| | In this edition, not everyone in AI can come out a winner, and Lina Khan’s next agenda. ͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- Trump’s affordability mirror

- Lina Khan’s plan for NYC

- Proxy wars

- Shutdown ends, markets shrug

- Don’t call it a bailout

|

|

The AI boom will have winners and losers. That much is obvious, but if it needed saying, David Solomon, Larry Fink, and Ray Dalio have all said it. The problem, as gargantuan sums of money go into funding the race, is that everyone thinks they’ll be winners. From call centers to online tutors to corporate consultants, each sector plans to ride the AI wave to end up on top — even if their business models are obviously vulnerable to being undone by it. So does Expedia, never mind the autonomous agents who will soon crawl airline and hotel offerings without anyone opening a browser. “Ultimately, travelers are looking for a trusted place or a trusted partner,” CEO Ariane Gorin told Semafor last week. Maybe she’s right, but that’s what travel agents — who also believed they were brewing an irreplaceable blend of humanity and technology — said right before Expedia put them out of business. AI is a technological Lake Wobegon, where all the children are above average. “Every company that we talk about investing in or lending to — it’s amazing, AI is good for everybody,” Mike Koester, managing partner of private-credit firm 5C, tells me. Optimism is the secret sauce of American businesses and the vibrant capital markets that sustain them. Europeans seem to dream smaller, figuring they’ll be constrained by borders and the risk-averse banks they are so dreadfully reliant on. “Socialism never took root in America because the poor see themselves not as an exploited proletariat but as temporarily embarrassed millionaires,” is an apocryphal quote paraphrased from John Steinbeck that helps explain why it’s hard for Washington to raise taxes on rich people. Everyone thinks they’ll be one someday. On the cusp of an AI boom, every CEO is a temporarily embarrassed billionaire, believing they will harness the best of AI and be immune from its worst — at least as long as they can lay off enough workers to stay ahead of the cost curve. Elsewhere in embarrassed billionaires, we check in on the Mamdani campaign and what exactly Lina Khan, Biden trustbuster-turned-mayoral advisor, is up to. |

