| Bloomberg Evening Briefing Americas |

| |

| Marine Le Pen pledged to topple Prime Minister Michel Barnier’s government after he failed to meet her demands on a new budget, threatening financial and political disruption for France. Barnier on Monday invoked a constitutional mechanism that allows for a social security bill to be adopted without a vote, but opens the door to no-confidence motions. Le Pen said her far-right National Rally party would join a left-wing bloc to support dissolving the government, all but ensuring the outcome. The National Rally is the largest party in the lower house of parliament, making Le Pen the most influential powerbroker in Paris. Even though Barnier agreed to almost all of her demands to tweak the budget legislation, Le Pen said she wouldn’t back the bill because of the government’s refusal to adjust pension payment increases. —Natasha Solo-Lyons | |

What You Need to Know Today | |

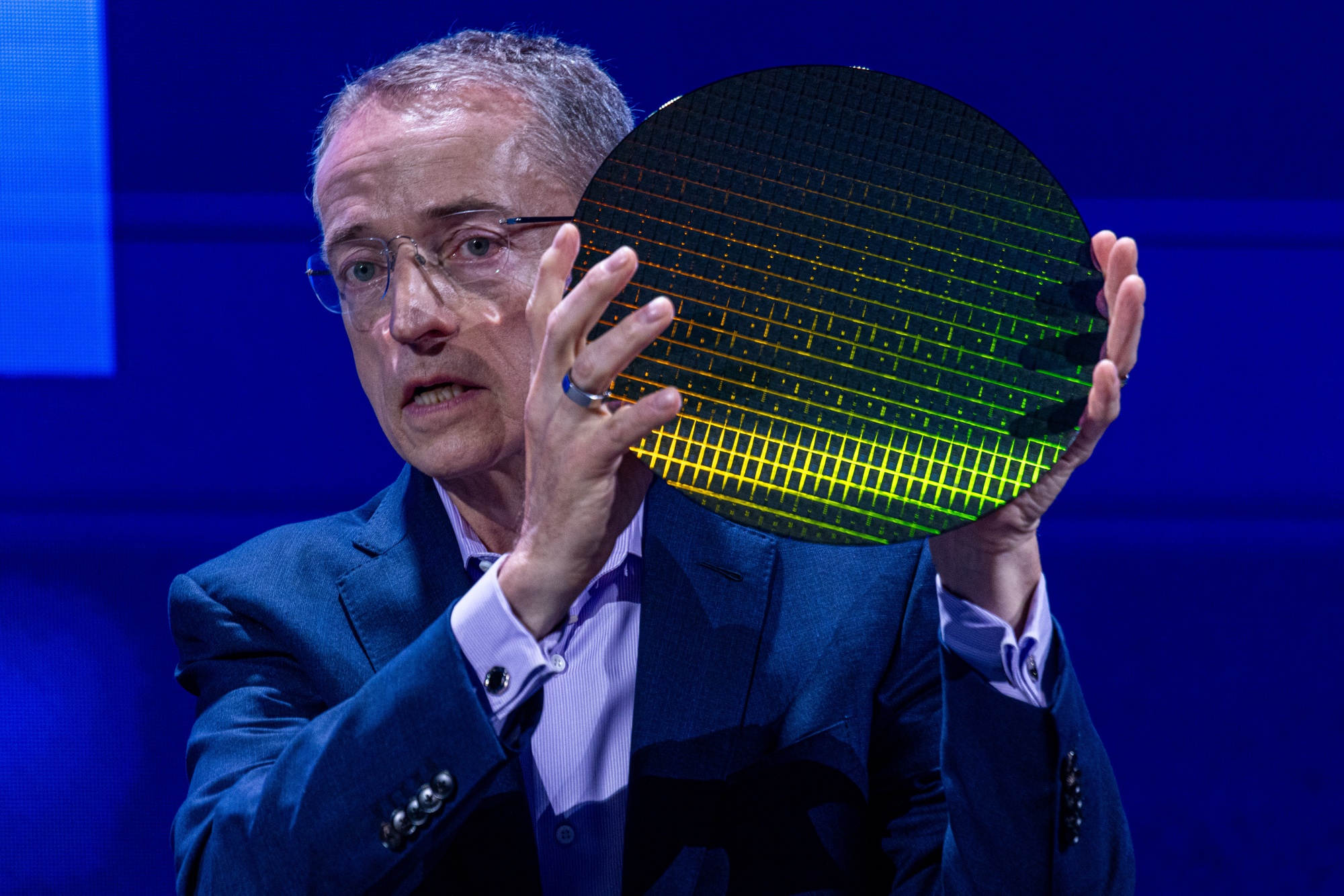

| Intel Chief Executive Officer Pat Gelsinger was forced out after the board lost confidence in his plans to turn around the iconic chipmaker, adding to turmoil at one of the pioneers of the technology industry. The clash came to a head last week when Gelsinger met with the board about the company’s progress on winning back market share and narrowing the gap with Nvidia. He was given the option to retire or be removed, and chose to announce the end of his career at Intel.  Pat Gelsinger Photographer: Annabelle Chih/Bloomberg | |

| |

|

| A rally in the world’s largest technology companies drove stocks to fresh all-time highs, with Wall Street traders bracing for a barrage of economic data and remarks from Federal Reserve speakers that will help shape the outlook for interest rates. The S&P 500 notched its 54th closing record this year in a “narrow” advance that saw just a few groups ending higher. The tech-heavy Nasdaq 100 rose more than 1%, Tesla led gains in megacaps and Apple hit a fresh peak. Treasuries pared losses after Fed Governor Christopher Waller said he’s inclined to vote for a rate cut in December, with swaps pricing in more than 70% of a quarter-point cut this month. Here’s your markets wrap. | |

| |

|

