| | The NBA opens a path for sovereign wealth fund investments and a massive seed round for an Islamic d͏ ͏ ͏ ͏ ͏ ͏ |

| |  | | | Global Capital Edition |

| |

|

- SWF’s path to the NBA

- New $1.2B climate fund

- Islamic digital bank

- Repeat 2025 playbook

Section 892 of the US tax code threatens sovereign funds. |

|

Not long ago, the Davos crowd thought about the Gulf only when they needed cash or worried about conflicts in the Middle East. Those days are gone. The Gulf is increasingly using the annual conference to its advantage, convincing the global elite that the region isn’t a place merely to look for money, but one where they should invest. Saudi Arabia seems to have the Gulf’s biggest delegation in Switzerland, pitching itself as a connector across energy markets, capital flows, data infrastructure, and diplomacy. Perhaps more than any other country in the region, its future depends on persuading global leaders and executives that they should be investing in the kingdom. The government recognizes that it can’t reshape its economy alone, and even its huge financial resources have limits. Speaking at Saudi House, Minister of Economy and Planning Faisal al Ibrahim said that “delivery at any cost” was justified when the country needed to catch up, but should now shift to a more rationalized approach. This doesn’t mean the era of large foreign investments is over. Saudi Arabia is still able to hold sway over global dealmaking when it wants to, as its sovereign wealth fund’s takeover of the video games-maker Electronic Arts illustrated. Qatar and the UAE are also making their case at Davos, entertaining pitches and encouraging their international partners to set up shop in Doha or Abu Dhabi. Those cities — like Riyadh — also want to attract investors and be seen as travel hubs, financial centers, and AI powerhouses. For CEOs looking for new markets to expand into, or bankers looking for who can finance the next big M&A deal, the Gulf “houses” in Davos can’t be ignored. |

|

The NBA courts Gulf funds |

Kirby Lee-Imagn Images/Reuters Kirby Lee-Imagn Images/ReutersThe next target for the Gulf’s apparently insatiable appetite for sports and leisure deals could be professional basketball — with the NBA trying to entice Middle East sovereign funds to invest in a new, European league. Gulf investors already own soccer giants like Manchester City and Paris Saint-Germain, part of a global spree that has seen them pour funds into boxing, cycling, golf, and F1, alongside more sedentary pursuits like e-sports. Sovereign wealth funds have long had designs on the NBA but can’t own more than 20% of a basketball franchise in the US. There are no such restrictions in Europe. They have already shown interest in basketball: The Qatar Investment Authority is a minority shareholder in the firm that owns the Washington Wizards, while Abu Dhabi’s Mubadala Capital has backed LA Lakers’ owner TWG Global. The UAE capital regularly hosts NBA exhibition games, and the league’s in-season tournament is sponsored by Emirates airlines. If European basketball deals are finalized, it could lead to changes for the sport back at home, NBA commissioner Adam Silver told The Athletic: “It may be that over time there are practices that we learn from in Europe that will then work in the US.” — Dominic Dudley |