|

Trump embraces affordability |

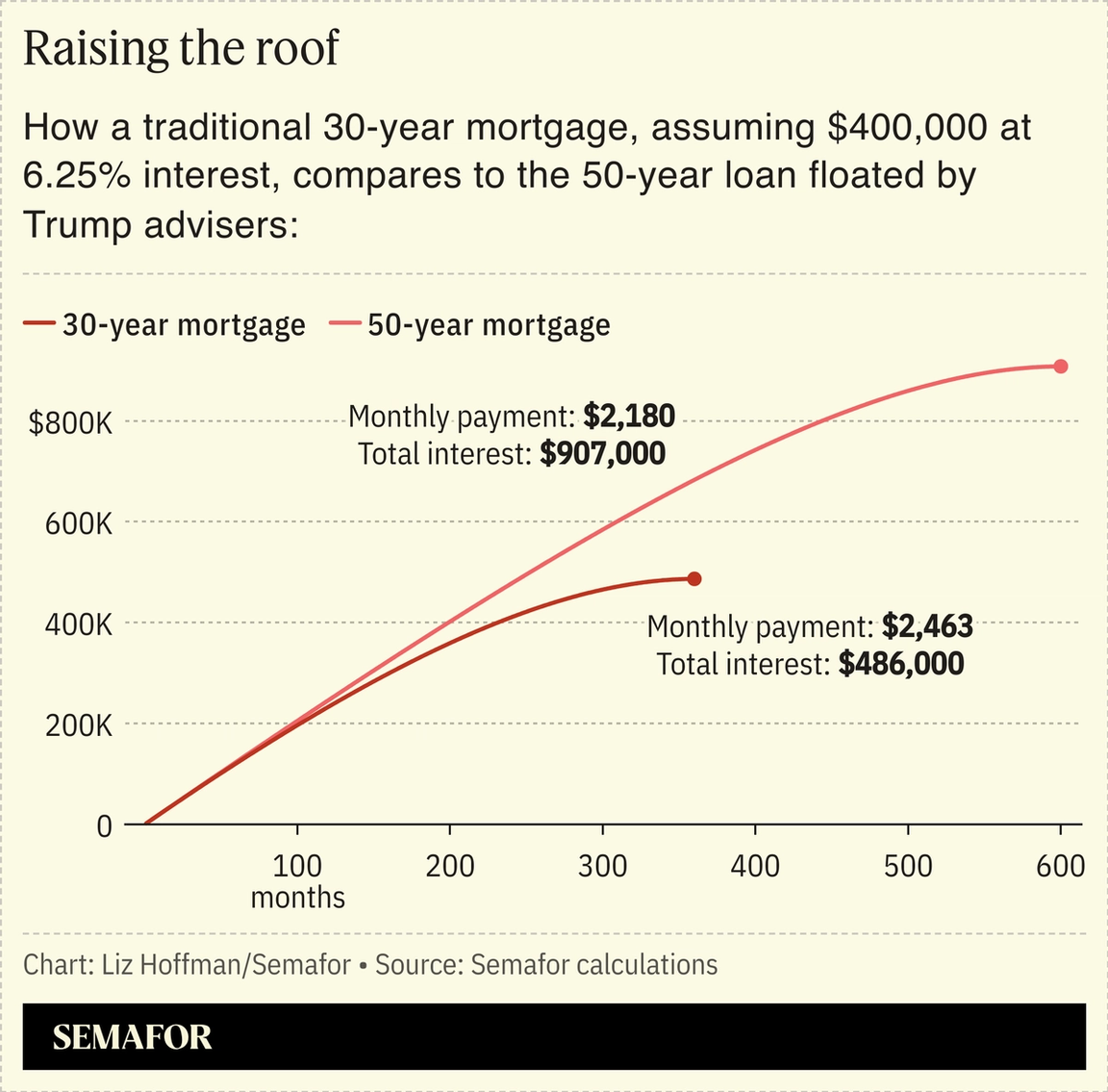

President Donald Trump has called the idea of an affordability crisis a “con job by the Democrats.” But ideas and comments from his top advisers over the past week — since Democrats won key races across the country — strain that claim and suggest the White House is getting nervous about consumer pain, Semafor’s Rohan Goswami and Eleanor Mueller report.  The administration has floated $2,000 tariff checks, investigations of meatpackers, cheaper drug prices, and 50-year mortgages (which would lower monthly payments but balloon long-term costs). On Wednesday Treasury Secretary Scott Bessent signaled coming tariff cuts on coffee, which has become a poster child for price increases. In a speech later at the New York Fed, Bessent pointed to lower yields on Treasury bonds, which set the benchmark for household loans. |

|

Lina Khan’s plan to make NYC cheaper |

Kylie Cooper/Reuters Kylie Cooper/ReutersLina Khan thinks beers at Yankee Stadium are too expensive — and that she has the law on her side. Since the antitrust crusader was added to NYC Mayor-elect Zohran Mamdani’s transition team, the business community has been puzzling over what she might be up to; local politics is a strange soapbox for trustbusting. People familiar with the transition have an answer: Khan has been scouring city and state laws — some overlooked by past mayors and some too new to have been tested yet — for legal footing for Mamdani’s priorities. “Excavating and enforcing the law” is how one transition adviser put it, a skill set the Yale-trained lawyer wielded at FTC by dusting off neglected powers, putting companies on notice, and bringing novel theories of harm. She has identified an early avenue in a 56-year-old NYC prohibition on business practices deemed “unconscionable” — a designation expansive enough to delight any regulator that’s scarcely been used this century. In her sights, the people said, are: hospitals that bill patients for painkillers available more cheaply at corner drugstores and sports stadiums charging nosebleed prices for concessions. Read more on Khan’s plans to police dynamic app pricing. → |

