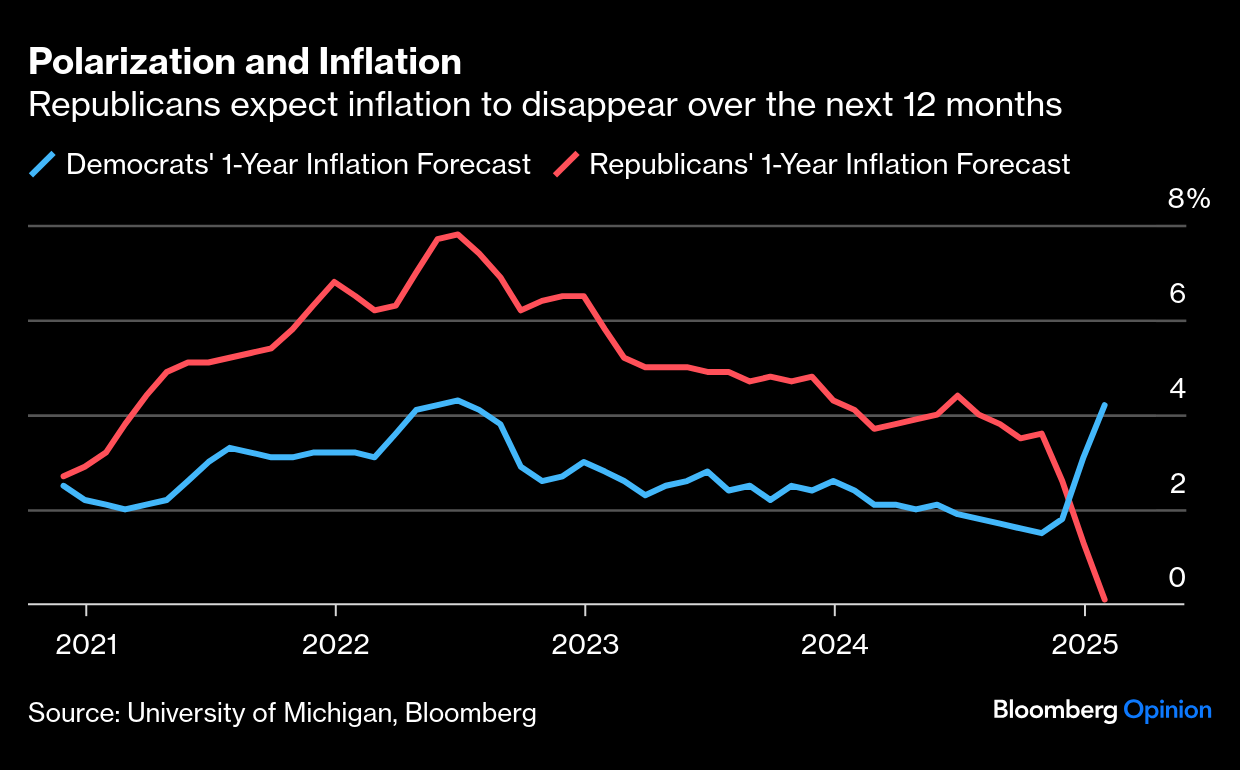

| We ought to have been able to forget about inflation by now. It was trending down, the Federal Reserve was cutting rates, and attention could move on to averting a recession and sustaining employment. But startlingly strong US employment, a global surge in bond yields, and a big rally for the dollar all ensure that the last consumer price inflation numbers for 2024, published Wednesday, will command attention. If the consensus of the economists interviewed by Bloomberg has it right, then the December number will mean yet more frustration, with core CPI (excluding food and fuel) remaining unchanged at 3.3%, too high to permit more rate cuts:  A significant rise would really set the cat among the pigeons. Worse, inflation expectations can be self-fulfilling. If consumers or companies expect prices to rise, they will buy more now — which pushes up inflation. The market’s clearest inflation forecast comes from the gap between inflation-linked and fixed-income yields. The point at which they break even is the implicit expected level of inflation. On that basis, the 10-year breakeven’s recent rise is generating disquiet. It’s within its range for the last two years, but only just: Meanwhile, the University of Michigan’s regular consumer survey found that expectations for inflation in five years are now higher than they ever were during the spike in price rises of 2022. With the exception of one month in early 2008, when the oil price was surging and about to crash, its current 3.3% is the highest in any month since 1996: The New York Fed conducts regular panel surveys of consumers’ expectations over three years. The latest, published Monday, shows forecasts rising, but far below their 2022 peak. The same is true of the quarter of consumers with the highest estimates: Complicating this is political polarization. December’s rise in jobs probably reflected a Trump effect. Business leaders tend to be pro-Trump, and his election might well have prompted them to hire more people. That’s good for the economy and stocks, but not for the battle against inflation, as it makes people more likely to spend. Politics have left expectations wildly dispersed. Michigan asks respondents for their party identification. One-year inflation expectations among Republicans were higher than for Democrats throughout the Biden administration. That has all changed. Democrats are suddenly braced for 4% inflation, while Republicans say prices will rise by only 0.1%:  Obviously, both groups are driven by their political preconceptions. If prices were to rise 4% over the next 12 months, that would mean rate hikes and the derailing of much of the Trump growth agenda. Republicans’ extraordinary belief that inflation is on the verge of almost total eradication could be even more of a problem. To show how optimistic a 0.1% headline inflation forecast is, this is CPI going back to 1945. It’s almost 70 years since inflation last dipped as low as 0.1% without the aid of a major crash in the oil price (which is unlikely now as oil is not that expensive): Michigan found the same partisan