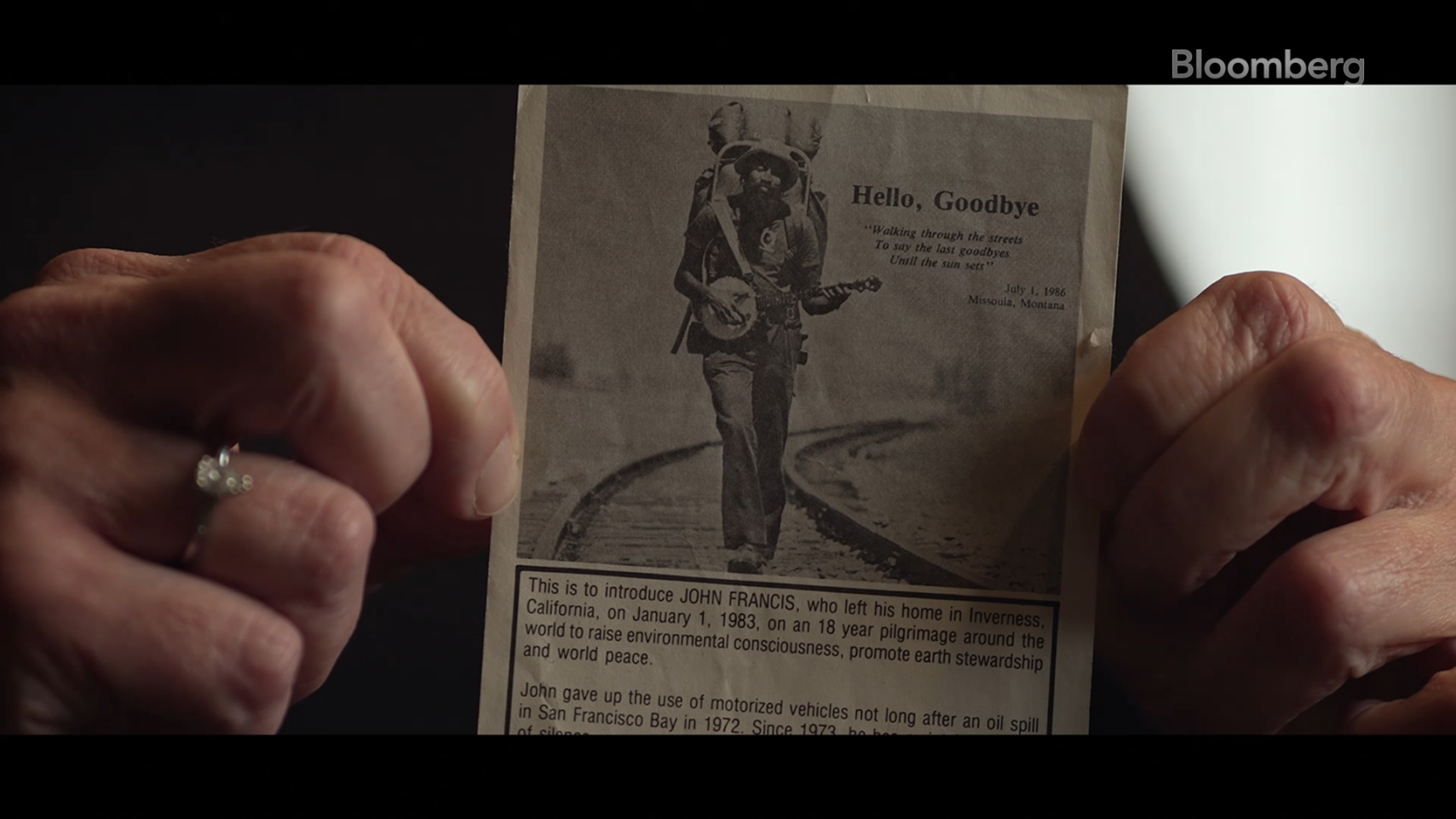

| In 1971, John Francis witnessed an oil tanker collision in the San Francisco Bay. The incident caused him to give up motorized transport and speaking. He spent the next 17 silent years earning the name Planetwalker. At 77 years old, Francis recounts his unique journey in a short documentary, which is available to watch now on Bloomberg.com.  Source: Bloomberg Green Docs and Los Angeles Times Short Docs The latest from the Uncovered series | The Pelley family — Kevin, Shauna, two cats, two dogs, eight ducks — had only lived in their dream home outside Seattle for about five weeks when a flood struck in November 2022. A river that used to be about 100 feet behind their house was now under it. The Pelleys soon found themselves saddled with a property that was unlivable and the mortgage was due. Their real-estate transaction, like hundreds of thousands completed in the US each year, was designed to redistribute the risk of owning a valuable, highly leveraged asset subject to the whims of fires, floods and other destructive events. The mortgage lender took no issue with the home’s proximity to the water. Closing the deal required a method for moving that weather danger away from the family and its lender. And that meant an insurer.  Kevin and Shauna Pelley on the foundation of their dream home in Graham, Washington, in February. The family was impacted by a 2022 flood and then another in 2023. Photographer: Grant Hindsley for Bloomberg Green While a company wrote the Pelley’s home insurance plan, and the family even bought flood insurance via the federal government’s program, they did not receive payment from either one. The Pelleys were hit with a perfect storm: volatile weather, a country failing to keep up with rising flood risk and a mortgage industry writing loans without considering the future of the environment around the home. Unfortunately too many Americans can relate: Homeowners in Florida and California have already been trying to reconcile their mortgage duration and dwindling insurance options with neighborhoods that may not live to see 30 years. In a nation where long-term loans are the gateway to homeownership for most families, climate change is rewriting the basic assumptions about risk. Read the full story online to find out why more American homeowners may find themselves without a safety net due to extreme weather. Also, catch up on all of the stories from “Uncovered,” our series about how climate change is upending the insurance industry. Part 1 looked at the fragility of US “last resort” insurers. Part 2 explored the risky business of private climate modeling. Part 3 revealed the harsh reality of the catastrophe bond market. Part 4 examined a first-of-its-kind program in the UK. Part 5 delved into lightly-regulated insurers on the rise in the US. Part 6 explained how African countries are turning to parametric insurance that still leaves millions to starve, and Part 7 detailed how China is trying to protect the world’s biggest uninsured economy from more extreme weather. Some hedge fund managers are sounding the alarm on overvalued nuclear power stocks and scaling back exposure after a stunning rally this year. Sydney-based Tribeca Investment Partners and Segra Capital Management in Palm Beach, Florida, are among funds that have recently trimmed bets on nuclear technology developers and utilities. “The concern I have is some of this stuff has rallied hard,” said Guy Keller, a portfolio manager at Tribeca. Still, “I would never” build a short position “because you’re one data-center announcement away from blowing yourself up,” he said.  