| | In today’s edition: Abu Dhabi builds a reinsurance platform, KKR moves into Saudi private credit, sh͏ ͏ ͏ ͏ ͏ ͏ |

| |   Riyadh Riyadh |   Jersey City Jersey City |   Abu Dhabi Abu Dhabi |

| | | Global Capital Edition |

| |

|

- Private credit in the Gulf

- Fintechs are VC darlings

- MGX nabs TikTok stake

- Reinsurance dreams

- A building in Jersey City

For New Year’s, a burger with a view. |

|

Remember how Trump’s tariffs were supposed to tank markets and trigger a global recession? Mergers and acquisitions bankers and lawyers missed that memo. Global M&A is on track to reach $4.8 trillion this year — the second-highest total on record — up 36% from 2024, according to Bain & Co. Gulf sovereign wealth funds were largely unfazed by the trade and oil headwinds this year. Even Saudi Arabia’s Public Investment Fund, which had signaled it would scale back overseas deals, emerged as the majority backer of the $55 billion acquisition of video-game publisher Electronic Arts, the largest leveraged buyout in history. With lower capital costs, easing regulation, and relentless AI fervor likely to carry into 2026, according to the Bain report, the deal environment remains attractive. The late-year flurry of activity we are tracking may be a sign of what’s to come. |