pattern in five-year expectations. A few months ago, politics barely entered into it when people tried to forecast that far ahead. That, too, has changed: Rising inflation now could ruin the Trump 2.0 agenda before it starts. Thus, the risks of conflict with the Fed appear to be growing. SMBC Nikko’s Joe Lavorgna, an economic adviser in the first Trump administration, put it this way: The Fed cut rates by a larger than expected 50 basis points last September when the job market appeared to be faltering. But then the jobs data rebounded and inflation surprised to the upside, and the Fed kept cutting interest rates by 25bps in November and December. The last cut was especially perplexing since it was accompanied by upward revisions to both their growth and inflation forecasts. If inflation remains sticky, monetary policymakers will be responsible.

That may well be true — but the message of the last four years is that incumbent politicians pay the greatest price for higher inflation. Beyond inflation, Trump 2.0 has to reconcile two other problems. It has unleashed animal spirits, and it intends to levy more tariffs. Both conflict with fighting inflation. Economists are convinced, according to Bloomberg’s survey, that US growth will speed up as Europe slows: Points of Return’s observation from five years ago — Doubting America Can Still Cost You a Lot of Money — remains relevant. The next measure of Trumpy animal spirits comes in Tuesday’s National Federation of Independent Business optimism index compiled by surveying small business leaders. They tend to be very pro-Trump. As with inflation, it looks like Trump supporters’ expectations could be impossible to meet: US exceptionalism will persist. Macquarie’s Viktor Shvets points out that the dollar accounts for 73% of global non-resident financing (US$13 trillion), while also being responsible for about 48% of SWIFT transactions and accounting for 88% of foreign exchange volume. While a little less dominant than in the past, it accounts for nearly 58% of global reserves: Essentially, nothing moves without the dollar, even if users are not aware of it. Despite rhetoric, there is no evidence of any meaningful weakening in dollar power. By contrast, the renminbi accounts for only 4% of SWIFT, less than 10% of FX transactions, and is ~2% of reserves.

But the level of the dollar could be driven by the uncertainties of Trump’s tariffs agenda. Chris Watling of Longview Economics suggests that Trump 2.0 will initially be (mostly) negative for the economy, while “growth-positive” factors are back-end loaded to the end of 2025 and beyond: Many of the drivers of growth in 2023 and 2024 are fading (or likely to be reversed by the new Trump administration). Trump’s economic agenda, whilst growth-friendly over the medium term, is likely to initially be negative for growth (tariffs and cutting government spending). The fiscal program will take time to get through Congress (as the 38 Republicans who defied Trump on the spending and debt deal before Christmas illustrated); while the effect (whilst positive) of unleashing animal spirits is unknown.

