| | While offshore wind faces another setback, nuclear fusion CEOs are happy to have closer personal tie͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Energy |  |

| |

|

- Fusion execs welcome Trump

- The next oil shock

- Africa’s energy trap

- High-seas climate fiction

- Catching up to China

Russia sells more LNG to China, but faces a fresh wave of naval drone attacks. |

|

The Trump administration’s latest salvo against offshore wind is a risky maneuver that could backfire for fossil fuels, and for Republicans’ midterm election prospects. On Monday, Interior Secretary Doug Burgum said he is “pausing” five large offshore wind projects on the East Coast, all of which were previously approved and are billions of dollars deep into planning, construction, and in some cases even partial operation. The reason: “national security risks identified by the Department of War in recently completed classified reports.” The spinning turbine blades, apparently, cause radar interference that can obscure the movement of enemy “targets.” This must be a new kind of threat; a former senior Energy Department official told me the Pentagon and intelligence services, which are normally sensitive to even extremely low-probability risks, never flagged this as a concern previously. And for what it’s worth, the soldiers who patrol the wind farm that is the world’s closest to an active front line, in southern Ukraine, are still perfectly able to spot and shoot down drones there. Of course, the more likely explanation is that US President Donald Trump has a longstanding personal grudge against offshore wind and is merely carrying out the latest in a year-long series of attacks on the industry. But the stakes are especially high this time. The move comes only a few days after the House of Representatives passed its stab at permitting reform legislation — which picked up a few recalcitrant Republican votes by dropping provisions that would have limited federal agencies’ ability to do exactly what Burgum just did. That bill’s chances in the Senate were already slim; now, as two senior Democrats wrote in a press release, it is “dead in the water.” And as much as Republicans might not want to tie Trump’s hands, those provisions also would have stopped a future Democratic administration from cancelling fossil fuel projects. Instead, Trump is reinforcing a pattern of tit-for-tat retributive permitting that could ultimately be more damaging to the oil and gas industry, which is under pressure to maintain market share in the US and globally before the economy shifts more to clean energy. “I’m sure there are a lot of oil and gas execs who are thinking the same thing,” the DOE official told me. Finally there’s the affordability issue: These wind farms were some of the biggest new power projects in the country. Cancelling them not only needlessly sacrifices 2.5 million homes’ worth of badly-needed electrons (and more to come, as investors balk at any future projects), but hands Democrats another potent talking point ahead of the midterm elections. Before then, the pause will certainly be challenged in court — a chance for Burgum to share more details about the supposed security threat, or forever give up any pretense to the “all of the above” mantle. |

|

Fusion execs welcome Trump |

Nathan Howard/Reuters Nathan Howard/ReutersWhile the planned merger between nuclear fusion startup TAE Technologies and Trump Media raised concerns in some corners about conflicts of interest, at least one group isn’t worried about unfair competition: Other fusion companies. The surprise announcement on Friday that a social media company in which US President Donald Trump is the largest shareholder is suddenly pivoting into the highly complex, highly regulated nuclear power industry immediately raised the prospect that Trump could use his influence to speed the company through government reviews and give it preferential access to federal funding, to the president’s personal benefit. But other fusion CEOs told Semafor that, in effect, a rising tide lifts all boats. “Ten years ago we could hardly have conceived of billions of dollars in private capital being made available to a commercial fusion energy company,” said Kieran Furlong, CEO of Realta Fusion. Andrew Holland, CEO of the Fusion Industry Association, agreed: “New sources of funding for fusion, whether publicly traded, private capital, or government partnerships can only be positive.” Trump Media’s flagging stock price popped on the news, but it will take time to know whether TAE is a good investment — beyond the monumental and still-unproven challenge of making fusion actually work at scale, success will require building and operating multi-billion dollar, first-of-their-kind commercial facilities. Of the dozens of fusion startups working now, many bankruptcies are inevitable. “There’s no way to fake your way in fusion,” said Alexander Valys, president of the startup Xcimer. “It doesn’t matter what names you’re associated with, the technology has to work, and that’s still the hardest thing.” |

