|

Financial disclosure: I hold a modest amount of BTC and ETH.

Don’t worry, I’m going to write a post about Trump’s flurry of executive orders very soon. But in the meantime, I thought I’d write about crypto.

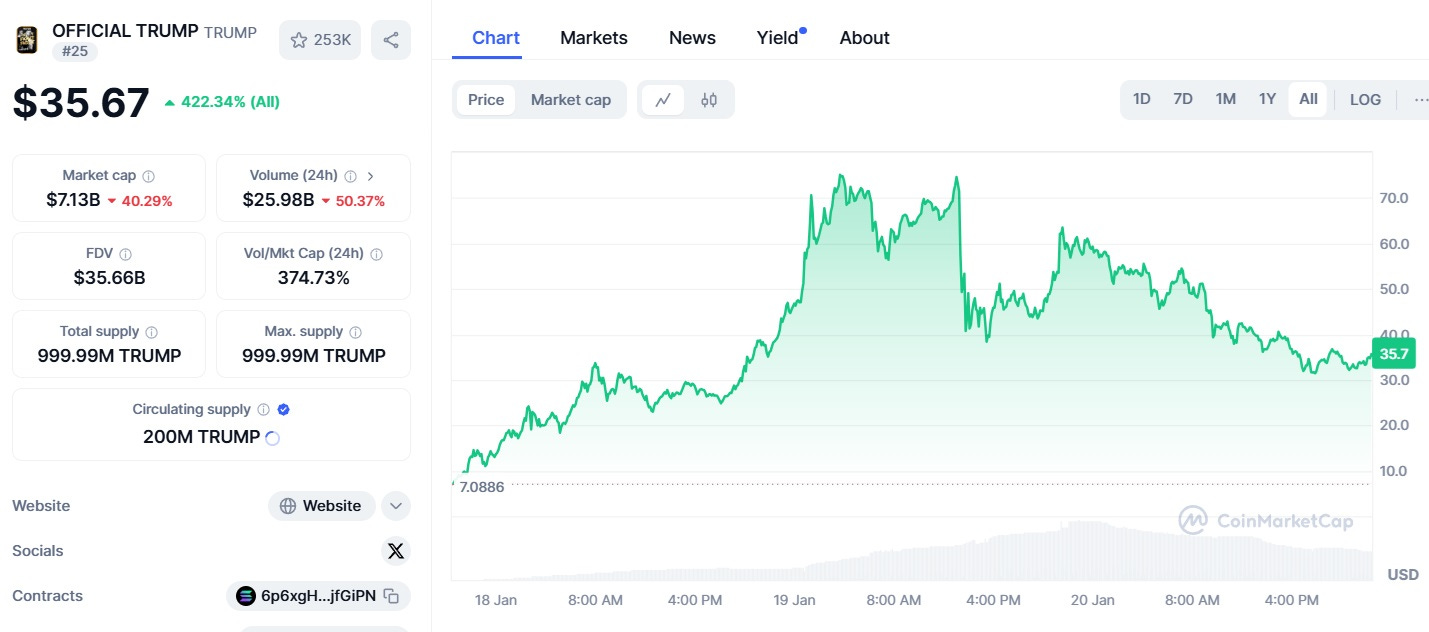

Just before his inauguration, Donald Trump and his wife Melania launched a pair of cryptocurrencies, called TRUMP and MELANIA. (The image at the top of this post is from the TRUMP launch.) The coins have both declined in value from their initial peaks, but their market capitalizations, as of this writing, are still around $7 billion and $800 million, respectively:

|

|

A lot of crypto folks weren’t too happy about TRUMP and MELANIA, believing that a stunt like this could undermine the respectability of crypto in general. Their interest in the matter is very simple to understand. Most crypto people — like me — hold Bitcoin, and probably Ether too. If crypto gains respectability and wide adoption by financial institutions, pension funds, etc., demand for Bitcoin and Ether will increase by a lot. This will cause BTC and ETH to go up enormously in price, enriching pretty much everyone in the entire crypto ecosystem.