|

|

Trump may attack proxy advisors |

Angelina Katsanis/Reuters Angelina Katsanis/ReutersTwo advisory firms, little known outside Wall Street but with very powerful enemies on it, are facing the full weight of the Trump administration, which blames them for a leftward shift in corporate boardrooms. The White House is weighing an executive order that would dramatically limit the power of ISS and Glass Lewis, which recommend how shareholders should vote on corporate matters like CEO pay and social- and climate-related policies, The Wall Street Journal reported. Semafor hears, too, that the Committee on Foreign Investment in the United States may open its own probe: ISS is owned by Germany’s Deutsche Börse and Glass Lewis by a Canadian private-equity firm. (“ISS is proud of its history of providing high-quality, independent, and objective advice to the world’s most sophisticated institutional investors,” a spokesperson said. Glass Lewis did not immediately comment.) The White House is also focused on how giant passive institutional investors like Vanguard and BlackRock vote their collective stakes of 20% or more at most US companies. “Mirror voting” — forcing them to cast their ballots in the same proportions that other investors do — has long been pushed by their critics, and is now getting the attention of the White House, people familiar with the discussions said. |

|

Shutdown ends, markets shrug |

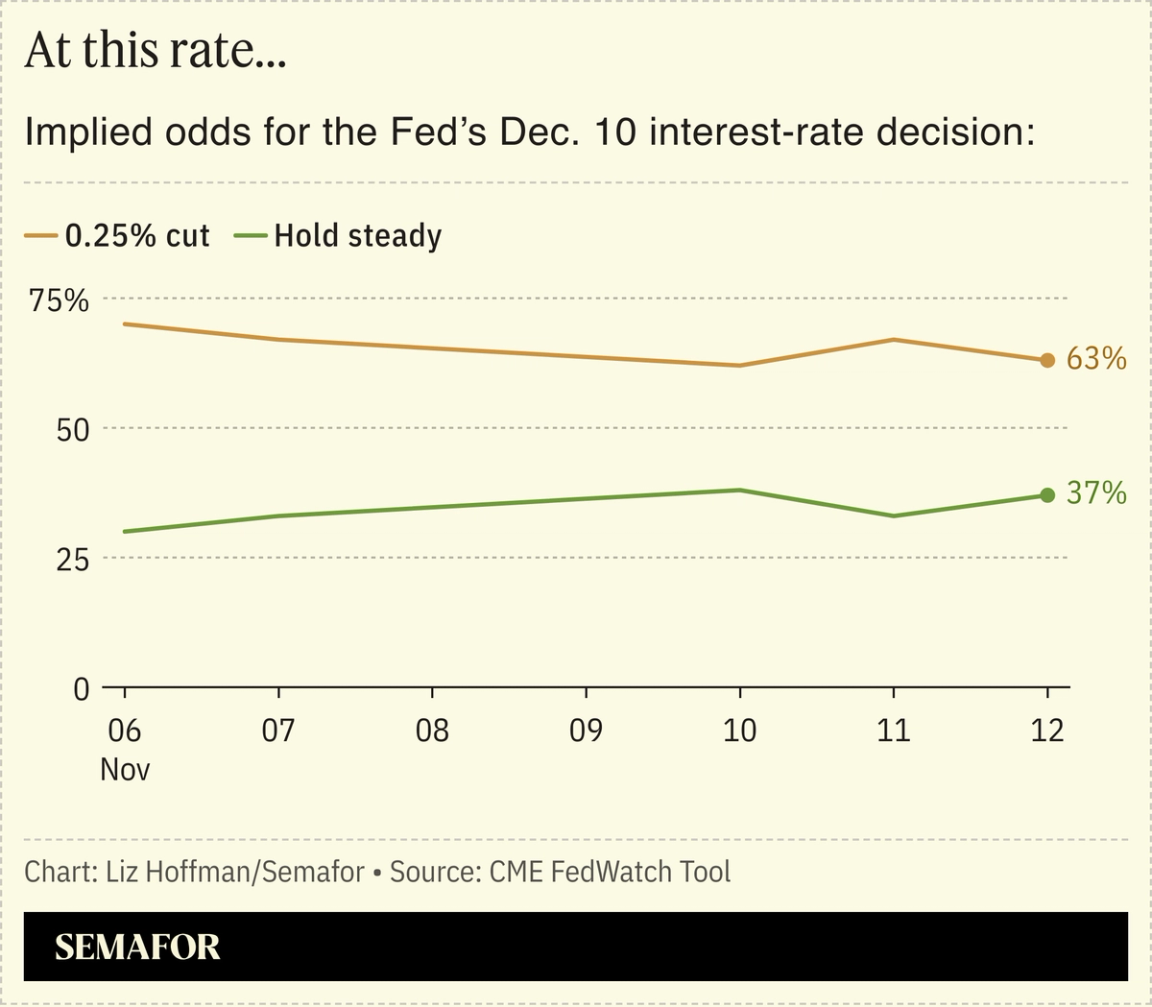

Buy the rumor, sell the news: The S&P 500 traded down about 1% this morning as the longest government shutdown in US history ended, paring gains from earlier in the week as the deal came together in Congress. Some services, such as food assistance, will come back online immediately, while flight schedules should return to normal in time for the upcoming holiday season. Economic activity generally recovers quickly after shutdowns; the Congressional Budget Office estimates $11 billion of permanently lost growth from this one, or about $80 per household. But this standoff took a toll on consumer sentiment, which is at its lowest level since June 2022, and the deal that ended it punts on the expiration of health care subsidies, which will raise premiums for millions of people. And the White House said Wednesday that it may never release October inflation data or the month’s unemployment rate, which will leave the Federal Reserve without key pieces of information as it weighs a December interest-rate cut. Traders got less certain as the shutdown dragged on and corporate layoffs piled up:  |

|

Don’t cry for Argentina, or the US Treasury |