|

ALTÉRRA, BBVA launch climate fund |

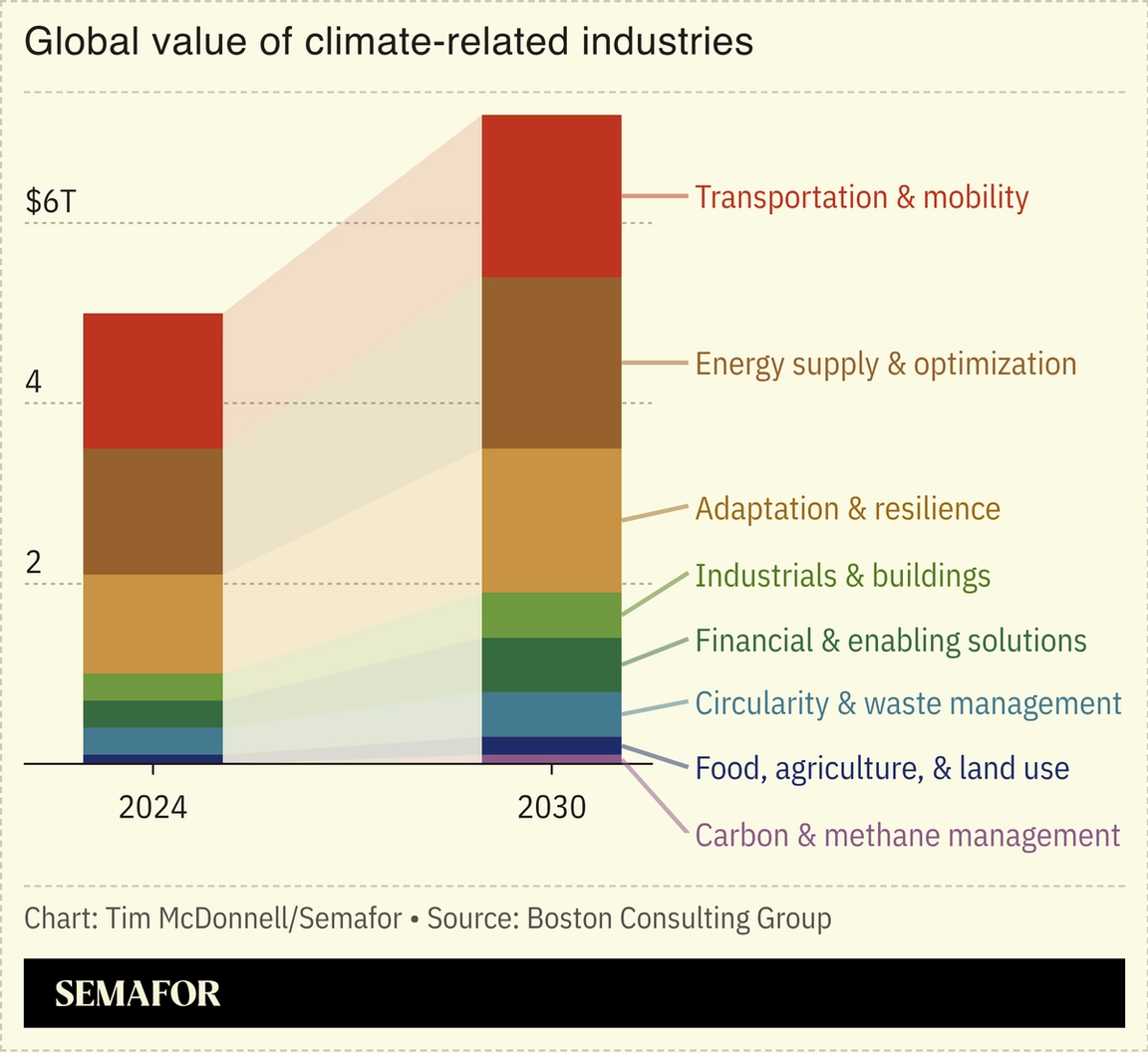

Abu Dhabi climate finance fund ALTÉRRA has clinched $250 million from BBVA, one of Europe’s largest banks, for a climate co-investment vehicle that will be registered in the UAE capital’s financial district. The Bilbao-headquartered bank is coming on as a strategic limited partner for the proposed $1.2 billion fund to back climate-aligned infrastructure, private credit, and private equity. Businesses focused on reducing emissions and adapting to climate change are the second-fastest-growing sector of the global economy after tech and are on track to be valued at more than $7 trillion by 2030, according to Boston Consulting Group. The UAE unveiled plans in December 2023, during COP28 in Dubai, to invest $30 billion in ALTÉRRA with the aim of mobilizing $250 billion by the end of the decade. It’s roughly 20% of the way to that 2030 target, according to its 2025 impact report. — Kelsey Warner |

|

Gulf’s biggest seed round |

The amount raised by Mal, an Abu Dhabi-based Islamic digital bank, in the biggest ever seed round in the Gulf. The bank is being led by Abdallah Abu-Sheikh — a UAE-based businessman who previously founded Botim, an internet calling app — with the financing round led by Abu Dhabi’s BlueFive Capital. Mal says it will use artificial intelligence to help build mobile-first products set for launch later this year. So far the firm doesn’t have any banking licenses, and could initially offer unregulated fintech products while it waits for approval. Abu-Sheikh said he’s in talks with regulators in Bangladesh, Indonesia, and Pakistan as well as the UAE as part of a plan to target the world’s two billion Muslims. But the path will be difficult: Getting license approvals either directly from regulators or through acquiring existing banks can be “fraught with compliance and regulatory hurdles,” and capitalizing a new bank is an expensive proposition, Kristie Neo, a UAE-based VC and tech journalist, wrote on her Substack. — Matthew Martin |

