 3 Billion ON TOUR to explore how South Africa’s leadership can help scale inclusive solutions across borders — from interoperable digital payments and cross-regional investment to expanding connectivity. As one of Africa’s most industrialized economies and a G20 member, South Africa stands at the center of efforts to advance digital and financial inclusion across the continent. With its strong financial infrastructure and growing influence through the G20 and B20, the country is uniquely positioned to drive the next wave of innovation and access. Nov. 18 | Johannesburg | Request Invite |

|

Sultan Barakat is a professor of public policy at Hamad Bin Khalifa University in Doha.  |

|

Aviation- On top of moving into a new larger Dubai airport, Emirates’ CEO is expecting another 300 aircraft, looking to add routes in Africa and Latin America, and leaning on sister airline flydubai to unlock growth over the next two decades. — The National

Deals- UAE-based Crescent Enterprises said it will invest $272 million over the next three years across the Gulf, India, and Southeast Asia in consumer, health care, manufacturing, and financial services.

Energy- Kuwait is planning a 1.5 gigawatt battery storage plant in a bid to ease chronic power shortages. — Reuters

- Abu Dhabi’s Masdar has signed a deal with Uzbek state-owned utility Uzenergosotish to develop 600 megawatts of battery energy storage — the largest such project in the country.

- Saudi Aramco is set to start gas production at its Jafurah field, one of the world’s largest shale basins, in the coming weeks as it looks to boost energy output amid rising power demand from data centers, industrialisation, and urbanisation. — Financial Times

Real Estate- Saudi Arabia will grant “lifetime residency” to foreigners buyin

|

|

|