|

View: Oil winners and losers |

Hannibal Hanschke/File Photo/Reuters Hannibal Hanschke/File Photo/ReutersHeading into 2026, the most important factor in the oil market remains the age-old balance of supply and demand, Amena Bakr argues in a Semafor column. US President Donald Trump’s return to the White House injected fresh volatility into global oil markets at a time of already heightened geopolitical tensions. New rounds of sanctions on major exporting states including Iran, Russia, and Venezuela, reinforced this feeling. Next year’s midterms could add another layer of complexity, as the Trump administration has a strong incentive to do what it can to keep gas prices low. The first quarter of next year is expected to be challenging. Supply typically builds during this period, and the OPEC+ group of crude exporters has already taken preemptive steps by pausing the unwinding of its production cuts for the full three months: They hope that demand will strengthen in the second and third quarters, helping support prices and allowing the group to return to its original plan of fully unwinding the cuts. Kpler, the firm where Bakr works, expects oil demand in 2026 to grow by around 1.3 million barrels a day, compared with about 1 million barrels a day of growth in 2025. Its outlook for prices suggests that Brent — currently selling at about $60 a barrel — will remain in the low $60s during the first quarter, before rising toward the mid-to-high $60s by the year-end. |

|

View: Africa’s energy trap |

Mike Hutchings/Reuters Mike Hutchings/ReutersMany African countries are trapped in a self-reinforcing cycle of low energy, low productivity, and economic concentration in extraction and agriculture, while higher-value industrial growth stalls or withers, analysts W. Gyude Moore and Meron Tesfaye argue in another Semafor column. Many African states have produced vision documents pledging economic transformation through value addition and industrialization. But these ambitions confront an unforgiving climb defined by power deficits and a global economy that is far less accommodating than it was for earlier industrializers. More challenging, however, is the fact that no country has become high-income with low-energy consumption — and the continent’s energy constraint is stark. Today, just 20% of Africa’s population, concentrated in South Africa and North Africa, generates over 65% of the continent’s electricity. Not coincidentally, these regions are also the most industrialized. Across the continent, industrial potential is held back by four structural energy faults: Costly and unreliable power supply; poor power infrastructure; inadequate, power-stifling domestic value retention; and industrial planning that is disconnected from energy planning. Many large power plants generate electricity that never meets local demand because distribution and demand stimulation are an afterthought. |

|

Playground, by Richard Powers. Readers of Powers’ Pulitzer-winning epic The Overstory will recognize some stylistic features of his newest door-stopper of a novel: There’s a laundry list of characters whose far-flung storylines gradually branch together; meandering but engrossing detours into linguistics, ethics, race, colonialism, marriage, and technology; and a generous helping of old-school environmentalism that borders on schmaltz but ultimately manages to stay grounded. This time we’re on the high seas, rather than high in the trees. On the surface, this is a sci-fi story about climate change adaptation. But the deeper and more interesting currents grapple with the risks of turning over our decision-making, relationships, and even identities, to AI. Buy Playground from your local bookstore. |

