| This is Bloomberg Opinion Today, a force multiplier of Bloomberg Opinion’s opinions. Sign up here. I’d like to dedicate this newsletter to the anonymous banker who told the Financial Times they feel “liberated” under Trump because they get a hall pass to say derogatory words that I’m absolutely not permitted to type in this newsletter. To that I say: Good for you!! I’m sure the people who look up to you — if there are any —would love to know that you chose to denigrate your fellow humans in the press for no reason, other than to puff your chest and decry the “woke doctrine.” It’s such a shame Aaron Brown says you might lose your job to artificial intelligence: AI advances of the last five years or so will completely eliminate some large categories of financial jobs that have been around for many decades.

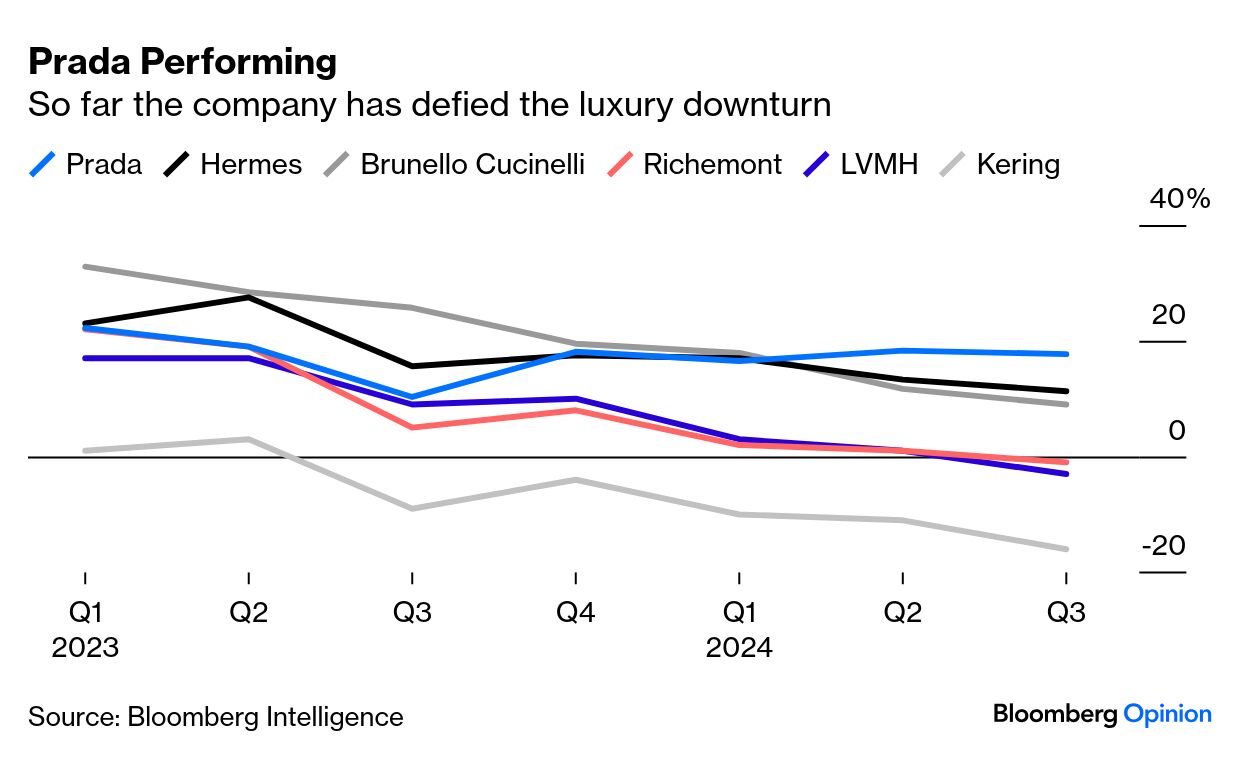

Although I have zero sympathy for the aforementioned foul-mouthed financier, I do feel bad for their colleagues who face similar disruption. Alarm bells are ringing on Wall Street, where the biggest banks have already thinned their ranks of equity analysts by over 30%. Pay cuts are raining down on bankers as JPMorgan toys with AI-powered chatbots, and many more careers could be on the chopping block in the coming years. Shuli Ren, who was an analyst at Lehman before it went under, says the job of a Wall Street researcher is increasingly irrelevant, even without factoring in AI: “Bureaucracy and banking regulations have steadily eroded the value-add that analysts can provide,” she writes. “Often, by the time sell-side research gets published, investors would have already found informed opinions elsewhere.” Plus, as Matt Levine noted last week, the S&P 500 is dominated by a handful of superstar companies, which means asset managers only have to know a few dozen stocks; the need to outsource research is minimal. If you’re in Italy, though, you’ve got a bit more time to cherish your beloved banking gig. Prime Minister Giorgia Meloni wants to protect bank branches and jobs after catching wind of UniCredit’s unsolicited offer to buy Banco BPM. But her meddling comes at a time when Paul J. Davies says Europe ought to be striving for more industry consolidation, not less. “France, Spain, Italy and Germany all have many more bank branches for their populations than the UK does,” he writes. Merging some of them “could help solve the sector’s high cost and low return problem, which leave finance more vulnerable to downturns and less able to compete with foreign firms, especially US investment banks.” They’d better move fast: Soon enough, Europe will have AI to compete with, too. Bonus Big Bank Reading: Jamie Dimon’s succession race at JPMorgan just lost a top candidate. — Paul J. Davies At a time when Mexico and Canada are generously sending brigades of firefighters, planes and air tankers to extinguish the deadly fires ravaging Southern California, does America’s president-elect really need to be threatening them with mass deportations and tariffs? Wouldn’t he be better off saying “thank you for sacrificing the lives of your own countrymen” to Claudia Sheinbaum and Justin Trudeau? I guess not: Patricia Lopez thinks Trump may find out