|

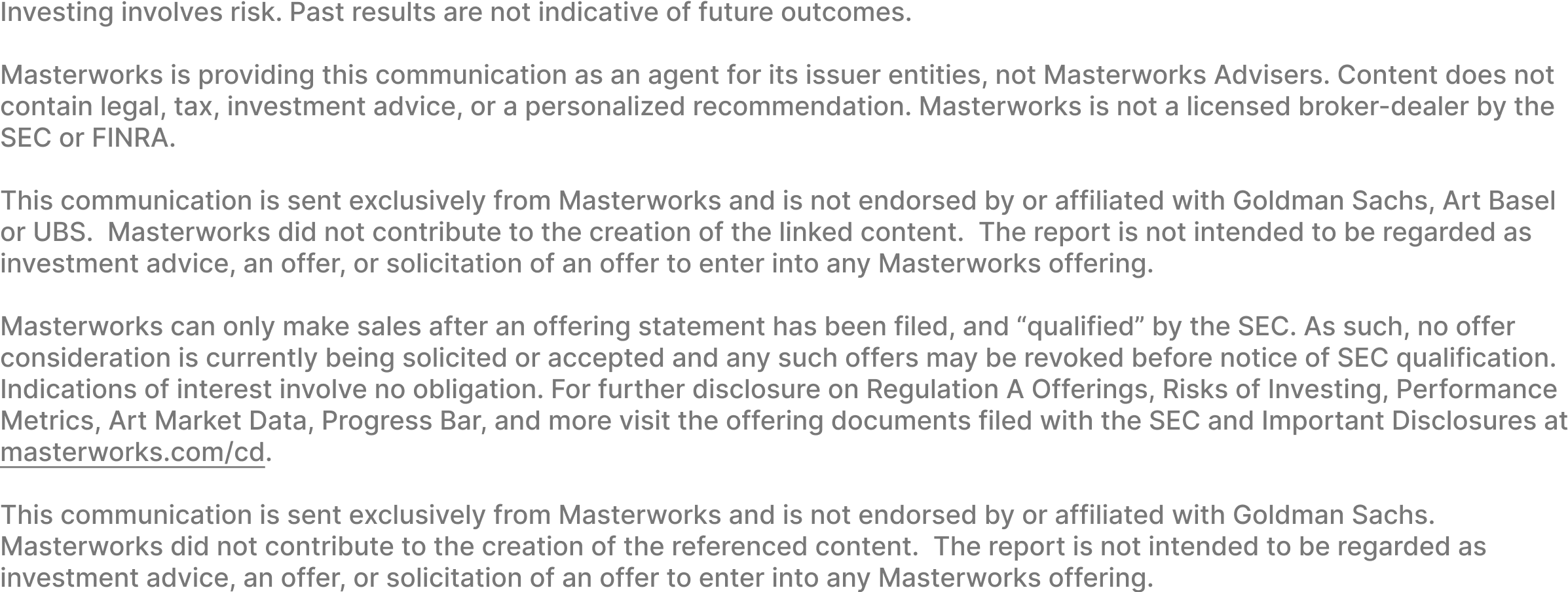

Hi N, The last decade spoiled us:

In one forecast among many, Goldman Sachs says the next decade (‘24-’34) will be different:

The wealthy have seen cycles like this before. It's why they've historically allocated to noncorrelated alternatives for a slice of their portfolio, including blue-chip art - not for aesthetics, but for returns. Would you like to learn more about artwork like Basquiat, Banksy and Picasso as a portfolio asset? Get started by scheduling a brief meeting to see if art investing is right for you. Thanks,

Edith Halpert

M A S T E R W O R K S

|