|

||

| Presented By Goldman Sachs Investment Banking | ||

| Axios Pro Rata | ||

| By Dan Primack · Feb 04, 2025 | ||

| Top of the Morning | ||

|

||

|

Illustration: Brendan Lynch/Axios |

||

|

America's attention has moved on from Los Angeles, but the staggering devastation from last month's wildfires remains.

The big picture: Successfully rebuilding areas like Altadena, Malibu, and Pacific Palisades will require major help from the private sector, beyond basic philanthropy. Driving the news: Billionaire real estate developer Rick Caruso, who lost the LA mayor's race in 2022 to Karen Bass, yesterday launched a new group aimed at expediting what comes next.

Zoom in: Caruso tells me that Steadfast LA wants to work in partnership with the city and state, providing ideas and expertise to overwhelmed public officials.

Zoom out: There is certain to be pushback against private-sector involvement if it includes buying up large parcels of land — some conspiracy theorists even believe the fires were intentionally set for developer profit — but Caruso views all of that as secondary to getting people back into homes.

The bottom line: "I'd really like to get more thought leaders from different industries involved," Caruso says, when asked what he wants the Pro Rata audience to know. "Including on the finance side, because this is going to take immense amounts of capital, and different colors of capital. When you see it with your own eyes, it's like rebuilding a war-torn country. No churches or schools or rec centers. It's a huge effort." |

||

|

|

||

| The BFD | ||

|

||

|

Illustration: Brendan Lynch/Axios |

||

|

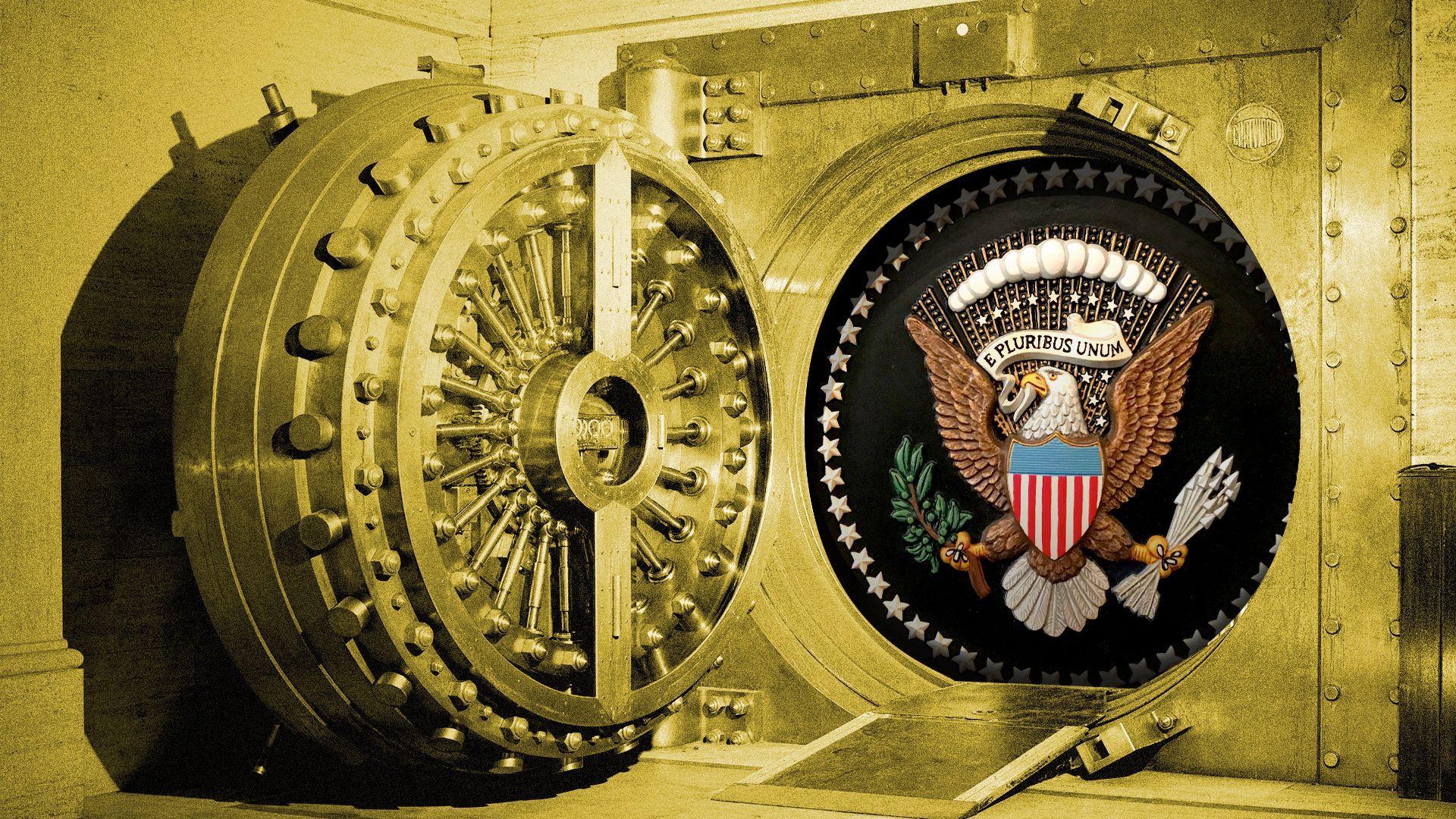

President Trump yesterday signed an executive order that calls for the creation of a sovereign wealth fund. Why it's the BFD: This could turn the federal government into America's most powerful investment firm, but isn't the sort of thing that debt-laden countries typically do. Zoom in: Trump was light on details, but some of what he did say seemed contradictory.

Flashback: The Biden administration also floated the idea of an SWF, to be focused on national security interests. It didn't go anywhere. The bottom line: Congress still controls the purse-strings, at least in theory, and may be loath to allocate a large pool of money for speculative investing. |

||

|

|

||

| Venture Capital Deals | ||

|

• StackAdapt, a Canadian programmatic ad platform, raised US$235m. Ontario Teachers' Pension Plan led, and was joined by Intrepid Growth Partners and Hudson Bay Capital. axios.link/4aI25cZ • Solaris, a German neobanking startup, raised €140m in Series G funding co-led by SBI Group and Boerse Stuttgart Group. axios.link/3Q3MR8M • Hidden Level, a Syracuse, N.Y.-based drone defense startup, raised $65m in Series C funding. DFJ Growth led, and was joined by Booz Allen Ventures, Revolution Capital, Costanoa Ventures, Washington Harbour Partners, Veteran Ventures, and Founders Circle Capital. axios.link/3Q3rRyU |