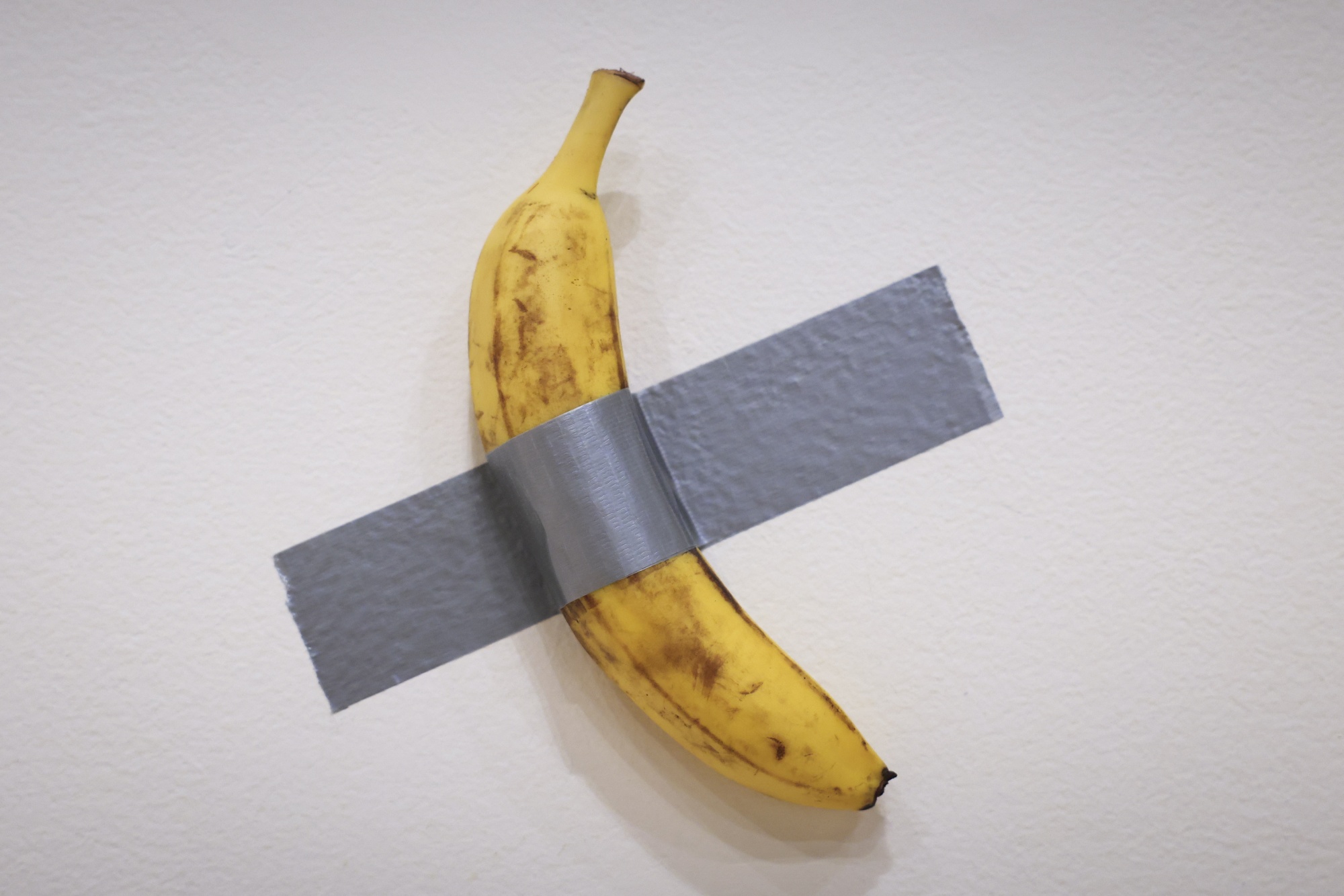

| This is Bloomberg Opinion Today, an all-around embarrassment for Bloomberg Opinion’s opinions. Sign up here. Three televisions hang from the ceiling to the left of my desk here in the office. On a normal day, I give them the a cursory glance a handful of times. Today was not a normal day! Every time I looked, there was a new name on the chyron: One minute it was Bill Hwang. Then it was Gautam Adani. A quick flash to Jussie Smollett. Then Matt Gaetz, followed by Pete Hegseth, who was quickly bumped by Gary Gensler, who was bumped again by Benjamin Netanyahu. By the time Jair Bolsonaro showed up, I had a full-blown neck cramp. That’s a lot of news for one morning-into-early-afternoon — but I have to begin this newsletter somewhere. So why not start with the US Justice Department’s 54-page indictment against Adani, the Indian tycoon with a $169 billion empire. Andy Mukherjee calls it “an unexpected gift to President-elect Donald Trump, and an all-around embarrassment for Prime Minister Narendra Modi.” The long and the short of the saga, according to the indictment, is that Adani Green Energy did a suspicious solar power deal back in 2020 that led to a $250 million bribery scheme with government officials, leaving investors and banks in the dark. Matt Levine calls out the strangeness of it all: “It’s a little weird, no?” he asks. “Indian executives of an Indian company listed in India who allegedly paid bribes to Indian government officials to win Indian government contracts were charged with crimes in the US. Paying bribes to government officials seems like it must be a crime, but why is it a crime in the US to pay those bribes in India?” Make it make sense! Turns out, Adani Green sold hundreds of millions of dollar-denominated bonds in 2021, some of which landed in the pockets of US investors. Although it’s considered a bribery case, Matt says the argument of the SEC, which filed a parallel complaint, has all the ingredients of a greenwashing case, too. “The argument is that the investors were defrauded because they thought the bonds were ESG, but the bonds were not in fact ESG. Or, rather, the bonds were issued to fund solar projects, yes, but their social and governance credentials were suspect, what with the bribes.” Can’t say we didn’t see this coming: As you might recall, New York City-based Hindenburg Research released a scathing report about Adani in January 2023, saying he pulled off “the largest con in corporate history.” Although Adani — one of Modi’s business allies— was able to shake off the short seller’s allegations, Andy says the DOJ’s “grave” indictment could “change everything.” Read the whole thing for free. Bonus India Reading: Playing political games with government handouts is almost certain to backfire. — Mihir Sharma Moving on to Matt Gaetz: 45 minutes after CNN’s Paula Reid informed the former congressman that she knew about a second sexual encounter between him and a 17-year-old in 2017, he withdrew his nomination to be Trump’s attorney general. Maybe that means our elected officials can stop worrying about who is allowed to enter the women’s bathroom?  For the past week or so, Republicans have been engaged in a smear campaign against the Democrat who will be the first openly transgender member of Congress, Representative-elect Sarah McBride of Delaware. Speaker Mike Johnson, who says “women deserve women’s-only spaces,” has officially issued a bathroom ban for the House of Representatives, mandating that transgender staffers must use the restroom that correlates to their gender assigned at birth. So Representative Nancy Mace of South Carolina is labeling bathroom signs and ripping up transgender flags, while Marjorie Taylor Greene of Georgia made some poor