- Canadian and Mexican currencies are hanging tough, despite tariff threats (including against China).

- Netflix wowed investors in after-hours trading with its rise in subscriptions — more on that later this week.

- “Drill Baby Drill” doesn’t necessarily mean more oil, or higher oil prices.

- Your chance to talk about inflation with Points of Return.

- AND: What happens when sports coaches take out their frustration on TV screens.

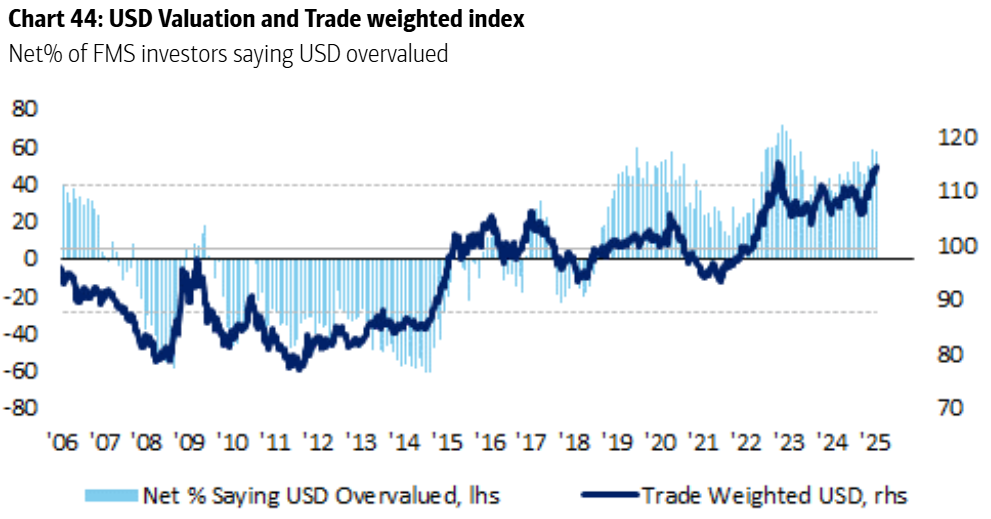

Free Trade and the Dollar | Just how bad has North American free trade been for the US? Nafta (the North American Free Trade Agreement) was thrashed out by George H.W. Bush and ratified under Bill Clinton before coming into force in 1994. Then Donald Trump renegotiated and renamed it the US-Mexico-Canada Agreement in one of the signature achievements of his first administration. The new treaty included a provision that it should be renegotiated again in 2026, but we now know that Trump wants to do it even sooner and is prepared to threaten 25% tariffs (not on the face of it permitted under the treaty) to force others to the table. Despite Trump’s discontent, US stocks have done far better than Mexico’s or Canada’s in the last 31 years, a gap that widened once Nafta became the USMCA. So it’s no surprise that anything that jeopardizes the agreement is considered market-unfriendly: Free trade is seen as having damaged US employment, and contributed to growing inequality, but there is no sign that it has damaged the interests of US capitalists. And judging by the Canadian dollar, markets aren’t at all convinced that free trade is going away. The US dollar dropped against its Canadian cousin in response to Monday morning leaks that there would be no new tariffs at first, surged when Trump announced the 25% tariffs plan — and then steadily slipped again Tuesday, in a slide barely interrupted by news of the president’s hopes to renegotiate: What’s going on? The US dollar has weakened at least in part because the post-election surge was somewhat overdone. That’s visible in the spread of US Treasury yields over German bunds, which ballooned in November as investors calculated that the new agenda would mean far greater growth, and hence inflation in the US. That bet has been trimmed back, which removes a little support for the dollar: The US dollar has been overvalued, and entered the year reliant on Trump 2.0 tariffs to maintain its strength. The latest Bank of America survey of global fund managers shows a widespread belief that the US currency was overvalued — and also showed a slight reduction in optimism compared to the post-election surge in December. That inevitably left it vulnerable to any story that challenged the prevailing narrative:  But the main drivers of the Canadian and Mexican currencies at present are conflicting judgments on the game theory confronting the US, Mexico and Canada, and attempts to read the mind of Donald Trump. The executive order on America First Trade Policy issued on Inauguration Day should be viewed as the first move in a game. George Saravelos, chief global foreign exchange strategist at Deutsche Bank AG, believes it sets the stage for “the most expansive presidential powers on trade in the post-Bretton Woods era,” and that Trump’s vague pronouncements are part of a deliberate strategy of uncertainty: There is an intention to generate ambiguity around tariff policy with an extremely wide range of ultimate outcomes. It is highly unlikely this gets resolved any time soon. Uncertainty is clearly a negative for global (manufacturing) growth and we believe will play a material role in preventing the release of dollar risk premium, despite elevated positioning.