|

Standard Chartered: Buy US stocks, gold |

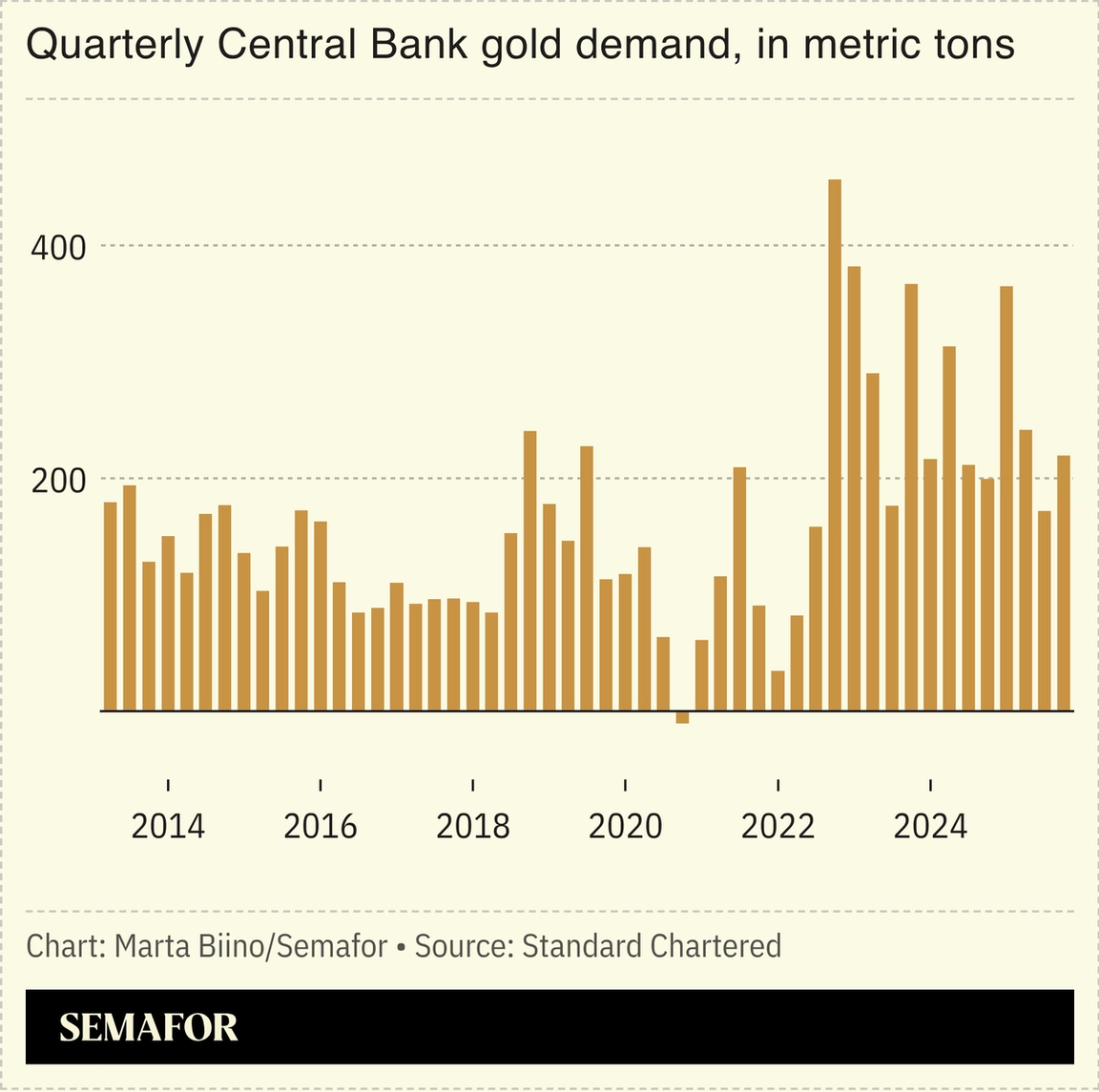

US stocks and gold are on a historic run, and the top investment pick for 2026 is to buy more: That’s according to Manpreet Singh Gill, Standard Chartered’s chief investment officer for Africa, the Middle East, and Europe, who reiterated the bank’s call from last year, saying that both asset classes still have room to grow. For US equities, the debate over an AI bubble is warranted, but the tech sector’s earnings growth, lower interest rates, and a weaker dollar can support further gains, Gill said at a briefing in Dubai. Gold surged more than 60% in 2025, a rise largely driven by demand from central banks seeking alternatives to US dollar holdings. Gill expects that trend to continue this year. — Mohammed Sergie |

|

Dr. Sultan Al Jaber, Managing Director & Group CEO, ADNOC, is joining the Semafor World Economy Global Advisory Board — a forum of visionary business leaders guiding the largest gathering of global CEOs in the US. The expanded board represents nearly every sector across the US and G20. Joining the Advisory Board at this year’s convening will be our inaugural cohort of Semafor World Economy Principals — an editorially curated community of innovators, policymakers, and changemakers shaping the new world economy with front-row access to Semafor’s world-class journalism, meaningful opportunities for dialogue, and touchpoints designed for connection-building. Applications are now open here. |

|

Every week, we ask a different expert what they’re focused on. Today, we’re talking to Taufiq Rahim, Principal at 2040 Advisory.

|

|

An obscure section of the US tax code that exempts foreign government entities from levies on certain types of investments. Section 892 has suddenly taken on new significance as potential changes threaten to saddle sovereign wealth funds with sizable tax bills. In December, the US Internal Revenue Service proposed rewriting the rules by narrowing what qualifies as “investment activity” in what the Financial Times warned could be a “potential bombshell.” The plan sparked concern among Gulf sovereign funds, which have pledged trillions of dollars for investment in the US. In response, Treasury Secretary Scott Bessent said the government received “feedback from stakeholders that will inform any final regulations on these technical US tax rules.” — Matthew Martin |

|

|