|

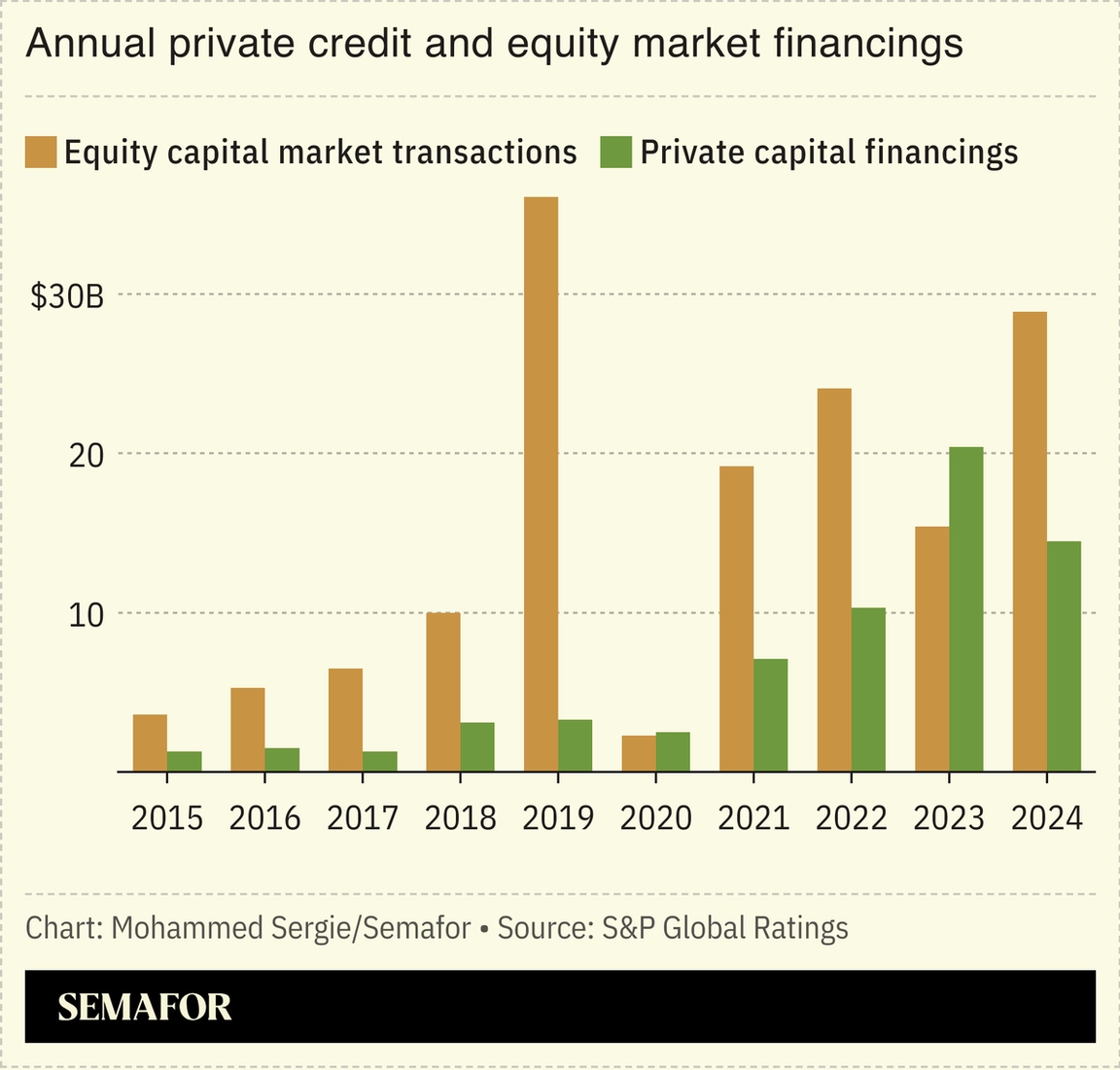

Private credit’s Gulf moment |

KKR announced its first deal in Saudi Arabia, the latest sign that demand for cash in the Gulf’s biggest economy is leading borrowers to seek out alternative sources of financing aside from banks. The US investment firm is leading a refinancing of debt on a $750 million water treatment plant in Rabigh on the kingdom’s west coast. The owner of the plant, ACWA Power, is part-owned by PIF. The KKR-led financing is around $550 million, according to a person familiar with the matter. KKR plans to expand in the kingdom and “deploy capital behind essential infrastructure,” Julian Barratt-Due, head of Middle East investing at the firm, said in a statement. Several years of rapid mortgage-fuelled credit growth, along with lower oil revenue deposits from the government, have left Saudi banks struggling to write new loans, especially ones with long durations. It also comes as the government is cutting spending and PIF is putting pressure on its development projects to find other ways to fund their ambitions. The deal caps a year of growing momentum for private credit in the region, where it was almost unheard of just a few years ago. Private credit firms are increasingly sensing an opportunity to step in and fill the gap while investing in projects that often have strong state backing. It also gives firms like BlackRock, KKR, and others who have traditionally raised more from the Gulf than they have invested in it, the opportunity to show they are keeping some money in the region. — Matthew Martin |

|

Fintech dominates a big year |

The share of financing raised by fintech startups out of a total $7.7 billion in the MENA region through November, according to data from startup analytics platform Wamda. This is set to be a breakout year for venture investing and lending — already more than triple the 2024 figure, and with December still to count. Momentum is down to the continued rise of financial services — and investor appetite — to support fast-growing offerings such as buy-now-pay-later (BNPL), e-commerce, embedded finance, and remittances, particularly in the Gulf. Megadeals from Saudi Arabia and the UAE drove momentum, while Wall St. banks and credit funds were the biggest lenders, and venture capital increasingly came from outside the region. Saudi-based BNPL platform Tamara’s $2.4 billion debt financing was the largest deal of the year, backed by Goldman Sachs, Citi, and Apollo. That was followed by digital SME lender Lendo’s $690 million revolving debt line led by JPMorgan, and Dubai-based Tamara competitor Tabby’s $160 million round, which tapped venture capital from Hong Kong. — Kelsey Warner |