Constellation Energy Corp. is reviving the shuttered Three Mile Island nuclear plant after agreeing to sell all the output to Microsoft Corp, which is seeking carbon-free electricity for data centers to power artificial intelligence. Photographer: Heather Khalifa/Bloomberg AI is threatening Japan’s green goals. The nation’s new draft energy strategy sees electricity generation jumping as much as 22% through 2040. The rapid rollout of massive power-hungry data centers jeopardizes the transition to cleaner fuels. Rwanda gets tough on dirty moto-taxis. The country is seeking to replace gasoline-fueled bikes that are typically used as taxis in its capital with greener alternatives through a new policy that takes effect on Jan. 1. E-waste is filling up landfills. The world generated 62 billion kilograms of electronic waste in 2022, with less than a quarter of it being properly recycled. Bloomberg Green has some tips to help solve the problem. By Mary Hui, Lauren Rosenthal, Ethan M Steinberg and Eamon Farhat Many ski towns across the Northern Hemisphere are gearing up for a promising snow season, but the threat of a changing climate continues to cast a shadow over the industry worth billions. In the US Northeast and New England, global warming has already added more than a week’s worth of unseasonably warm days into the winter months — so warm it’s difficult to produce even artificial snow. “By the time it’s Christmas and New Year’s, it’s going to be above-average for most of Canada and the US,” said Bryan Allegretto, a forecaster for OpenSnow. “So no big Arctic front or cold fronts for anyone for the holidays.”  Dry scrubland alongside a run at La Molina ski resort in Girona, Spain, earlier this year. Photographer: Angel Garcia/Bloomberg Resorts with taller ski slopes — including those in the US West — have tended to fare better financially. Even wet, rainy weather fronts can still translate to plenty of snow at higher altitudes. In the Northeast, where mountain ranges are smaller, resorts are forced to sink more of their budgets into sophisticated snowmaking machines that can be expensive to operate. Over the next few weeks, the jet stream is set to cause issues for the US and Canada, pushing warm, moist air ashore from the temperate Pacific Ocean. Across the other side of the Atlantic Ocean, the outlook is a bit better. Parts of the Swiss Alps could get as much as one meter (3.3 feet) of fresh snow by the end of Monday, according to MeteoSuisse. Still, the warming climate and expected positive phase of the North Atlantic Oscillation — a see-saw of high and low pressure near Greenland — will likely mean fewer and less intense snowfall events across much of Europe, according to Atmospheric G2 meteorologist Olivia Birch. Continue reading the full story on Bloomberg,com. Dreaming of a ‘white Christmas’ in the US? Search this map to find out the last time communities across the country have seen snowfall on Dec. 25. If you’re looking for more weather insights sent directly to your inbox, get the Weather Watch newsletter — tracking the market, business and economic impacts of extreme weather from Bloomberg’s team of dedicated reporters. |