Others see signs of cold feet. Louis-Vincent Gave of Gavekal Economics argues that Trump’s policies may be less aggressive than feared “not because he has fallen out of love with tariffs — the threat clearly remains in force — but because the US economic situation is very different from 2017.” Back then, he points out, the fear was deflation. This time, he has returned to office thanks to “the inflation which had destroyed the purchasing power of the US consumer.” Trump’s freedom to levy tariffs isn’t unobstructed. Further, game theorists are beginning to grasp that the USMCA junior partners do have power to retaliate. US exports to each country run at almost triple American exports to China, so retaliatory tariffs could inflict real pain on US exporters: Further, as Marc Chandler of Bannockburn Global Forex points out, the preponderance of Canadian and Mexican imports to the US come from American companies. While tariffs would potentially endanger Canadian and Mexican jobs, they would also damage the profits of US businesses. Put only slightly differently, Nafta and the USMCA have produced benefits for the US that tariffs would endanger. This isn’t as simple as it seems. Expect the lurches in the foreign exchange market to continue. The Art of Pleasing Two Masters | Trump’s executive orders unleashing “Drill, Baby, Drill” — lifting leasing bans on drilling in offshore oil and gas in most US coastal waters — has done little to halt Brent crude’s longest losing streak since October. In Trump’s universe, lower oil prices lead to less inflationary pressures. The problem is that it’s hard to see how a fall in oil prices encourages the massive production that is the aim of the president’s directives. Trump’s orders — lifting the ban on leases and withdrawing from both the Paris and UN climate agreements — are a delicate act of pleasing consumers and oil producers. Mark Malek of Siebert argues that the emergency declaration leaves energy companies worse off, as their margins will come under pressure. “It is true that there is ‘liquid gold’ under the US, but even gold is subject to the laws of basic economics… sorry,” he adds. Essentially, it’s difficult for the president to have his cake and eat it, too. Further, it’s curious that incentives for further production are regarded as a prudent policy for a sector bedeviled by a supply glut. Harry Colvin of Longview Economics adds that price, and not drilling permits, will drive meaningful increase in US oil production. Colvin found no correlation between production and the number of leases: Colvin suggests that the cost of Arctic drilling is prohibitive if measured against current oil prices of about $79 dollars per barrel. Currently, exploration and production companies’ average breakeven price is around $78 per barrel, which explains Alaska’s low drilling activity: That is, while no new leases for drilling in Alaska were issued under Biden, the number of outstanding leases has remained unchanged and at high levels (currently covering 2.6 million acres of public land. For comparison, New Mexico has 4.2 million acres of land granted under lease). The number of spudded wells on that land last year was 1,352.

A further issue is that as Grace Fan of TS Lombard argues, current oil production output doesn’t justify declaring a national energy emergency. The US’s position as the lead energy producer is not in doubt. As shown by TS Lombard, power generation, not oil production, is the problem: What then forms the basis for the emergency declaration? Fan suggests that the new administration hopes to fast-track oil and gas and mining projects, but much hinges on the fine print. Last year’s Supreme Court decision to overturn so-called Chevron deference — a precedent that government regulators should be given some discretion to interpret statutes — means that legal challenges to any new Trump rules have a better chance of success. This could thwart faster implementation — and leave the administration reliant on judicial expertise. In the end, oil producers are likely to see extra profits, she argues, but not from increased production: We expect more US oil and gas producers (particularly smaller firms) to see greater profits from fewer environmental rules and regulations — as opposed to simply producing more. Also positive for the sector is Trump’s vow of refilling the Strategic Petroleum Reserve, although — as with comprehensive federal permitting reform — both initiatives hinge on legislative action.

With China near peak oil demand, however, she remains convinced that oil and gas prices are in terminal decline, “even if Trump can delay the arc throughout his presidency.” For now, finding a sweet spot that works for consumers and oil producers is a matter of foreign trade. Punitive tariffs can stifle fragile economies — hurting oil demand and causing prices to fall further, discouraging production. As Samer Hasn of XS.com puts it, if Trump acts less aggressively in many issues — including foreign trade — there could be greater relief in the energy market as concerns for the future of the global economy would ease: This trade war could put further pressure on the global economy to slow down and could prevent China from achieving its growth targets and could push the euro zone into recession, according to surveys and forecasts that we have seen in recent months. If China is able to obtain favorable trade terms… the oil market may get rid of one of the most important negative factors pressuring prices.

The election prodded oil prices up at one point by nearly 8%, driven in large part by fresh sanctions on Russia by former President Joe Biden. If Trump can indeed resolve the Russia-Ukraine conflict, more oil would make its way to the market. That would not be the best incentive to boost US production. Jean Ergas of Tigress Financial Partners suggests that tariffs on Canada, if they came to fruition, would be much more serious and make the inflation fight far harder. “Canadian crude would influence the price, and it’s existential; it’s the heavy crude that American refineries are geared for.” In reality, it’s not so simple as “Drill, Baby, Drill.” —Richard Abbey Let’s Talk About Inflation… | Amid the excitement, it remains a necessary condition for the success of the new US administration that it does not let inflation take off again. There is at least some risk of that happening. To discuss this further, I will be talking in a Bloomberg Live Q&A on Wednesday at 1 p.m. Eastern Standard Time, with Candice Zachariahs and Jonathan Levin. It’s like an X Space, but you need to be a Bloomberg subscriber to take part. Please join us, and submit questions or comments if you can. Here is the link to join:  Sometimes you just have to take it out on an inanimate object. Today there is news that the new manager of the once-great football club Manchester United broke a dressing room television in his anger with his team after their 3-1 home defeat to Brighton on Sunday. For those of us who root for Brighton, this is highly amusing, and brings back memories of other times when their victories triggered violence against television monitors. Violence in the dressing room is a strategy that once worked for Sir Alex Ferguson, the greatest of all football managers, albeit by damaging David Beckham’s face. And it’s been applied to finance as well, with Cliff Asness, whose stature as a quantitative hedge fund manager more or less equals Ferguson’s as a soccer coach, reportedly punching a screen during the quant meltdown of 2007. But I’m not recommending it — and particularly not for Bloomberg terminals. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Marcus Ashworth: The UK’s Not Out Of the Woods. It’s Heading in Deeper

- Stephen L. Carter: How Trump’s TikTok Ban Reprieve Could Work

- Lionel Laurent: Elon Musk’s Antics Are Too Much for Germany’s Central Bank

Want more Bloomberg Opinion? OPIN . Or you can subscribe to our daily newsletter. |