| | In this edition: Nigeria bank prepares to finance DRC mine sale, Kenya’s bourse bets on M-Pesa, and ͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Africa |  |

| |

|

- Nigerian bank preps DRC bid

- S&P boosts DRC outlook

- Kenya bourse bets on M-Pesa

- Nissan to sell S. Africa plant

- Zim farmers turn to Trump

- Nigeria’s statehood crisis

The Week Ahead, and the discovery of a rare, endangered grasshopper. |

|

Nigeria’s UBA moves to back Chemaf sale |

| |  | Ruben Nyanguila |

| |

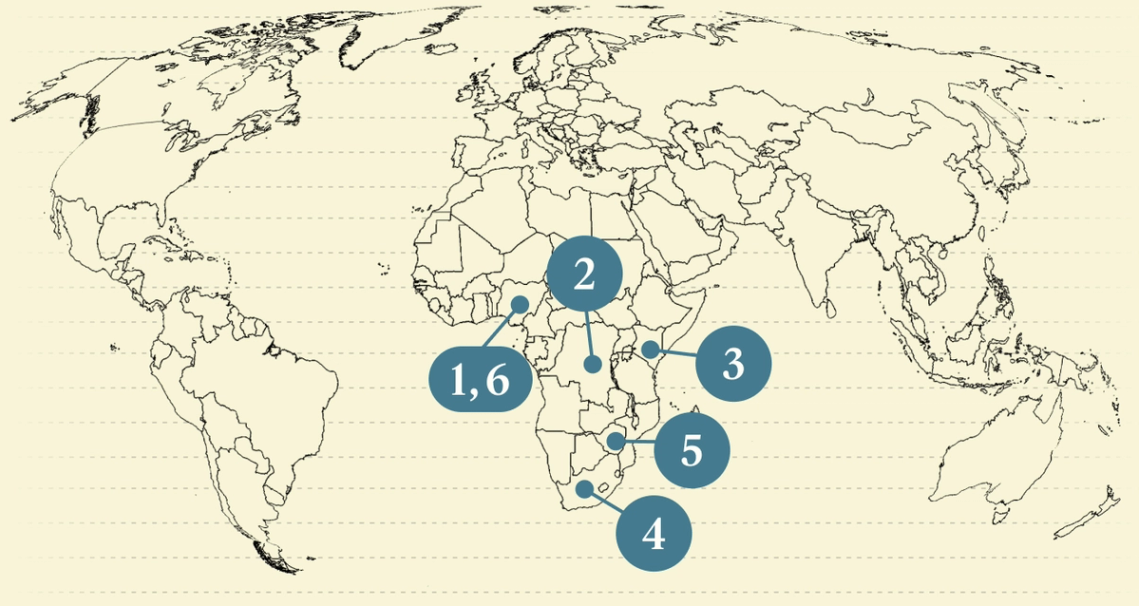

A copper and cobalt mine in DR Congo. Jonny Hogg/File Photo/Reuters. A copper and cobalt mine in DR Congo. Jonny Hogg/File Photo/Reuters.Nigeria’s United Bank for Africa is drafting a $50 million working-capital facility for Congolese metals trader Buenassa to support its bid to acquire Chemaf, the Trafigura-backed copper-cobalt producer, according to documents reviewed by Semafor. The move comes as banks and mining corporations on the continent prepare for US-aligned mineral deals at a time when the White House is vying to outdo China in securing DR Congo’s critical supply chains. The Dubai-headquartered Chemaf has been in a sale process since late 2023. Its flagship Mutoshi mine project is among the assets on a shortlist that Kinshasa has recently flagged to US investors under the US–DR Congo minerals partnership track. There is growing interest and competition to secure mining and processing rights to DR Congo’s minerals. State miner Gécamines has also proposed an approach to acquire Chemaf and bring in a new investor while marketing output to US buyers, adding another route to the same asset. Buenassa CEO Eddy Kioni told Semafor the company was open to teaming with Gécamines and US partners, aiming to direct output “mainly to the United States.” |