On the other hand, the launch of new “memecoins” doesn’t enrich the average crypto holder. Yes, you can buy these coins and hope to make a profit. One bold and lucky investor turned $1 million into $120 million investing in TRUMP (though that number could go down if he holds onto it and it crashes). But in general, new memecoins like TRUMP and MELANIA don’t enrich crypto people nearly as much as increased adoption for the existing coins that they already own.

And the crypto people are right that TRUMP and MELANIA just make the whole space look bad. The original idea of cryptocurrency was that it was going to replace fiat currency as the standard means of payment. So far that hasn’t happened, or come anywhere close to happening, but the dream remains that one day people could buy their pizza and beer with BTC or ETH, stablecoins like Tether and USDC, or maybe even a BTC imitator like DOGE. But absolutely no one thinks that one day we’ll be paying our grocery bills with TRUMP or MELANIA. The purpose of these coins is not to be currencies, but speculative assets. Their reason for existence is to transfer money from investors to other investors, not from buyers of physical goods to sellers.

This does not mean TRUMP or MELANIA will ever go to zero. As we’ve already seen with a huge number of other cryptocurrencies, it’s possible for assets with no fundamental value whatsoever to retain market value over long periods of time. Some people hold on to the speculative assets — and are willing to pay some price to keep holding on to them — on the off chance that someday other people will notice those assets and speculate on them in turn, allowing the current holders to sell at a profit. This is exactly what happened to Dogecoin.

Speculation is a game of higher-order beliefs. I might believe TRUMP is fundamentally worthless, and you might believe the same, but if you believe that someone out there thinks it’s not worthless, you might think you can sell it to that person. And then I might buy some TRUMP so I can sell it to you, and so on.

There are a number of economic models that explain how this can lead to financial bubbles. The most famous is probably DeLong et al. (1990), which argues that if there are some people called “noise traders”¹ who mistakenly believe an asset is more valuable than it really is, and if smart traders who know the true value aren’t able to get enough money to trade against the noise traders, it can force the smart people to temporarily go along with the herd and cause a bubble.

Another paper in this vein is Abreu and Brunnermeier (2003). They argue that even if the smart traders would together have enough financial firepower to pop a bubble, they can’t always do it, because they would have to short the bubble at the same time. Short-sellers don’t coordinate with each other (in fact, it’s illegal to do so). So each short-seller doesn’t know when the others are going to make their move, and so instead they ride the bubble for a while.

For models like these to explain the value of TRUMP and MELANIA, there would have to be someone out there who thinks these memecoins have long-term value. But in fact, the models will work just as well if there are people out there who love to gamble, even when they know it’s likely to lose them money. We know from the existence of craps and roulette that there are some people who like to take financial risks that have a negative expected payoff, as long as there’s a chance of winning big. Observationally, people who just love to play roulette aren’t really distinct from people who mistakenly believe that the odds of roulette are in their favor. So TRUMP and MELANIA might have value because some people just like to gamble on exciting memecoins, even knowing they’ll probably lose money.

But on the other hand, it is possible that TRUMP and MELANIA do have fundamental value. One simple way this could be true is if President Trump directs the federal government to buy his own memecoins with taxpayer money. He has already discussed the idea of creating a “strategic Bitcoin reserve” (i.e., using taxpayer money to buy Bitcoin). What if his reserve also bought a little bit of TRUMP and MELANIA? That would of course be incredibly corrupt, and in any well-functioning society it would be illegal. But in the age of Trump, who knows what will fly?

In fact, though, there’s another, much more plausible reason why TRUMP and MELANIA could actually have real, fundamental value. It’s because these coins allow people to give Donald Trump money without actually transferring him funds.

Suppose you wanted to buy a favor from Donald Trump, and he wanted to let you buy a favor from him. How could you do it? You can’t just pay him a giant bribe — that’s illegal. Maybe you could pledge him a bunch of cash for his presidential campaign. But there are campaign finance laws that will get in your way, and even if you succeed, he can only use the money for his campaign, not to buy yachts or whatever else he might like to use the money for.