| A Fidelity Investments mutual fund increased the value of its equity stake in Elon Musk’s X by more than 32% in October, its largest monthly increase since making the investment in late 2022. Fidelity’s Blue Chip Growth Fund valued its stake in X Holdings Corp., the parent of the social network, at $5.53 million at the end of October, up from $4.19 million in September, according to the fund’s monthly report. The fund originally invested about $19.7 million in October 2022. Despite the increase, Fidelity’s fund has marked down X’s valuation by nearly 72% since Musk bought the company for $44 billion in October 2022. | |

| |

|

| It’s set to be a record year for wind power in the UK, at least in terms of how much goes to waste. Burgeoning capacity and blustery weather should have driven huge growth in output in 2024. But the grid can’t cope, forcing the operator to pay wind farms to turn off, a cost ultimately borne by consumers. It’s a situation that puts at risk plans to decarbonize the network by 2030 and makes it harder to cut bills. Crucial to the net-zero grid target is a massive build-out of renewable power, particularly from wind. Britain has boosted its offshore fleet by 50% in the past five years and is set to double it in the next five, BloombergNEF data show.  Sheep graze in a field near wind turbines in Biggleswade, UK Photographer: Chris Ratcliffe/Bloomberg | |

| |

|

| Cargill is cutting thousands of jobs globally after the largest privately held company in the US missed profit targets. The Minneapolis-based firm, the world’s largest agricultural commodities trader, will cut about 5% of its 164,000-strong workforce as part of its 2030 strategy, according to an internal memo seen by Bloomberg. (The reductions are said to not affect its executive team.) Cargill had already told employees earlier this year that it would reduce the number of business units to three from five after less than one-third of its businesses reached their earnings goals in fiscal 2024. | |

| |

|

| Bitcoin bulls are starting to express doubt after what seemed like the digital currency’s inevitable march toward $100,000. “While we’re seeing strong institutional buying pressure, particularly from entities like MicroStrategy’s continued accumulation strategy, the broader crypto ecosystem is experiencing a diversification of capital flows from both institutional and non-institutional participants,” said Chris Newhouse, director of research at Cumberland Labs. As Bitcoin’s price plateaus, interest is rising in other digital assets. | |

| |

|

| |

| |

| |

What You’ll Need to Know Tomorrow | |

| |

| |

| |

| |