Jonathan Ernst/Reuters Jonathan Ernst/ReutersThe US drew nearly $900 million from its account at the International Monetary Fund last month just as Argentina received the same amount as a deadline loomed for it to repay an IMF loan, the Financial Times reports, citing IMF data. That’s separate from the US Treasury’s purchase of pesos as Argentina’s currency was wobbling in the run-up to an election that Trump ally Javier Milei’s party ultimately won. It looks increasingly likely that a private-sector $20 billion loan Treasury had been organizing on Wall Street won’t be needed. A prickly Bessent defended the aid as not a bailout but a “generational opportunity in Latin America to create allies” and said the US turned a profit helping Milei keep power. “Most bailouts don’t make money,” he told MSNBC, which is debatable: The 2008 bank rescues were hugely profitable for taxpayers, though the 2020 airline rescues won’t be. |

|

➚ BUY: Bubbles. Activist hedge fund Ancora has a big stake in Bubble Wrap-maker Sealed Air, and has been quietly pushing the company for months to sell itself — something it is now in advanced talks to do, Rohan scoops. ➘ SELL: Bubbles. A sell-off of tech stocks this week renewed already persistent worries about AI. Semafor’s Reed Albergotti is more sanguine: “The total addressable market for this product is virtually every person and company on the planet.” |

|

Companies & Deals- In on the action: FanDuel is joining the frenzy around prediction markets, teaming with CME to offer contracts carefully designed to sidestep gambling bans in certain states.

- Congrats, we’ve recreated cable: The cost of streaming services continues to rise: Over the past six years, the price of Disney+ has nearly tripled, Apple TV is up 160%, and Netflix is up 38%, WSJ reports. Americans aren’t canceling (yet) but opting for cheaper ad-supported tiers that streamers, which for years pitched themselves as free from the worst parts of TV, rolled out under duress.

- Extra hot: Starbucks workers went on strike in more than 40 US cities today, a “Red Cup Rebellion” (Christmas marketing starts early at Starbucks, which launches the PSL in August) that could become the biggest walkout in the company’s bumpy labor history.

Watchdogs- Brussels pouts: European authorities have launched a new investigation into Google for allegedly demoting certain news outlets in search results. The probe could throw a wrench into efforts to tamp down transatlantic trade tensions.

- Abe-nomics: The US minted its last penny Wednesday.

Markets- Hibernating: Michael Burry, whose call on the US housing market in 2008 was chronicled in The Big Short, is hanging it up. “Onto much better things,” he said after deregistering his hedge fund. Burry’s been good at identifying bubbles, but they don’t always pop: His perpetually bearish calls led Elon Musk to call him a “broken clock” after he shorted Tesla.

|

|

|