Tariffs can be implemented quickly. The question now is how fast, and how big. Oxford Economics’ baseline is for a phased and limited scenario where the US gradually imposes blanket levies of 30% on Chinese exports, along with more targeted tariffs on Canada, Mexico, the EU, Japan, South Korea, and Vietnam. They also assume some retaliation: While it’s true that Trump’s recent threats to impose bigger bilateral tariffs on Canada and Mexico could harm these economies more than the US, at the same time, the dollar would weaken on any softening of the full-blown tariff approach.

That was proved emphatically by trading action after main US markets closed on Monday. At 4:32 p.m. in New York, Bloomberg published a story headlined, Trump Team Studies Gradual Tariff Hikes Under Emergency Powers. It’s worth reading the report in full, as it explains the debates going on within the new administration. Nothing is set in stone yet, but the news that people there are alive to the risks of going too far, too fast, had an immediate effect on the euro. It strengthened: The gradual tariff story made up almost all the ground the euro lost against the dollar after the unemployment data on Friday. Somehow, Trump’s team will have to square the circle of tariffs, growth and inflation. The foreign exchange markets will arbitrate their success.

—Richard Abbey It has now been five years since Covid-19 officially claimed its first victim. The social and political reverberations will continue for decades. As far as the stock market is concerned, Covid’s few clear beneficiaries have squandered their advantage. Shares in Moderna Inc. rose 20-fold after its development of a vaccine. We’re still taking Covid boosters, but the effect on Moderna’s bottom line has worn off. Monday’s sales forecasts were deeply disappointing, driving an 18% selloff. Amazingly, Moderna now lags the overall the S&P 500 over those five years. The fate of Peloton Interactive Inc., makers of great exercise bikes for solitary workouts, was more brutal. More surprisingly, even Zoom Communications Inc. has failed to match the S&P. It’s become a regular part of life for many of us, overtaking earlier leaders like Skype. But the advantage hasn’t lasted. Meanwhile, Netflix Inc.’s subscriptions ballooned during the pandemic, while the forced closure of work on many shows reduced costs. But its advantage faded, and Netflix stock tanked relative to the market in 2022. It’s since made that back, but Covid didn’t provide a lasting benefit: One damaged sector to stage a real recovery was tourism. The hotels, resorts and cruise lines sector lags the broader market by 20% over the last five years, but it had been much worse than that. The terrible publicity about cruise lines in the first few months of Covid proves not to have been terminal. One sector that belatedly succumbed is office property. The implications of working from home on demand for office space have steadily set in. In the last two years, as resistance to return-to-office orders has grown, office property REITs have fallen much further. Market prices now imply that the pandemic permanently transformed the economics of offices: The greatest beneficiaries, it now appears, were the giant companies, led by the Magnificent Seven, that attracted the lion’s share of the money created from the fiscal and monetary largesse that followed the pandemic. Money is fungible and seems to find its way to wherever the best returns will be. Those benefits have endured. Last week, amid recommendations for cacophonous music to turn up loud, I omitted to celebrate the life of a musician who never had a chance of making that list — Peter Yarrow of Peter, Paul and Mary, who has died at 86. Yarrow wasn’t perfect, but he was a wonderful musician whose trio made music for the ages — helping the world discover the likes of Bob Dylan and Pete Seeger in the process. Yarrow himself wrote Puff the Magic Dragon, which is timeless. To the end of his days, he insisted that there were no drug references. I’m not sure I believe him, but Rest in Peace Peter.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Matthew Brooker: Reeves’ Art of the China Deal Is No Masterclass

- Clive Crook: Surging Bond Yields Make a Strong Case for Fiscal Sanity

- Marc Champion: What If Trump Were to Rule Like Putin?

Want more Bloomberg Opinion? OPIN . Or you can subscribe to our daily newsletter. |