Instead, what you can do is to buy a bunch of TRUMP or MELANIA. When you buy one of those memecoins, you increase the demand for the memecoin. Its price then goes up. This makes Donald Trump richer, without any money actually having to change hands.

Let’s think of a little example to see how this works. Suppose the price of TRUMP is $50. Then you buy $1M of it, driving the price up to $55 — a 10% increase. Through the magic of mark-to-market accounting, this means that Trump’s entire stake in TRUMP goes up by 10%. And since Trump himself owns almost all of TRUMP, this means he suddenly gets billions of dollars richer on paper.

In other words, by spending $1M, you were able to make billions of dollars appear in Donald Trump’s crypto wallet. And it’s all perfectly legal, too — you didn’t actually transfer a single dime to Trump’s bank account or his crypto wallet or anything. All you did was buy something that he owns and drive up the price. And Trump will know you bought it, too, so maybe he’s inclined to do you a favor in return.

Note that TRUMP is perfectly set up to do this. The “float” — i.e., the amount of TRUMP that actually gets traded on the open market — is very small compared to the amount that Trump owns. Trump reportedly has over $50 billion of TRUMP (at January 19th prices), while the publicly traded portion was only around $13 billion. The smaller the float, the cheaper it is for one rich guy to come in and pump up the price.

Now, can Trump actually get all of those new billions of paper dollars out, and turn them into actual dollars he can spend? No — at least, not quickly. For that he needs what we call exit liquidity — he needs to find someone willing to trade him USD for TRUMP. And as soon as he starts selling huge amounts of TRUMP, the price will crash hard, eliminating much of his paper wealth. That’s the downside of the tiny float. Live by the mark-to-market accounting, die by the mark-to-market accounting.

But in the long term, he can get a substantial portion of it out. Remember that every time someone wants to pump up Trump’s wealth, they have to trade USD for TRUMP. Trump himself could sell some of his TRUMP to the guy who’s trying to do him a favor, but this might violate some pesky anticorruption law. Instead, there will be middlemen — people who pay Trump for his TRUMP whenever he wants to sell off a bit of it, and then hold onto it, knowing that eventually they’ll be able to sell it at a higher price to someone who wants to pump up Trump’s wealth. These middlemen look like speculators, but they’re really just market makers.

The exit liquidity doesn’t have to be an idiot or a speculator or a compulsive gambler — it can just be the next guy who wants to scratch Trump’s back. And so on and so forth, into infinity. Trump is old, but he has kids, and he will presumably leave them his crypto when he dies. This has the potential to sustain the value of TRUMP indefinitely, without it being a speculative bubble.

Could this run afoul of antibribery laws? I’m no legal expert, but it seems to me that if I buy a lot of TRUMP, and the cops and prosecutors demand to know why I did that, I can just say “I thought it would go up!”. And who could prove otherwise? And if Donald Trump then does something that helps my business, well, he just appreciates a smart crypto investor, right?

And now here’s the thing — this doesn’t just work for Trump. It works for anyone. All you have to do is to create your own memecoin, and hold onto most of it, and float a small amount of it on the market. Now anyone who wants to give you money without paying gift taxes or running afoul of anticorruption laws can do so simply by pumping your memecoin. Now, most people don’t have hordes of favor-seekers trying to give them money, so in practice, only famous and/or powerful people will be able to pull this off.

In other words, memecoins are a form of payment technology — not the normal kind of payment, but an approximate, sloppy one. The uncertainty about how much money you’re actually giving someone by pumping their memecoin is the price you pay for the immaculate, plausibly deniable nature of the gift. It’s a little bit like a financial hawala — a way of sending money through informal relationships without ever formally transferring it.

This is, of course, an invitation to vast corruption. But with Trump in power, it seems doubtful that the Department of Justice will crack down on this sort of thing anytime soon. Meanwhile, the possibility of memecoin pseudobribery means that these coins might actually have fundamental value after all. Unfortunately, as with so many other crypto use cases, this one would be all about evading the spirit of the law.