soul at FedEx print a massive poster that says, “There are TWO genders: MALE & FEMALE. Trust The Science!” Nia-Malika Henderson says such rhetoric only serves to perpetuate disinformation and stereotypes. “Transgender Americans don’t represent some existential threat to the social order,” she writes (free read). “Proposals like bathroom bills only serve to create us-versus-them divisions” that have led to a flood of anti-trans bills — more than 600 in 2024 — encompassing “every aspect of life, sports, education, employment and bathrooms.” Through it all, McBride has been the picture of calm: “I’m not here to fight about bathrooms. I’m here to fight for all Delawareans. … I will follow the rules as outlined by Speaker Johnson, even if I disagree,” she wrote on X. Her colleague AOC, on the other hand, went after officials across the aisle: “They’re not doing this to protect people,” she said. “They’re endangering women, they’re endangering girls of all kind, and everybody should reject it, it’s gross.” What would compel someone to pay $6.2 million for a banana duct-taped to a wall? I have a few ideas: - You’re really rich.

- You’re really stupid.

- You’re really hungry.

- All of the above.

Although I have never met crypto entrepreneur Justin Sun — the proud owner of Maurizio Cattelan’s “Comedian” — I fear the answer is all of the above. “In the coming days, I will personally eat the banana as part of this unique artistic experience, honoring its place in both art history and popular culture,” he posted on X after the Sotheby’s auction wrapped up. But don’t worry, Sun can “manifest” his edible art whenever he pleases: His purchase included a starter kit with a detailed instruction manual, a banana and a roll of duct tape. How generous.  Photographer: Kena Betancur/AFP Forgive me if this sounds glib, but I have to think that humankind will look back at this $6.2 million purchase of a banana and say that’s the moment when it all started going downhill. That level of gluttony can’t be good for the world, right? One could argue that the silliness of it all may indicate that we’ve reached an economic tipping point. The US stock market is at historic highs, but Nir Kaissar says warning signals are flashing red. Take one look at Warren Buffett’s $325 billion cash pile, and you’ll know where we’re heading: Meanwhile, in the Real World, none of us mortals has millions to spend on a single banana! Instead, we’re lucky if we can keep a steady paycheck. “People are as reluctant to leave their jobs as they were in early 2008,” John Authers says, and negotiating power is “now lower than the norm for the last quarter-century.” In today’s landscape, “it is tempting to romanticize the 1960s, when 30% of the labor force had manufacturing jobs that offered stable wages, long-term employment, a defined-benefit pension and enough income from a single earner to support a family,” Allison Schrager writes. But it’d be a mistake to return to the economy of yesteryear: “Making your way in an uncertain world and a constantly changing economy has always been hard — and always will be. But things are not harder than they used to be; in many ways they’re getting easier.” If it’s any consolation, you could go buy a banana at Safeway (29 cents each) and duct-tape it to your wall tonight. Boom! You’re practically a millionaire. Bonus Economy Reading: The UK has led the way in reforming regulation of research on stocks and shares. This year could mark a welcome turning point. — Chris Hughes Where can Europe find €500 billion for a defense upgrade? — Bloomberg’s editorial board Three charts to debunk China’s so-called debt crisis. — Shuli Ren The Māori treaty debate reveals the ugly side of New Zealand politics. — Karishma Vaswani Mike Tyson and Jake Paul’s |