the hard way that “the world is a lonely place without friends, even for the most powerful nation in the world.” Back when President George H.W. Bush was in office, Patricia says he built “a coalition of countries that acted as force multipliers to repel Iraq’s invasion of Kuwait. He didn’t bully them or command them. He relied on long-standing relationships. He reached out a hand, and found many hands reaching back.” Without the goodwill of America’s allies, Trump will have a hard time accomplishing much of anything, says Stephen Mihm. Take his plan to deport millions of immigrants: When President Dwight Eisenhower’s administration launched Operation Wetback — truly the most atrocious code name they could have picked — in 1954, it worked closely with Mexico’s government to move deportees via train to the Mexican countryside. “Trump wants to repeat this feat. That won’t happen, though, unless Mexico cooperates,” Stephen writes. “There are increasing signs that it will not.” Let that be a lesson for all: Be nice to your neighbors! They’ll only help put out your fires for so long. Word on the street is that Prada is mulling a purchase of Versace, which would be … weird? When I think of Versace, I see Jennifer Lopez at the 2000 Grammy Awards. When I think of Prada, I envision Harris Dickinson holding a ludicrously capacious bag or Hunter Schafer in sheer fabric. Sandwiching the two together is an awful idea, and Andrea Felsted agrees: While Prada and its sister brand Miu Miu have become the poster children for post-pandemic profits, she says Versace’s sales growth has stalled and is on the verge of an operating loss. Taking on the Capri-owned brand could end up messing with Prada’s good juju.  Big tech is helping the stock market stay afloat amidst all the Trump-era speculation, but not for long, warns Jonathan Levin: “The return of 10-year Treasury yields to their 14-month highs in recent days has finally hit confidence in even the strongest performers. For all their earnings strength, innovation stocks tend to exhibit ‘high duration,’ meaning their valuations hinge on cash flows expected far in the future. To the extent that traditional market relationships still hold, higher rates should imply lower fair-values for those stocks today.” A Texas law requiring age verification to view pornography has a First Amendment problem. — Noah Feldman Republicans expect inflation to disappear over the next 12 months. That’s a daunting target for Trump. — John Authers Not for the first time but maybe for the last, net neutrality is gone — and I will not miss it. — Tyler Cowen Investors might not be allowed to consider risks if those risks are politically disfavored. — Matt Levine Kate Middleton’s cancer is in remission. Walmart’s new logo looks a lot like the old logo. More progress on a Gaza ceasefire and hostage release. The first-ever film released in theaters and prisons. What’s worse than fatbergs on the beach? Mystery balls. A French woman lost $850K in an AI Brad Pitt scam. TikTok’s beef tallow skincare trend is a misnomer. Notes: Please send lard and feedback to Jessica Karl at jkarl9@bloomberg.net. Sign up here and find us on Bluesky, TikTok, Instagram, LinkedIn and Threads. |