|

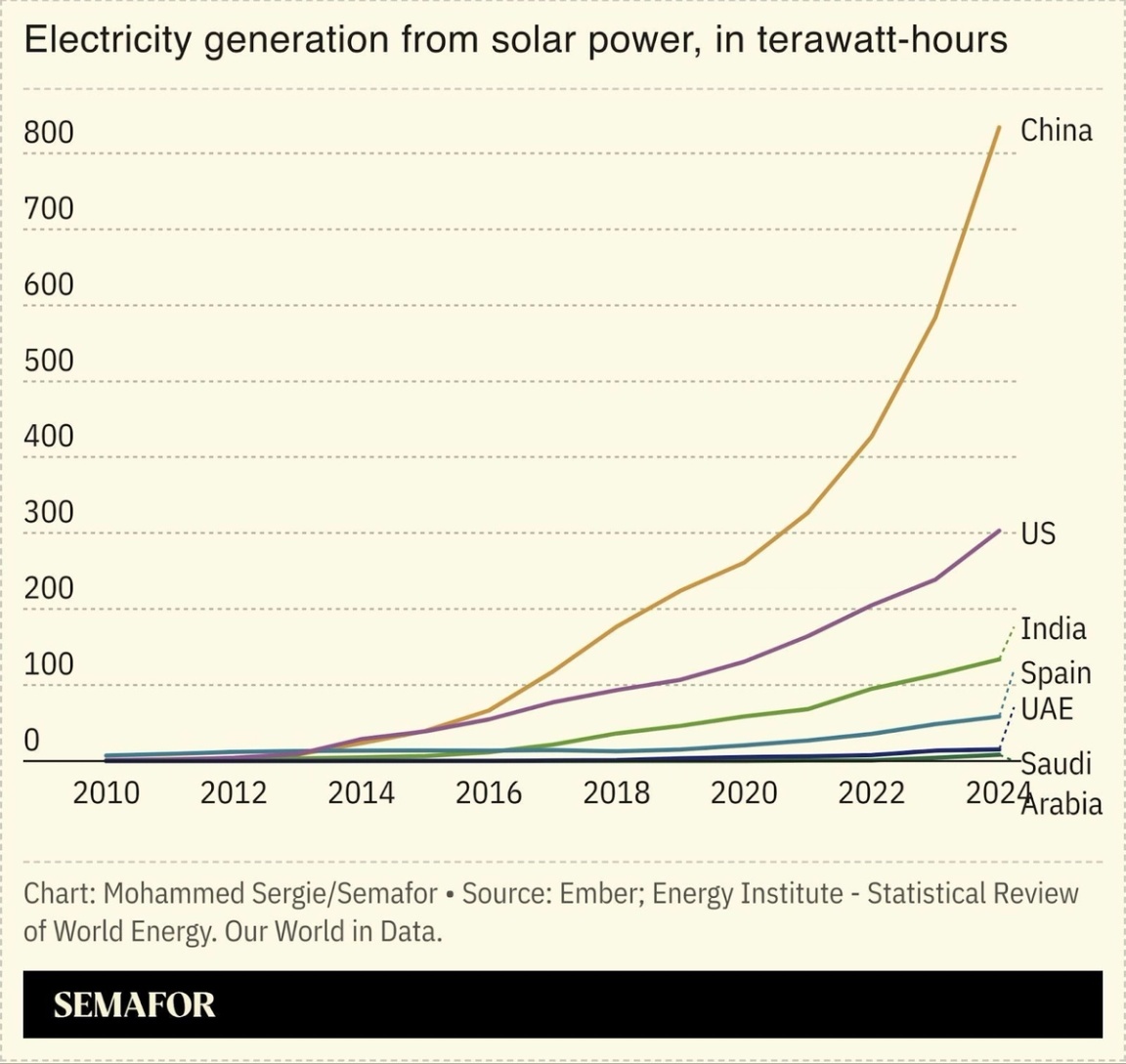

Oman loosens China’s solar grip |

Oman’s United Solar Holding has secured $30 million for a polysilicon manufacturing plant which, once complete, will be the largest facility of its kind outside China. The funding has come from Waaree Solar Americas, a US subsidiary of Indian solar module maker Waaree Group, in a deal finalized during Indian Prime Minister Narendra Modi’s recent visit to Muscat. When complete, the plant will produce 100,000 tons a year of polysilicon — enough to support 40 gigawatts of solar module production — offering customers an alternative to China, which has a near-monopoly on the market. It is part of a growing trend for Gulf countries to develop renewable energy manufacturing capabilities, with some analysts predicting the region will become a hub for solar panel exports. United Solar, which is backed by the Oman Investment Authority, will supply polysilicon to Waaree’s global operations, including those in the US. — Dominic Dudley |