|

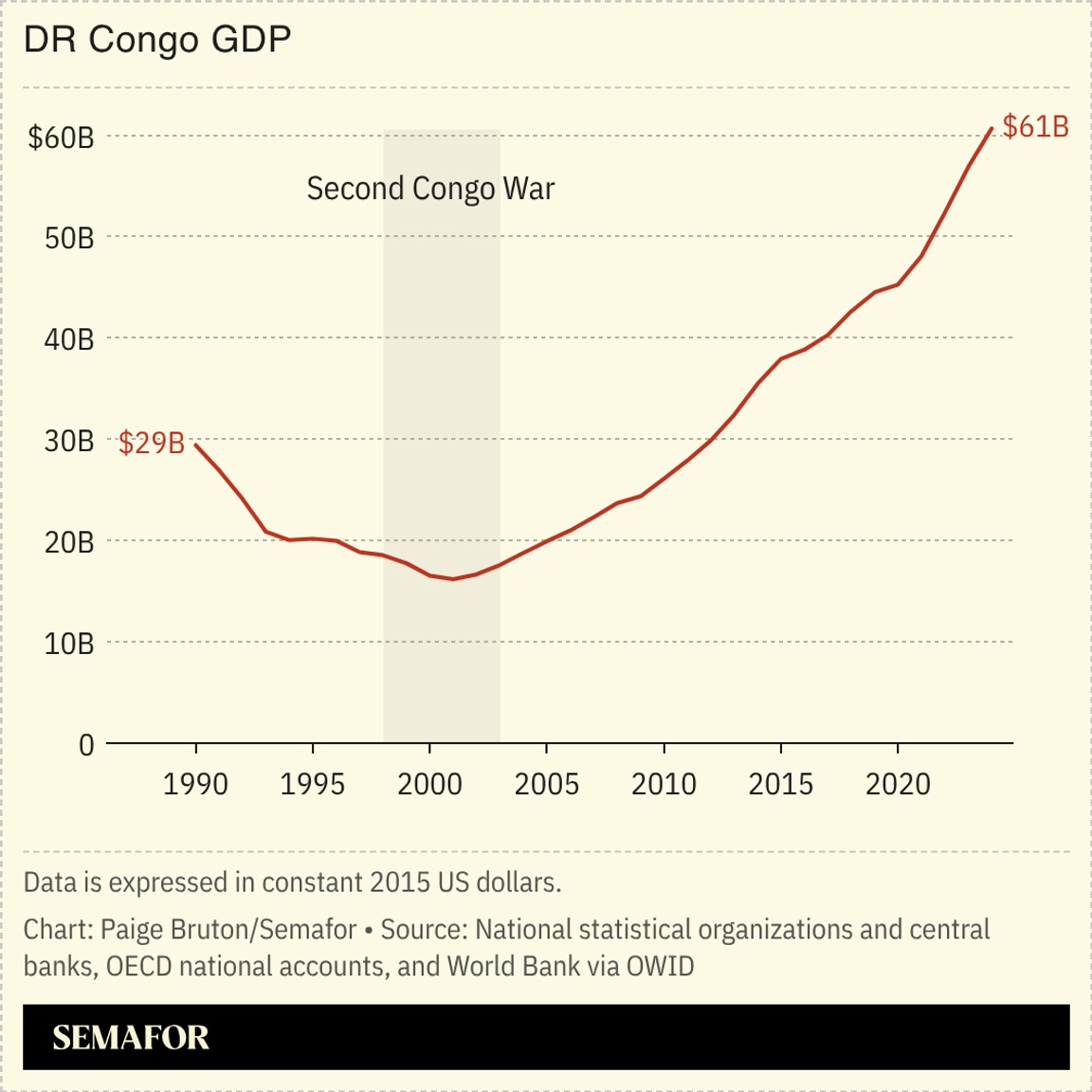

DR Congo wins positive outlook |

Global credit ratings agency S&P raised DR Congo’s outlook to positive from stable, citing its fiscal performance and rising exports. The revision represents a reprieve for the mineral-rich nation, which for years has grappled with a conflict in the east of the country. It holds some of the world’s biggest metal deposits, including of cobalt, a key component in the lithium-ion batteries that power EVs. S&P’s decision comes shortly after the International Monetary Fund approved a new $440 million financing facility for the country, though fund officials warned of commodity price fluctuations, as well as the risk of an uptick in fighting with Rwanda-backed rebels. |