|

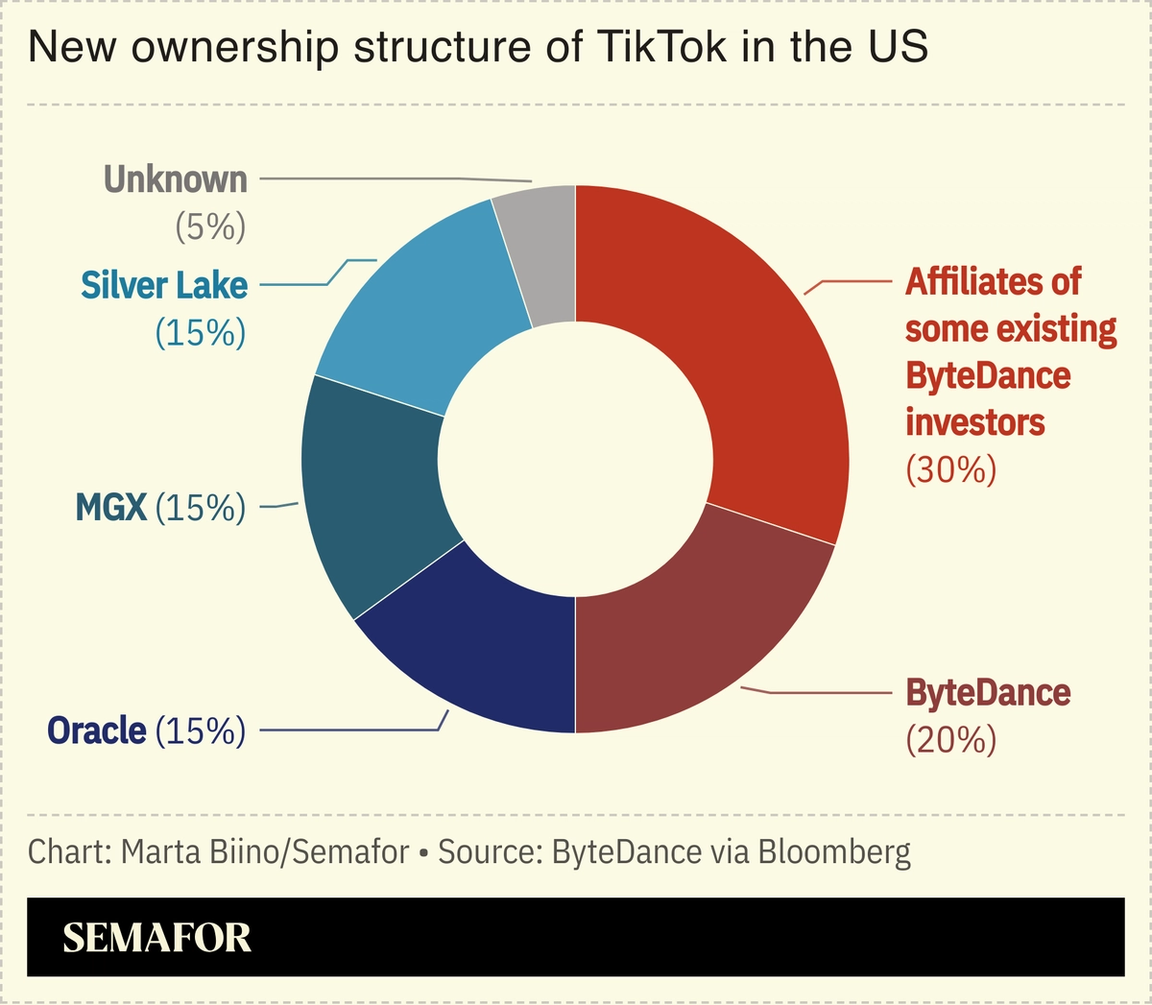

Abu Dhabi firm gets TikTok slice |

| |  | Reed Albergotti |

| |

TikTok parent company ByteDance is finally selling a majority of the US version of the app to a consortium of investors that include Abu Dhabi-based MGX, the US’ Oracle and Silver Lake, and some mystery investors that haven’t been named. The deal, first reported by Axios last week, hasn’t satisfied China hawks who are taking issue with the fact that the content recommendation algorithm, TikTok’s secret sauce, will be licensed from ByteDance by the US consortium. That could still open the app up to manipulation by the Chinese government, they say. A big question is who the mystery investors are. The $14 billion price tag for TikTok is incredibly low. It sounds like an AI startup’s Series B fundraising round, not an acquisition price for the hottest social media app around. |