|

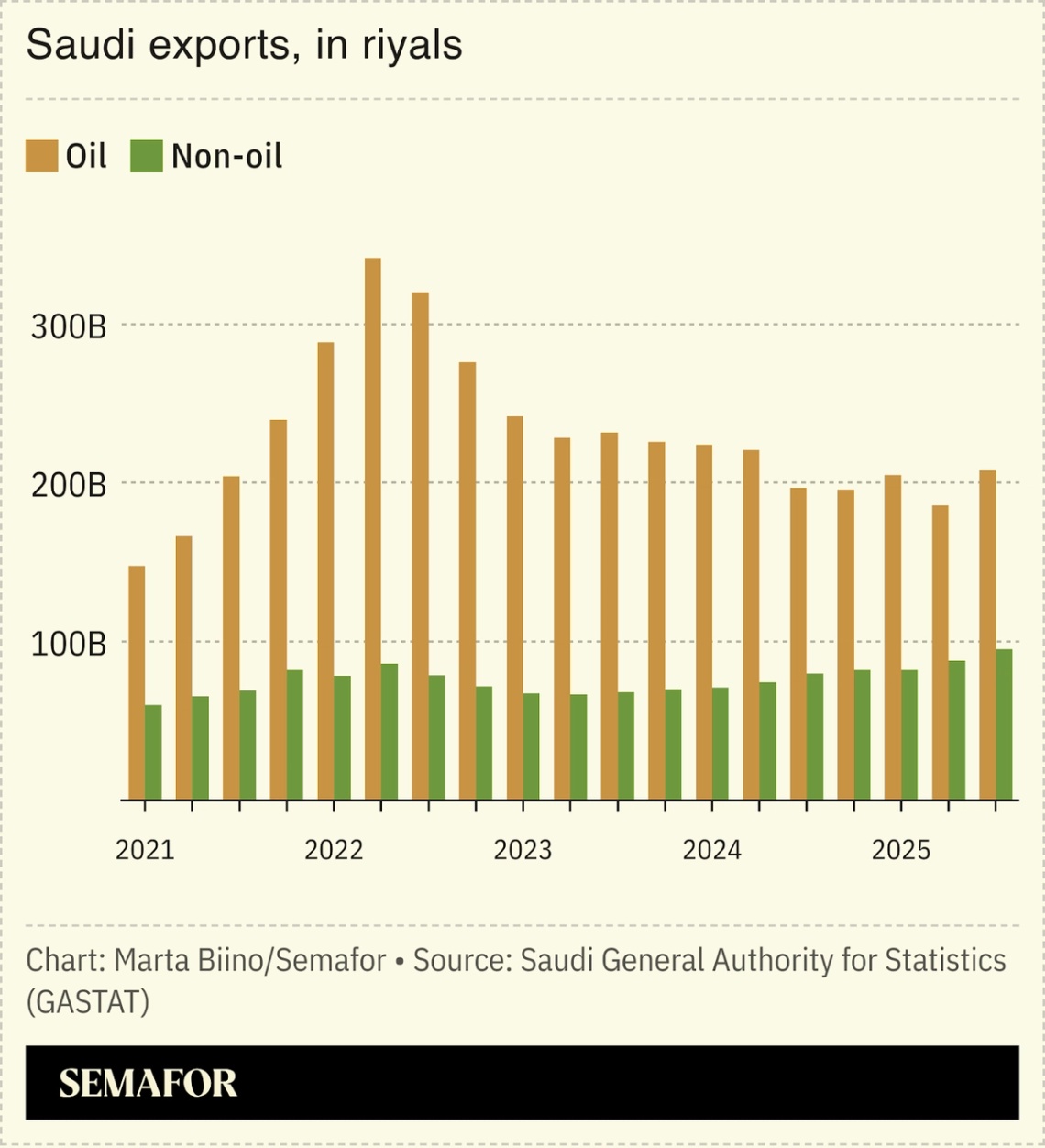

New EnergyFossil Fuels- Non-oil exports are surging in Saudi Arabia: new data showed that in the third quarter, non-oil trade neared 100 billion riyals ($26.7 billion) and it could cross that threshold for the first time in Q4.

- Russia’s LNG exports to China hit a record high in November, as buyers appear willing to risk Western sanctions to secure cheaper fuel.

- Harbour Energy, one of the UK’s largest independent oil and gas companies, announced a $3.2 billion cash-and-shares offer for US-based LLOG Exploration.

TechPolitics & Policy- A Swiss court said Monday it will admit a legal complaint against cement maker Holcim, which claims the company isn’t doing enough to reduce carbon emissions.

- Russia said a drone attack hit two tankers and two piers in the Black Sea port of Taman.

Minerals & Mining |

|

|