|

Kenya seeks new stock investors |

| |  | Martin K.N Siele |

| |

Thomas Mukoya/File Photo/Reuters Thomas Mukoya/File Photo/ReutersThe Nairobi Securities Exchange is betting on mobile money platforms to attract more retail investors after ending a decade-long IPO drought, with leading telcos expected to soon roll out trading services on mobile money apps to widen access to capital markets. Andrew Barden, chief executive of Wall Street Africa Group, a Nairobi-headquartered financial intelligence company, told Semafor that he expected mobile money platforms such as M-Pesa and Airtel Money to drive “a massive number of new retail traders coming into the NSE.” He described last week’s IPO of the state-run petroleum transporter, Kenya Pipeline Company, as “a litmus test” for the NSE’s strategy to reach 9 million new retail traders by 2029. Meanwhile Ian Mwangi, a Nairobi-based economist, said that new retail investors would have to be convinced to buy stocks instead of more traditional investments. Retail investment participation in the NSE has been historically low. Many have compared the introduction of trading on M-Pesa to the launch of Robinhood in the US in 2013. The timing is also key: More IPOs may be on the cards as Kenya’s government looks to privatize further state assets to fund infrastructure projects. |

|

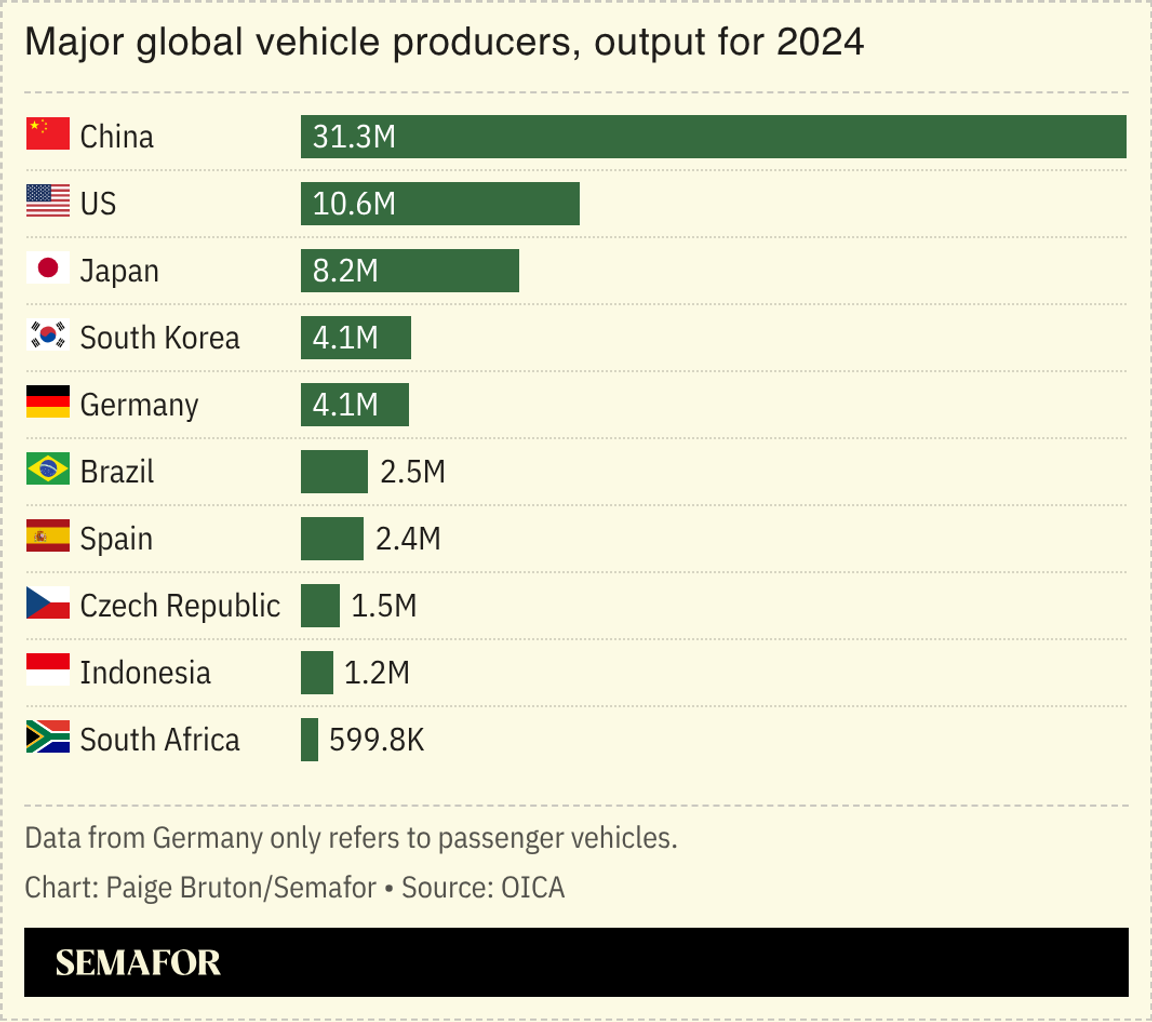

Nissan sells S. Africa plant to China’s Chery |

Japanese automaker Nissan will sell its manufacturing plant in South Africa to Chinese state-owned rival Chery, ending a five-decade presence as the company battles to regain its footing in the global market. The move follows a boom in Chinese car brands in the country in recent years, making up more than a tenth of cars sold in South Africa. Chery will buy the land, buildings, and associated assets of the Nissan property, subject to regulatory approvals. Nissan said the plant in Pretoria had become less viable to the firm due to “external factors” and that the sale would be completed this year. The Japanese company still plans to sell cars in South Africa “through sales and distribution operations.” Car production in South Africa rose 1.5% year-on-year by last December to just over 600,000 units, but imports rose more than 30% in the same period as competition from China and India shake-up the market. Chery has thrived in South Africa since it resumed operations in the country in 2021 after a hiatus, selling various models including electric vehicles. It was the eighth best-selling car brand in South Africa last year, where the market is still dominated by Nissan’s Japanese rivals Toyota and Suzuki. |