|

Abu Dhabi builds reinsurance platform |

Courtesy of ADGM Courtesy of ADGMThere have been plenty of proclamations from Gulf financial centers about building insurance and reinsurance hubs. Most haven’t taken off. A startup in Abu Dhabi plans to change that. RIQ — founded in May with $1 billion in backing from International Holding Co. and partnerships with BlackRock and Abu Dhabi-based asset manager Lunate — aims to become a top-tier global reinsurer, drawing strength from being based in the UAE’s capital, its Chief Executive Mark Wilson said in an interview. Abu Dhabi and other wealthy Gulf states share an essential trait that makes insurance a natural fit. “The two longest forms of capital in the world are sovereign wealth funds and insurance companies,” Wilson said. “That seemed like a rather good match.” RIQ plans to use its partnerships with BlackRock and Lunate to shape the investment side of the balance sheet, while Swiss Re is supporting the liability side, particularly around underwriting expertise. Beyond capital and technology, the ease of doing business in Abu Dhabi may be its biggest advantage. — Mohammed Sergie |

|

Understanding a New Jersey move |

A rendering of the planned Jersey City high-rise. Courtesy of Modon Holdings. A rendering of the planned Jersey City high-rise. Courtesy of Modon Holdings.Abu Dhabi-backed Modon Holding is headed for Jersey City, New Jersey, with a joint venture to develop a luxury condominium high-rise with US-based property developers. The move from the anchor asset of L’imad is one of the few clues about the direction of Abu Dhabi’s latest state-linked fund, which popped up practically overnight earlier this year after buying a controlling stake in Modon from Sheikh Tahnoon bin Zayed’s IHC. Modon remains the only publicly known holding of L’imad, which has yet to publish a corporate website or publicly name leadership. Modon — estimated to be worth around $17 billion by sovereign wealth tracker Global SWF — is Abu Dhabi’s government-mandated master developer behind projects such as Hudayriyat and Reem islands. But it has a handful of international assets in a portfolio that spans high-end real estate, hotels, as well as entertainment and sports venues. Most are in the UAE, with outposts of an EDITION hotel in Reykjavik, a golf course development in Spain, and a London convention center. International footprints are becoming the norm among Gulf property developers who were once locally-focused. Emaar, Dubai’s largest listed developer, is also eyeing the US to achieve growth. — Kelsey Warner |

|

Semafor is heading to Davos — where global leaders converge to strike deals, posture, and if we’re being honest, schmooze. Semafor will bring you the big ideas and behind-the-scenes chatter from the global village in Semafor Davos, your must-read guide. Get the insider’s guide — subscribe to Semafor Davos. |

|

Every week, we ask a different expert what they’re focused on. Today, we’re talking to Javier Herrera, who leads Kearney’s private equity and M&A practice in the Middle East and Africa.  |

|

Courtesy of Five Guys Courtesy of Five GuysNYE in the Gulf comes with a luxury price tag. New Year’s Eve only became a public celebration in Saudi Arabia in 2020, marked by Riyadh’s first fireworks display. Five years on, the turn of the year has become a showcase for the kingdom’s high-end tourism push. In AlUla, a desert concert with Syrian megastar Assala and $2,000-a-night stays at Habitas or Banyan Tree are on offer. At the Red Sea resorts, rooms also come with hefty price tags; guests can expect a mix of beach parties, private dinners, and spa packages. Dubai’s been doing NYE glitz for years, but even there, the markup is hitting new heights: The best seat in the house for the Burj Khalifa fireworks is in the prosaic environs of a Five Guys in Dubai Mall, which will set you back a mere 1,750 dirhams ($475). But not to worry, unlimited burgers and shakes are included. |

|

|