|

Zimbabwe’s white farmers turn to Trump |

The amount of money white farmers in Zimbabwe are trying to win in compensation for having their land seized by the state, a fight they hope the Trump administration will support. They have turned to a US lobbying firm with ties to the US president to make their case, reported Bloomberg, trying to capitalize on the White House allegation that white people in southern Africa are being discriminated against by Black-majority governments. “They are lobbying on our behalf to see if we can get Trump to agree to something,” a Zimbabwe farmer involved in the campaign told Bloomberg. Trump’s repeated claims of a “genocide” against white people in South Africa have been widely debunked. Thousands of white farmers in Zimbabwe had their land violently seized in the 2000s under a controversial land reform program intended to redress colonial-era land grabs. |

|

View: Nigeria’s statehood problem |

A shelter for displaced people in northwest Nigeria. Temilade Adelaja/File Photo/Reuters. A shelter for displaced people in northwest Nigeria. Temilade Adelaja/File Photo/Reuters.Nigeria’s security challenges are more complicated than the flawed narratives around “Christian genocide” propagated by US President Donald Trump, wrote a regional violent extremism expert in a column for Semafor. US cruise missiles “are not the answer to issues as complex” as the insecurity crisis facing the country, wrote Obi Anyadike, Senior Africa Editor at The New Humanitarian. It faces multiple challenges including jihadi insurgencies expanding out of the northeast, separatist tensions in the southeast, farmer conflicts in the center, and the violence of criminal gangs in the northwest. “What links them all is the weakness of Nigeria’s security architecture and administrative systems,” argued Anyadike. “Early warning is rudimentary and community liaison mechanisms are flimsy. The police — and the broader judicial apparatus — is flawed and deeply distrusted. The resultant impunity means people turn to alternative structures for protection, from vigilantes to the very criminals that oppress them.” |

|

Business & Macro |

|

|